Venture Capital funds have invested a yearly record into the crypto market, eclipsing over $17 billion in 2021 already.

When excluding the $9.7 billion capital injection by Block.one into the crypto exchange venture Bullish, the second quarter saw $6.2 billion in private funding directed toward the digital asset industry, as shown in the chart below. This represents an approximately 90% increase quarter-over-quarter!

Let us dive deeper into the VC space in blockchain and crypto to see how the industry has matured over time and what emerging areas are getting investors excited.

Crypto deals are becoming bigger

In the past year, Crypto financial services companies and infrastructure-focused companies drew the most venture interest. The increased funding was driven by several big rounds from firms included in this top 10. These companies raised a combined total of ~$4B.

The largest rounds were - FTX (Crypto exchange valued at $18B in $900M funding round) and Circle (creator of USDC which now wants to be a bank raising $440M)

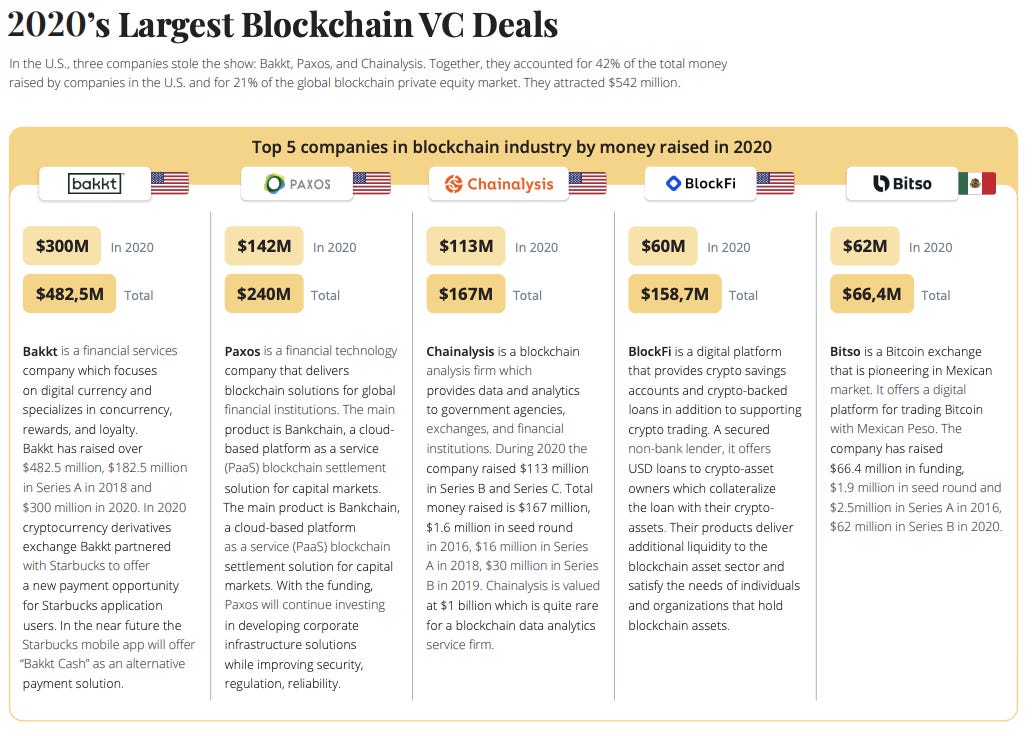

In comparison some of the largest deals in 2020 were tad bit smaller, but also had similar themes with largest funding rounds going to exchanges & custodians (Bitso, Blockfi, Bakkt) and infrastructure (Paxos).

In 2021, with Andreessen Horowitz launching $2.2 billion crypto fund, and many others reserving dry powder for the industry - blockchain and crypto deals are only set to become more competitive and larger in nature. Historically, one of the most active firms is Pantera Capital. Based in the US, Pantera Capital focuses exclusively on projects related to blockchain technologies. The company has had 113 investments since 2014 and is the lead investor of 31 organizations. Even as the older funds continue to be very active, 2020 also saw the emergence of strong activities from highly focused and fast growing funds. In particular, TRGC stands out with its 23 investments across the layer 1 and 2 DeFi project category. For most active VCs see this list.

Blockchain VC industry is maturing

An increasing number of traditional venture capital firms are investing into this space; however, blockchain private equity still amounts for less than 1% of the global venture capital market. This signals the high level of risk associated with blockchain private equity, but this also signals just how early we all are in this space and that there is still room for significant growth in the future. During the 2017 crypto bull run, blockchain venture capital almost reached 2% of the VC market. 2021 may be similar due to market momentum surrounding the Bitcoin halving and the stimulus action of governments.

In comparison with the trajectory of “internet-specific” VC investments, this puts the blockchain industry in a period similar to the early 1990s, about a decade before the dot-com bubble. Between 1990 and 1994, internet-related deal flow grew from 0% to 5%, peaked at over 45% in 2000 and has since corrected to a stable 10% – 20%1

