Being the CFO of a crypto company can be one of the most challenging jobs - especially as many folks are transitioning from Web2 companies.

First, the cryptocurrency market is highly volatile and subject to rapid price fluctuations. This can make it difficult for CFOs to accurately forecast revenue and make financial plans.

Second, crypto companies often operate in a regulatory grey area, with different countries having different rules and regulations regarding cryptocurrency. This can make it difficult for CFOs to navigate the legal and compliance landscape and ensure that the company is operating within the law.

Third, crypto companies are often startups that are in a high-growth phase, which can be stressful for CFOs who are responsible for managing the company's financial resources and making sure that it is financially stable.

Overall, being the CFO of a crypto company requires a high level of financial expertise, strong analytical skills, and the ability to adapt to a rapidly changing industry.

As we look back on the events of 2022, it's clear that significant challenges and opportunities lie ahead for CFOs leading crypto and DeFi organizations.

First, 2022 saw the continued growth and adoption of DeFi platforms. We can expect to see more companies and individuals using these platforms to manage their financial assets and conduct transactions without the need for traditional financial intermediaries.

We have also seen the continued development of broader Web3 technologies, which enable users to interact with decentralized applications and protocols more seamlessly.

2023 will certainly present challenges and opportunities for Web3 CFOs. One of the biggest challenges will be the need to understand and navigate the complex and rapidly evolving landscape of Web3, crypto, and DeFi.

CFOs will need to develop a deep understanding of these technologies and their potential implications in order to make informed decisions.

Another challenge will be the need for Web3 CFOs to ensure compliance with increasingly complex and varied regulatory frameworks around the world.

Despite these challenges, there are also significant opportunities for Web3 CFOs. One of the biggest opportunities has, and will continue to be the ability to access new sources of liquidity and funding through DeFi platforms. CFOs will be able to use these platforms to raise capital and manage their financial assets in new and innovative ways.

Perhaps most of all, a natively global system of finance and commerce can allow DAOs, DeFi platforms, and Web3 teams to hire, operate, and grow at a scale and reach unprecedented 1n economic history.

By staying up to date with the latest developments, developing a deep understanding of these technologies, and working closely with legal and compliance teams, Web3 CFOs can navigate the challenges and take advantage of the opportunities that lie ahead.

Challenges facing Web3 CFOs today and key insights

Request.finance’s team spoke to 250 finance and operations leaders at Web3 companies to find out what their biggest challenges were when they started their new role, and what they learned.1

Education is needed to help finance professionals understand Web3.

Most CFOs at Web3 organizations come with prior experience in financial operations, accounting, or similar roles, but struggle with learning about Web3. A common refrain is the difficulty in keeping up with the rapid pace of new technologies and applications: from Layer 1s and 2s, to the alphabet soup of ZKPs, NFTs, EIPs and more. Sifting through vast amounts of new information, and trying to understand and incorporate new decentralized applications (dApps) into their workflows is a challenge many CFOs face.

"Traditional accountants have a hard time wrapping their head around concepts in crypto like swapping tokens on AMMs. Most don't even understand Etherscan."

- Jeff Ye Myat, COO, Bluejay Finance

o 66% of Web3 CFOs indicated that they had more than 3 years of experience in a finance or accounting role before joining a Web3 organization.o Over 99% of CFOs at Web3 organizations said they did not have formal on-boarding processes when they started in their roles.o 63.6% said that knowledge of Web3 was one of the biggest gaps in their professional knowledge when they first started as a Web3 CFO.Source: FT Partners Research

Financial Operations (FinOps) tooling in Web3 represents a tremendously underserved Saas category.

Existing payments, accounting, or enterprise resource planning (ERP) tools are ill suited to the needs of Web3 CFOs.

There is an urgent need for more crypto-native accounting tools that can pull and label data from various blockchain networks, for financial reporting purposes. The demand for no-code blockchain analytics tools was also a key issue highlighted. Despite the existence of platforms like Dune Analytics, writing specific queries to meet the crypto accounting needs of CFOs still requires programming languages like SQL. Few CFOs have the technical know-how, or the time to create customized reporting tools for their own in-house use. The lack of appropriate tooling has led many Web3 CFOs to fall back on familiar, but painstaking manual reconciliations on spreadsheets, and using macros and pivot tables for financial reporting in crypto.

o When asked about the availability of FinOps tooling in Web3, over 85% of CFOs polled said that it was "insufficient" compared to Web2.Landscape of providers in the space who are racing to fill this void…

Web3 CFOs are re-emphasizing self custody of their organizations' digital assets, following he string of collapsed CeFi platforms in 2022, like Celsius, Hodlnaut, and FTX.

