Fintech Infrastructure 1.0: Coming of Age

Peeling the fintech onion and why middleware stack is becoming so important

Do you know how Revolut manages to scale internationally so rapidly while expanding their product portfolio? The answer lies in white-labelling APIs of multiple “Financial Infrastructure as-a-Service” (or FIS) players below. Revolut, similar to Chime and many others, is a consumer interface stitched together on the back of these infrastructure players.

Revolut is made of following components:

DriveWealth powers commission-free trading

Truelayer unlocks funding instruments

Data API enabling customers to connect their external bank accounts to Revolut in a few clicks

Payments API to enable customers to top up and access funds instantly, in real- time, without having to enter card details or share their bank credentials

Simplesurance: cell phone insurance made simple

Lending works: Make borrowing simple for Revolut users by delivering instant Credit

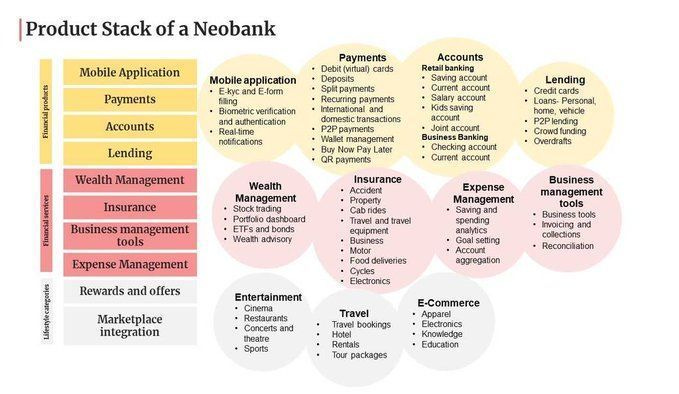

Each layer of the Product stack of neobank is increasingly being served by third-party providers who specialize in the layer (or aggregators)

Revolut…