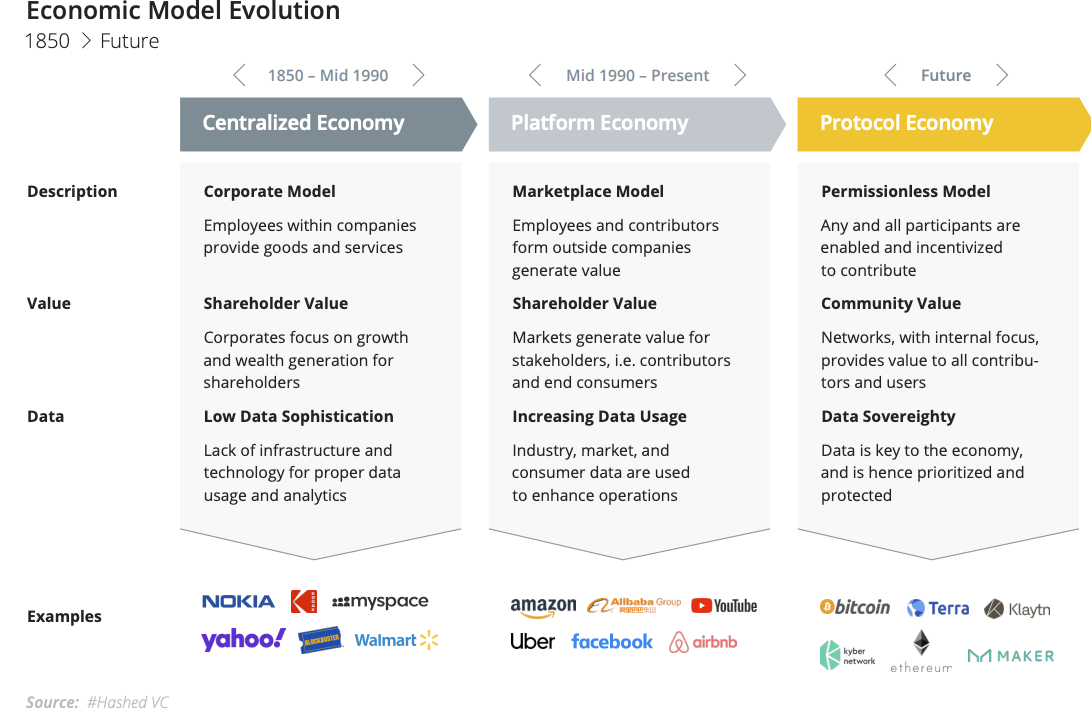

Over the past few decades, we have seen a gradual shift from fully centralized economies to platform economies. This process is characterized by the realization of large companies that they cannot effectively compete with crowd-sourced contributions. Some examples of this are social networks, such as Facebook or YouTube, where content is exclusively produced by the platform users (both with and without external incentives). Similar examples are Airbnb and Uber, where the company does not possess the infrastructure for the offered services but, rather, just facilitates transactions via its platform.

In a decentralized protocol-based economy, the protocol is the intermediary and the protocol itself is maintained by community contributors. There can still be centralized services offering interfaces to the protocol, but the success of the protocol itself no longer relies on any individual company.

We are also seeing many top banks become active: 55 of the top 100 banks by assets under management have made investments in the blockchain space as of July 2021.

They invested in 71 companies in 17 different areas, through a total of 99 investments. An impressive 68 of these companies are still active as of July 2021.

The companies that have received the most investment by top banks are Circle ($711M), Dianrong ($649M), Ripple ($392.9M), NYDIG ($355M), Paxos ($340M), Digital Asset ($262.12M), Fireblocks ($179M) and Lukka ($97.3M).

Areas in Crypto attracting most VC funding

With the fundamental blockchain infrastructure already built, venture capital focus is now shifting to higher layers of the tech stack: (1) functionality and (2) apps. For example, if TCP/IP and HTTP are the foundational protocols for the internet, Ethereum and other smart contract platforms are becoming the foundational infrastructure layer on top of which various blockchain applications are built. As each layer develops, it becomes the foundation for the next one. The currently thriving world of decentralized finance would not have been possible without Ethereum as a base layer (to read more, refer this article on Cryptechie)

In 2020 capital went into these areas, by order of magnitude:

Blockchain infrastructure: 38%

Trading infrastructure: 23%

Wallets: 15%

Crypto exchanges: 12%

Payments: 11%

Compliance and regulation: 3%

In my opinion, “access to crypto” theme will continue in 2021 with exchanges, wallets emerging locally in each region/geography. This implies that funding to crypto infrastructure, compliance and regulation will only become bigger in 2021. Investors are still betting on custody, tax, data, and protocol infrastructure to improve the industry’s user experience.

According to the Block, out of the most active investors, year-to-date, Coinbase and its venture fund have made the most blockchain investments, coming in at 25 deals. The firm invested broadly across the ecosystem, with no one category making up more than 20% of its investments. By contrast, the second-most active investor this year, Alameda Research, has adopted a more concentrated approach. More than half of Alameda’s investments are DeFi projects, with the Trading & Exchange category as the second-most popular category. The Hong Kong-based quantitative cryptocurrency trading firm’s deal flow has noticeably risen this year, with strategic-style investments benefiting FTX and Serum. Of all the funds, Digital Currency Group remains the most focused on the Banking & Payments category with investments in Avanti Financial Group, Circle, Coinme, Lolli, Transparent Systems, & Wyre.

Investing themes in 2021 to watch out for

1. Existing companies raising larger rounds in a shorter time span will get an egde in key markets & verticals

Exchanges and wallets (both centralized and decentralized) are likely the first battle frontier which benefit from economies of scale, brand and distribution. We are likely to see investors ‘double-down on many of the companies as the massive need for supporting the crypto-economy unleashes a spike in growth for many players putting ‘growth capital’ in play quickly. While there will be unintended consequences and many large companies may not survive when metrics come under a microscope, the overall crypto-economy will be the ultimate beneficiary.

The majority of blockchain investment deals have been in the seed round. Between 2012 and 2020, there were ~1,500 recorded deals in the seed round compared to 248 angel investor rounds and 378 Series A. Interestingly till last year, only five companies had done a Round D or E including: Circle, Coinbase, High Fidelity, TradAir, and Robinhood, although Robinhood’s crypto trading abilities does not really make it a “blockchain company” like Circle or Coinbase.