Each time a centralized exchange (CEX), or centralized finance (CeFi) lending platform runs into financial trouble, they bring down with them all the fund managers, companies and their employees whose crypto assets are stored on their custodial wallets

o About 97.5% of Web3 CFOs indicated that more than half their organization's digital assets and crypto treasury are held in self custody today.o Interestingly, most Web3 CFOs polled were already actively practicing self-custody. Only 27.3% of Web3 CFOs indicated that the implosion of centralized crypto platforms in 2022 led to a shift towards more self-custody.Despite the challenges, Web3 CFOs are optimistic about the growing need for more finance professionals in the blockchain space.

o 76% of Web3 CFOs polled estimate that the demand for finance, accounting, tax and audit professionals will grow over the next 12-24 months.Ultimate guide for Web3 CFO: what you need to know2

1. ROLES & RESPONSIBILITIES OF WEB3 CFOS

2. CRYPTO WALLETS & CUSTODY

3. FIAT BANKING

4. ON/OFF RAMPS

5. CRYPTO PAYMENTS

6. TREASURY MANAGEMENT CHAPTER

7. FINANCIAL REPORTING & COMPLIANCE

8. LANDSCAPE OF CRYPTO COMPANIES

1. ROLES & RESPONSIBILITIES OF WEB3 CFOS

The role of the CFO in Web3 is similar to that of a CFO in a traditional company, with the added complexity of navigating the unique challenges of the cryptocurrency and decentralized finance (DeFi) space.

Some specific responsibilities of a CFO in Web3 include:

Forecasting revenue and making financial plans: The highly volatile nature of the cryptocurrency market means that CFOs must be adept at forecasting revenue and making financial plans that are responsive to market changes. This may involve analyzing market trends, studying the performance of other crypto assets, and using financial modeling tools to create projections.

Managing risk: CFOs must be able to identify and manage financial risks, including the risk of losing funds due to hacking or other security breaches. This may involve implementing security measures to protect the company's digital assets and developing contingency plans in case of unexpected events.

Ensuring compliance: As the regulatory landscape for cryptocurrency and DeFi is constantly evolving, CFOs must stay up to date on the latest rules and regulations and ensure that the company is operating within the law. This may involve working with legal counsel to understand the regulatory environment and implementing policies and procedures to ensure compliance.

Managing the company's financial resources: CFOs must be responsible for managing the company's financial resources, including its budget and cash flow, to ensure that it has the financial stability to sustain its operations. This may involve developing and implementing financial strategies, managing the company's financial budget, and ensuring that the company has adequate cash reserves.

Web3, on the other hand, refers to the development of a decentralized, open-source internet where users have greater control over their data and online interactions. This is achieved through the use of blockchain technology, which enables the creation of decentralized applications (dApps) and smart contracts that can facilitate peer-to-peer transactions and interactions without the need for a central authority.

Web3 organizations deserve, and need better software tools to help finance and operations teams manage their day-to day finance workflows. Automation of repetitive processes like payments, and integrations with other applications in both Web2 and Web3 are key to simplifying FinOps for Web3 teams. These tools can also empower CFOs to add strategic value through better visualization and reporting of the organization's crypto asset values, and cash flows across different chains, token types, and platforms.

2. CRYPTO WALLETS & CUSTODY

Wallets and keys are the crypto equivalent of bank vaults - where your funds cannot be moved without your consent. Understanding them is key to managing your team's crypto assets.

• Crypto wallets are software programs that store private and public keys, which are used to send and receive cryptocurrency respectively. Unlike regular wallets, your crypto always lives on the blockchain, which is a digital ledger that records transactions, and account balances.

• Public keys and wallet addresses are like bank account numbers, or wire transfer instructions you can share publicly to receive deposits.

• Private keys are like authorized signatures that allow you to send and withdraw money. They are used to "sign", or authenticate blockchain transactions. Crypto wallets use a seed/recovery/backup phrase to algorithmically create private keys. They must be safeguarded at all costs. Each seed phrase can also be used to generate multiple wallet addresses linked to it.

TYPES OF CRYPTO WALLETS

There are different types of crypto wallets. Each has its own advantages and disadvantages, allowing them to play different roles, and meet different needs in your crypto FinOps.

While most CFOs already likely have existing wallets in use at their organization, this section can still be relevant.

Understanding different wallets can help you evaluate whether your organization's current crypto wallets are being used in a way that is fit-for-purpose. For instance, if your company's entire annual payroll is being held on an centralized exchange's hot wallet, you may want to rethink that practice. "We've always done it this way" is a poor reason to maintain an existing process.

Here, we map out what we consider to be the most crucial distinctions between wallet types that you should consider when choosing to adopt wallets for your Web3 organization's needs.

MPC vs Multi-sig

For most organizations, either a multi-sig, or MPC wallet is likely to represent the best tradeoffs between security and useability.

How can CFOs decide between a multi-sig, or MPC wallet? For the technically adroit CFO, a more detailed discussion can be found in a blog article written by Nichanan Kesonpat for the 1kxnetwork.

But for those who want the TL;DR - here is a practical summary of some key differences between the two types of wallets:

Evaluating crypto wallets

With hundreds of options available, it can be challenging to know which crypto wallet is right for you. As a CFO, the stakes are even higher. You need to be sure that you're choosing a wallet setup that will protect your company's crypto assets and give you the peace of mind you need to focus on your job.