For example, Chainalysis, a blockchain analysis company, secured $100 million in Series E financing in June 2021, bringing its total valuation to a staggering $4.2 billion. It had previously closed on $100 million in Series D financing in March 2021, doubling its valuation to over $2 billion. The round came just four months after the company secured a $100 million Series C round at a $1 billion valuation. This highlights the tremendous growth of the cryptocurrency industry.

Internationalization will be a key growth catalyst for companies as in the de-centralized world, its easy to unlock crypto-to-crypto transactions globally. Investors will seek out companies that can strike a balance between de-centralization & regulation as crypto company rapidly scale across geographies.

2. Crypto infrastructure will remain a key focus, as ‘arms dealer’ in the global arms race for digital assets

Overall, the industry is maturing as each crypto cycle attracts a new wave of first-time retail and institutional investors and exchanges, wallets become larger. This could result in an “arms race” to become the arms dealer to crypto companies similar to the one we have seen unfold in fintech. In fintech, we have witnessed vertical infrastructure players such as Galileo, Marqeta, Drivewealth etc. (refer this Cryptechie article) arm the neo-banks & tech companies to launch fintech products faster. We are likely to see a similar trend unfold in Crypto, where companies such as Paxos, Circle, Coinbase Cloud, Chainalysis, Taxbit etc. will create the new infrastructure API layer across identity, compliance, trading, wallets, payments, DeFi, NFT etc. to empower “any company to become a crypto company”.

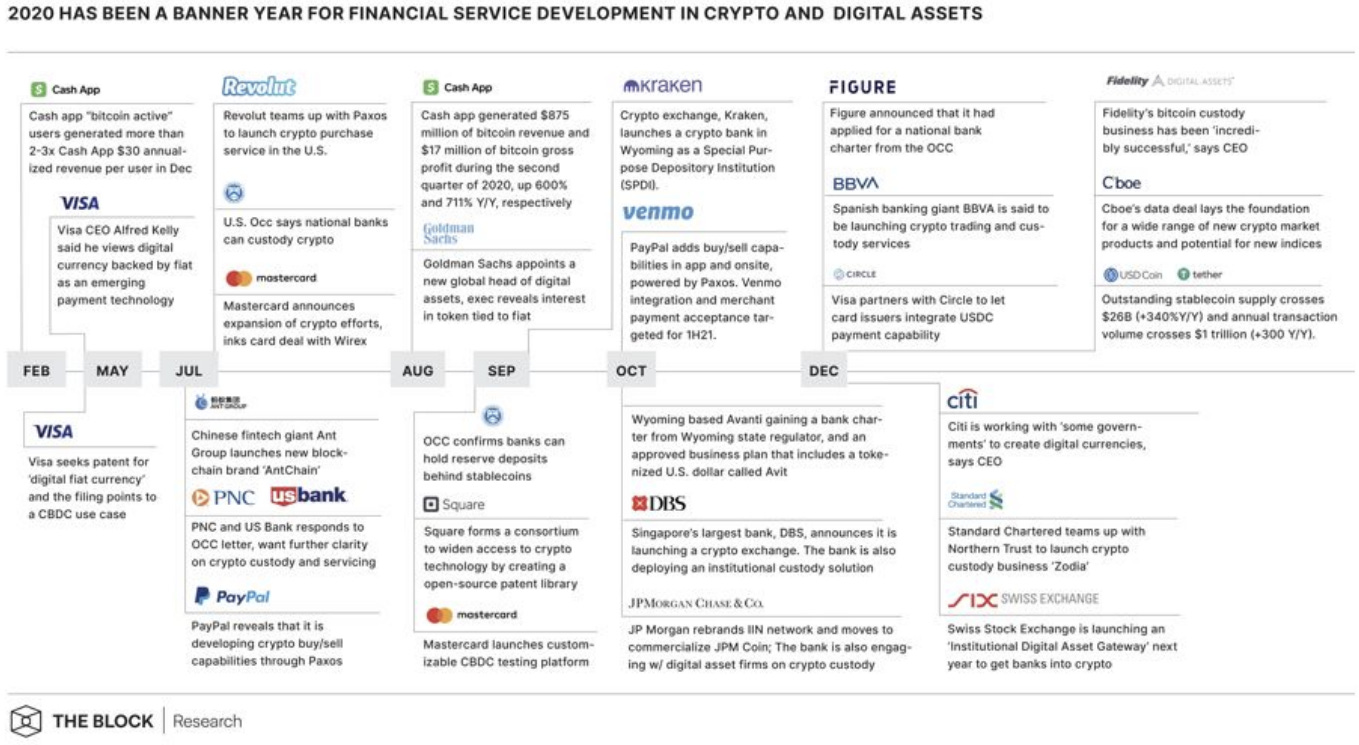

The accelerated pace of financial service crypto announcements through the back half of 2020 should provide incremental motivation for new entrants on the margin to consider "exploring" the digital asset industry in 2021. What do they have to lose at this point when you have Square selling billions of dollars of bitcoin a year, and PayPal, Visa, and Mastercard all ramping up ways to get more active in the space? One of the most apparent use cases for crypto has been trading and speculation — and it's not just native crypto exchange and brokerage businesses that have capitalized on this. Fintech discount brokers, wealth management platforms, and even more traditional financial services companies like Fidelity are in on the secret that offering crypto purchase and trading capabilities is an easy way to: a) increase monetization per user, and b) build stickiness and goodwill with key demographic

PayPal made headlines when it announced that it would offer crypto services similar to those available in Square’s Cash App. The firm partnered with Paxos and used its brokerage service to obtain a conditional license from the New York Department of Financial Services. Firms such as PayPal will be tasked with either producing its crypto services and offerings in-house and through partnerships, or if it is better served acquiring a company in the space. Logistically, it may make more sense to start with partnerships, build relationships with existing players, and evaluate the demand/utility of crypto services before making any significant deals. Naturally, Brokerages & Custody firms that provide the infrastructure needed for mainstream companies to offer crypto services will be an area of interest.

Some interesting examples here to watch out for:

Compound Treasury: designed for non-crypto native businesses and financial institutions to access the benefits of the Compound protocol. They offer High-Yield Interest Powered by USDC of upto 4%. By working with Fireblocks and Circle, Compound Treasury has built a product and flow-of-funds that enables neobanks, fintech startups, and other large holders of U.S. Dollars to access the interest rates available in the USDC market of the Compound protocol, while abstracting away protocol-related complexity including private key management, crypto-to-fiat conversion, and interest rate volatility

Circle: Circle API Services comprise a suite of infrastructure for diverse digital currency payments and treasury use cases. Their yield services allow anyone to earn interest on USDC lent into collateralized borrowing markets.

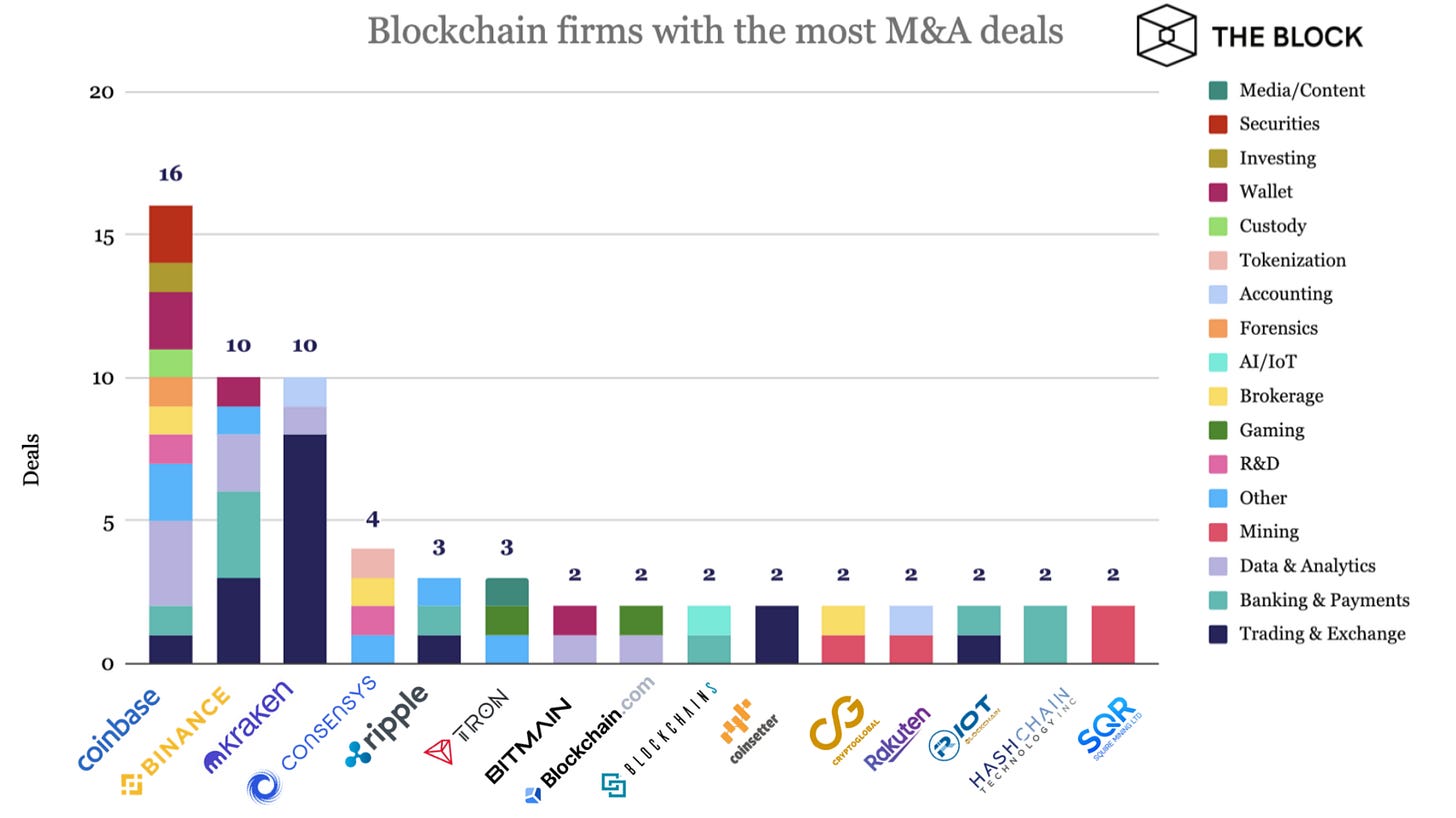

3. VC funds will seek M&A of portfolio companies and start driving some consolidation

Crypto exchanges have spectacular revenue generation capacity, and — unlike miners for whatever reason — are much more likely to expand into new industries, as well as acquire down the value chain. Adjacent opportunities abound given the industry’s long term Metaverse thesis, as well as the need to catalyze institutional financial adoption, thus leading to acquisitions across the banking, data, gaming, and media sectors.

Over time, we think the value chain will be controlled by fewer players and end up more coherent and standardized. Vertical integration examples include institutional investment shop Galaxy buying crypto custodian BitGo (to be able to have more control over assets under management), Coinbase acquiring Xapo , PayPal acquiring Curv (to get closer to onchain assets), or Binance buying CoinMarketCap (to acquire customers into the exchange). As a company, you want to be fast and take out manufacturing costs.

Coinbase, Binance, and Kraken led the way in 2020 according to data from The Block. If we were to consider 2021, the story would also include FTX — the $18 billion crypto derivatives exchange which bought portfolio app BlockFolio and has a tight connection to specialist blockchain Solana.2

Binance kept its top position as the industry leader in trading volumes and acquired data giant CoinMarketCap for $400 million to strengthen its top of funnel. FTX was one of the fastest growing and most innovative exchange operators of the year, and it acquired Blockfolio for $150 million for many of the same reasons. Kraken-backed Cryptowatch entered the list of top data sites. And Digital Currency Group leveraged CoinDesk’s (virtual) events business for a financial advisor event that introduced its prime brokerage and asset management services to new clientele. Oh, and DCG even went the other direction too, acquiring an exchange of its own in Luno.

4. The unbundling of centralized exchanges

Exchanges remain at the center of the crypto universe for three reasons: 1) they make all the money in an industry fueled by trading fees; 2) they haven’t yet been forced to unbundle certain functions for technical and regulatory reasons; and 3) most users are complacent, and trust exchanges as de facto custodians.

Most crypto services boil down to exchange, custody, and information. If you want to buy or sell, send or receive, lend or borrow, or create or redeem a blockchain-based asset, then you need a centralized exchange or a smart contract with similar capabilities. Then you’ll need somewhere to store those assets (by yourself or via a hosted service), and stake and vote as needed in crypto’s participatory economies. Finally, you’ll need quantitative data to feed your services, events monitoring to ensure your custodial setup stays in sync with network developments, and general research and education tools for buy/sell/ hold updates.

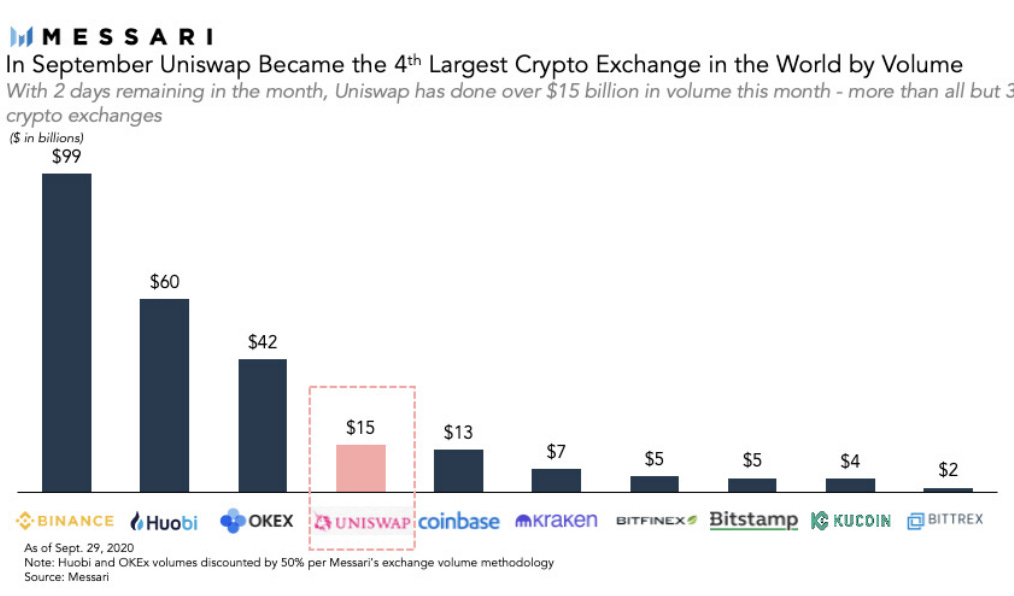

This year’s primary crypto infrastructure question is simple: do you believe exchanges will continue to aggregate all of these critical functions under one umbrella? Or are they at risk of being replaced or unbundled. In three years, Uniswap has grown from a proof-of-concept built by a novice developer (former mechanical engineer) and funded by an Ethereum Foundation grant to a top ten global trading “venue,” and a multi-billion dollar token project!

One of the ways other tech companies are driving a wedge in this space is through the Crypto debit and credit cards which have the potential to onboard millions more into the ecosystem. A growing list of crypto-to-fiat debit rewards programs on the market (that is nearing close to +50 unique card programs) is an indication that this market has surely evolved in 2020. Beyond BlockFi credit rewards card, news that Square Cash App offered a 5% bitcoin-back boost reward for any three transactions using its Cash Card— a special Boost promotion over two days and for a max payout of $7.50 — offers a completely different calculus in terms of onboarding new users into bitcoin, especially relative to other crypto card programs. For context, Cash App sees ~30 million monthly active users base (and more than 80 million customers in to total as of 3Q’20). Venmo credit cardholders can now also use monthly cash back in their Venmo account to auto-purchase cryptocurrency of choice, with no transaction fees. Should other recent fintechs that have launched a crypto offering (SoFi, Robinhood, M1, etc.) look to use crypto-rewards tied to debit card transactions, this could significantly expand the number of people that own crypto in the U.S.

5. Institutional adoption will drive need for full “prime

services" offering

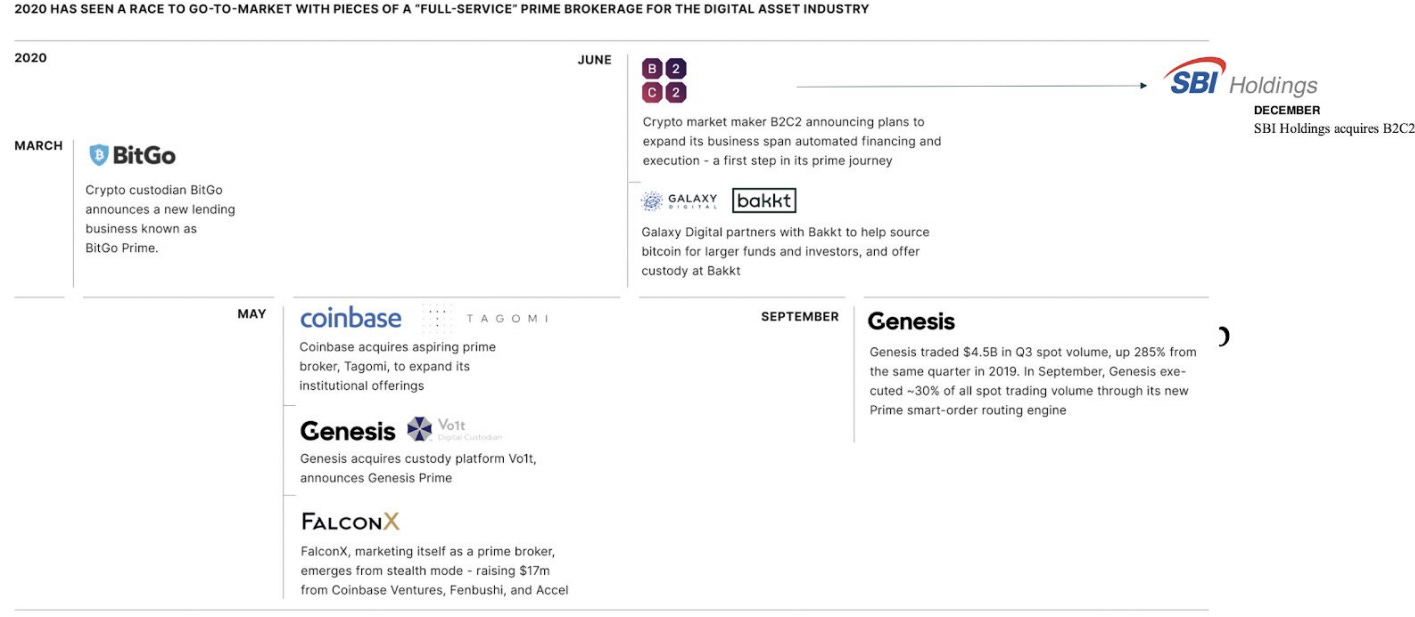

One of the most common investing themes that will emerge in 2021 will be the clear need for a "full prime services" offering for institutional investors who need a piece of crypto action. This phrase refers to a company or service that exists in the middle of the market and offers a single source of spot and derivatives trading aggregation, margin extension, custody services, capital introduction, and even trade offerings from different core starting points: custody, market-making/OTC, borrow/lending, derivatives, clearing/settlement functions and execution. Looking ahead, the consensus view among market participants is that many institutional digital asset providers will expand their offerings across these verticals to become the crypto sector’s version of a traditional prime broker. In 2020, a handful of companies made strategic acquisitions or launched new lines of business in order to build towards full prime offerings.3

6. Blockchain data, analytics and tax is attracting a lot of attention

An expected increase in regulatory and compliance mandates for the industry will make data, tax, compliance & analytics companies more attractive. Chainalysis’ recent $100 million raise valued the blockchain analytics firm at $4 billion. More consolidation within the sub-sector should be expected as firms compete to become the premier data provider. While the deal was small in magnitude, CB Insights’s acquisition of Blockdata may signify what’s to come in the M&A market. Specifically, more external players could potentially become interested in entering the crypto market. From CB Insights’s perspective — which is likely shared by other external players — the development and deployment of digital currencies by central banks and financial institutions have brought credibility to the industry. This sentiment, paired with banks and fintechs entering the space with new crypto offerings, has also provided an extra degree of credibility to the industry. Specifically, more external players could become interested in entering the crypto market, particularly in sectors prone to consolidation, like crypto data and analytics and infrastructure providers. Branching from data & analytics, crypto tax software companies like TokenTax or Lukka, which analyze users' trading data and determine taxes owed, will be potential targets for exchanges, external players such as Turbotax, or even brokerages that want to add to their product suite.

Crypto tax software Taxbit raised $133m at a $1.3bn valuation. Taxbit provides reporting software to the IRS for institutional clients. This is a timely raise given the infrastructure bill and the global push to tax the Crypto industry. Keeping up with Crypto tax reporting is hard; this software is selling shovels in a gold rush.

7. DeFi continues to dominate the pie for VC investments

The investment of capital in DeFi applications was a dominant theme in 2020.You can read more here on Cryptechie on how “How DeFi is eating financial services”.

The success and quality of new projects have attracted involvement by some investors who previously had little exposure to this sub-sector before this year. As per the Block, the DeFi segment was the most popular category and accounted for roughly 20% of all venture deals. In aggregate, of the 121 companies, the most active investors allocated toward, roughly 31% were DeFi-related.

Decentralized Finance Decentralized platforms for financial products connect the real world to the digital world via wallets and on-ramps, driving mass adoption and engaging noncrypto users through financial rewards and other benefits.

VCs made the first steps in the field of DeFi back in December 2017 when MakerDAO raised $12 million in a round led by Andreessen Horowitz and Polychain Capital. Following that, 2018 can be categorized as the year of the first big wave of VC capital inflow to the emerging segment. The backbone projects of the DeFi industry, such as dYdX, Compound, Universal Market Access, Argent and Set all raised funds during 2018. In aggregate, the five startups collected $28.2 million in equity and token sales during those early days of DeFi.

From 2019 on, the sector has been growing exponentially in total value locked in decentralized finance protocols, and so has the importance of VC-led funding. After the explosive “summer of DeFi” in 2020, venture capitalists are more confident about the product-market fit of their portfolio projects. During late summer and autumn of 2020, funding rounds for DeFi protocols were publicly announced at a quickening pace, with venture capitalists, such as Polychain Capital, Framework Ventures and CoinFund, being heavily involved.

There are five main verticals inside the decentralized finance segment: trading and exchanges (including liquidity and derivatives projects), lending, infrastructure, data and analytics, and a side category for other startups. With 18 funds active in funding DeFi projects, the map comprehensively represents the fundraising activity in the DeFi industry as well as portfolios of the dominant players. Of 220 venture capitalists that participated in at least one publicly announced funding round, 28 have carried out 6 or more DeFi investments in 2020, and more funds are joining the group of DeFi backers.

The biggest boon for crypto in the past year has been the explosion of crypto credit markets. Centralized, retail-facing services like BlockFi; institutional lenders like Genesis, BitGo, and Galaxy; and DeFi lending protocols like Compound, Aave, and Maker, all had banner years, and helped bring greater liquidity and stability (long-term!) to the hyper-volatile crypto markets. At the same time, they helped drive usage of new applications that require stable base currencies, tighter trading spreads, and fewer inter-platform price dislocations. Most importantly, credit kept assets locked in the crypto economy, and away from the taxman.

In the past, if you had a major expenditure like a down payment for a new home or a student debt repayment, and you wanted to fund that payment with crypto gains, you’d take a massive capital gains tax hit and miss out on upside for the underlying portfolio. Today, things are different. It’s reasonable (if not smart) to take on over-collateralized loans with healthy margins of safety to pay for one-time expenses like a new home. The availability of on-chain collateralized credit in both DeFi and centralized services could seriously reduce selling pressure in the next uptrending market. That’s true for both retail and institutional investors alike. A shock that sparks cascading liquidations is always a doomsday scenario, but that seems like more of a risk later in the cycle than early on. It’s more likely the crypto credit market’s maturation makes this the most liquid bull run yet.4

8. Gaming, metaverse and other media & entertainment will emerge as mainstream application for NFT, Web 3.0

2021 will be the year for non-fungible tokens. NFTs are virtual data units stored on a blockchain—often used to certify unique ownership of a digital asset that could represent a myriad of digital and real-world items, such as art, music, games, videos, or collectibles. We’re already starting to see their very early development in 2020, but 2021 will be the year of more mainstream amplification for these digital collectables. You’re going to see gaming companies tapping into fashion-inspired NFT companies as they create unique skins and collectables designed by and for their community at large. You’ll see more artists leverage the power of unique digital collectables to amplify their value offering to their fans. You’ll continue to see more exciting experimentation done around digital art, new mainstream collaborations, and more.

Investors have poured $90 million into NFT and digital collectibles companies so far in 2021, according to data shared with CNBC by Pitchbook. That’s almost triple the $35 million that NFT start-ups raised last year. The largest deal was for Sorare, a blockchain-based fantasy football game, which raised about $50 million in February from VC heavyweights like Benchmark and Accel, as well as soccer star Rio Ferdinand

Polygon, a maker of a crypto-based platform for nonfungible tokens (NFTs), has set up a $100 million fund for projects aimed at combining the hot blockchain technology with gaming. To cater to game companies, Polygon is setting up Polygon Studios to focus on gaming projects so that developers can fuse their Web 2.0 games with the Web 3.0 decentralized technology.

Ultimately, NFTs are a vehicle by which one can sell specific ownership rights of an asset, without granting full benefits of the ownership itself, provided that the asset’s value is not dependent on physical use. Although NFTs are trending primarily in the art world at the moment, there are other assets , such as diamonds, gold or land, that could be the next NFT trend. The marketplaces will need to adapt to these new asset categories to survive. “NFTs are digital assets where we are seeing increased interest from our clients, whether that be NFTs of art or sporting moments -look at Kinsale Spirit’s recent auction of a digital representation of a rare cask of 20-year single malt which raised over €80,000.17 The convergence of digital and physical experiences are what NFTs can enable. As digital assets continue to evolve, we’re closely watching NFTs and exploring how we support clients today, and in the future.” 5

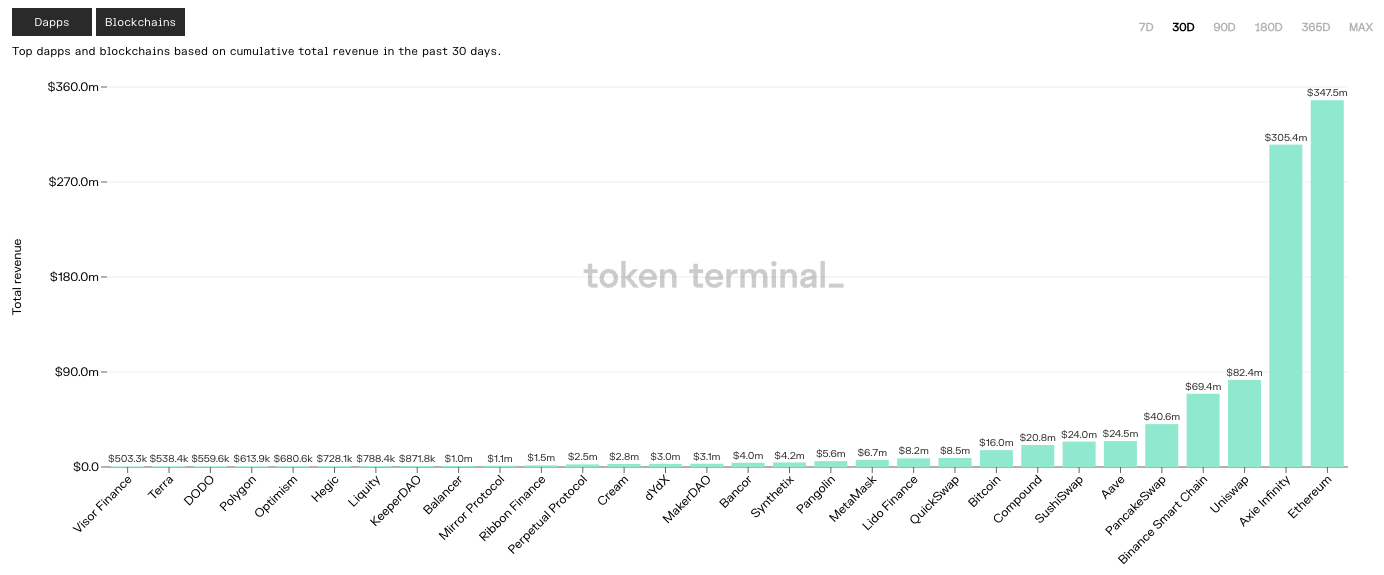

The most cited example here is Axie Infinity— a crypto-meets-Pokémon game in which players raise, battle, and trade cute NFT pets called Axies —which caught the majority of the crypto world by surprise with its impressive growth and revenue figures through the vertically integrated ecosystem created over time. There are currently over 500,000 players engaged with the game and many using it to make a living in the Philippines. In the last week alone, Axie Infinity generated roughly $40 million in revenue, more than all of Ethereum's gas fees in the same period. In the chart below, Axie Infinity shows a revenue of $300M+ in last 30days - more than next 10 protocols combined, including uniswap, binance smart chain, aave etc.

Virtual worlds & gaming will drive tokenization of assets and mass adoption and blockchain interaction by non-crypto consumers, who are active users of large gaming projects. Gaming, media and entertainment are likely the first industries we start seeing product-market fit for protocols. We’re having digital first generations who are going to live in the Metaverse, who are buying land, who are buying clothes, who are buying experiences there, it creates almost like a second huge market for consumer goods and experience.

9. Every Venture fund will become a Crypto VC; VC DAOs may emerge to upsize traditional investing

For consecutive years, six of the 10 most active funds in 2019 were once again among the most active funds in 2020. These firms include Coinbase Ventures, Digital Currency Group, Dragonfly Capital, NGC Ventures, Pantera Capital, and Polychain Capital. Now, we are seeing many all types of funds - traditional funds, large marquee VCs, hedge funds etc. - jump into this space. The chart below shows the ever expanding universe of VCs with Corporate VC arms leading the way, including AU21 Capital, Binance, CMT Digital, IOSG Ventures, ParaFi Capital, and SNZ Holding. The three most common investments between the most active funds were Acala Network, Amber Group, and Dune Analytics.

Future trend: The death of VC funds? Someday, there might be a different way of investing — VC DAOs. A decentralized autonomous organization has certain features that make it ideal for fundraising, investing and supporting a project through a period of rapid growth. The network effect and ability to crowd-source investment are particularly effective at raising awareness among potential users, investors and developers, with fewer formalities associated with raising capital via a VC. Some DAOs are encroaching on the early-stage fundraising market, an area previously controlled by VCs and angel investors. Investing in a DAO is relatively easy, especially if you know how to buy Ether and already have a crypto wallet. DAOs have much more flexibility to invest in novel strategies beyond equity investing and even basic token investing. They can make OTC markets for unlisted assets, invest in managed trading funds, sponsor teams in competitive crypto gaming leagues, buy and securitize NFTs, and generally monetize any new trend the crypto-native asset class spawns next. VCs still maintain a number of key advantages, such as more legal and regulatory clarity, strategic support and personal connections to other industry players. Those VCs looking to innovate can consider how a DAO uses network effects and influencers to rapidly conduct due diligence, fund and raise awareness for projects. Not all of these advantages are unique to DAOs but, instead, are a bi-product of open and transparent business operations. Notable examples of VC DAOs as per Cointelegraph:

MetaCartel Ventures is a for-profit community that targets Ethereum DApps and includes prominent Ethereum developers, such as Stani Kulechov of Aave and Hugh Karp of Nexus Mutual

The LAO is a member-directed venture capital fund registered in Delaware that has already backed over 30 blockchain projects

With around 300 million users as of 2021, crypto is more ubiquitous than ever. That being said, there’s still plenty of room for crypto to grow and spread worldwide; despite the growing numbers, 300 million crypto users is only 4% of the world’s population. This is the most exciting stat on the crypto space and what gets me going everyday!

Follow me on LinkedIn

Nakul

If you liked this post from Cryptechie, please subscribe and share!

https://mercuryredstone.com/wp-content/uploads/2021/04/Cointelegraph-consulting-venture-capital-report.pdf

https://lex.substack.com/p/long-take-acquisition-arbitrage-betwee

https://www.tbstat.com/wp/uploads/2020/12/Digital-Asset-2021-Outlook-The-Block-Research.pdf

https://messari.io/pdf/messari-report-crypto-theses-for-2021.pdf

https://www.bnymellon.com/us/en/insights/all-insights/venture-capital-investment-in-nft-marketplace.html

Great insights! Thanks for sharing! With the tightening over crypto in China, what's your thought on the potential impact to the overall crypto economy globally? Thanks!