To help you cut through the noise, you must first be able to understand what's important to you, before looking at how the different wallet types map onto those needs. It's important to remember that you can use different wallets to meet different needs.

When choosing a crypto wallet, consider the following factors:

SECURITY

Security is paramount when choosing wallets. This includes who controls your private keys, and how transactions are approved - which affect your ability as a CFO to implement access control management, spending policies, limits, and permissions.

Other security measures you should consider in a crypto wallet include fraud detection and prevention features, two-factor authentication (2FA), or seed phrase recovery.

The track record of a wallet, including time in the market, or previous security breaches or hacks should also be noted.

CHAINS & TOKENS SUPPORTED

The wallets you choose should support a wide range of blockchain networks, as well as token types like non-fungible tokens (NFTs). The more extensive the support for different chains & currencies, the simpler your organization's wallet management will be.

ADDITIONAL FEATURES

Wallets increasingly offer additional features to increase their usability, including the ability to convert or "swap" token types within the wallet, offering native staking, or other features like making batch payments. These features should help to simplify and automate your FinOps processes in crypto.

COST & FEES

Depending on which wallets you use, they either have one-time upfront costs, or ongoing fees charged to users. Hardware wallets typically only have upfront costs. Custodial, or multi-sig wallets may charge ongoing fees for custody, on/off ramp fees, transaction fees, conversion fees, staking fees.

PRIVACY

Privacy is a slightly contentious point, especially in the wake of the US Treasury's sanctions on the popular cryptocurrency mixer, Tornado Cash. However, there are legitimate reasons why CFOs may want to have optional privacy-preserving transactions, like when making payroll.

Web3 CFOs need to balance the need for privacy with the need for compliance with accounting and financial reporting requirements. This can be a challenging task, as privacy-preserving crypto payments may make it more difficult to track and report on financial transactions.

This may involve using specialized privacy preserving dApps while implementing strict internal controls and processes to ensure that their organizations are able to support privacy-preserving crypto payments while also meeting their financial reporting obligations.

Here's a handy checklist for CFOs to use when evaluating crypto wallets:

CUSTODY

• Where are my private keys / key shares / key shards? Who will own them?

• What% of my private keys or key shards do I control?

• Can I have instant access to my assets and execute transactions at anytime, from anywhere?

• Do I have a strong and robust recovery protocol?

• Is the governance engine secure? How?

• What happens if the service provider stops operating?

• What happens if servers are down?

• Has the technology provider been audited by industry security experts?

OPERATIONS

• Does the solution support the blockchains, and token I want to use?

• Are there transfers/transactions limits, or minimums?

• Are there fees involved?

• Does my setup scale across team and projects?

• How can I connect my accounts to my backend systems?

• How can I automate my workflow to be more efficient?

• Do I have access to Web3 use cases (NFTs, DeFi, staking)?

• Can I implement privacy-preserving solutions?

GOVERNANCE

• What are the different user roles and how do they interact?

• What are my teams and my back office allowed to do?

• Who has access to what?

• How can I prevent internal collusion?

• Can I create and manage whitelists?

• Can I implement governance policies and user access rules when I want? How long does it take?

• Can I choose who will be involved in the approval process for all transactions?

FINANCIAL REPORTING & COMPLIANCE

• How can I track my administrator and operator activities?

• How can I meet financial reporting and other audit requirements?

• Is the technology recognized and approved by regulators?

• Can I collect data from various chains and token types easily and with clarity?

3. FIAT BANKING

Someday, blockchain payment rails will dominate payments, stablecoins will have replaced fiat currencies, tradable assets are tokenized, and decentralized finance platforms will stand where banks and other financial institutions once used to. That day is not today. The reality for some time to come, is that decentralized finance will continue to exist alongside their traditional finance counterparts. Remember that the gold standard dominated global finance from c. 1873 until the Nixon shock in 1971.That's nearly a century! It's predecessor, the silver standard, lasted even longer: starting with the Sumerians c. 3000 BCE until 1873 - nearly 4, 872 years. Today, traditional institutional investors who participate in your equity round may want to wire money in fiat. Your employees may prefer to receive a portion of their salaries directly in fiat currencies to meet daily expenses. More commonly, you will find yourself having to make purchases with merchants or vendors (normies) that only accept fiat. Choosing a bank that can support your fiat payment needs is crucial.

Some best practices to consider:

1. BANK USING SPECIAL PURPOSE ENTITIES

Typically, when opening a corporate bank account, you will be required to declare whether or not the business deals in cryptocurrencies. A declaration in the affirmative is highly likely to create problems as the Uniswap Labs founder and CEO, Hayden Adams, discovered.

And of course, making untruthful representations to your bank is inadvisable either. So how do you navigate this conundrum, if you cannot go completely bankless? When speaking to crypto CFOs, we found that most of them had to set up a bank account under an Special Purpose Entity (SPE) registered as a consulting or technology company. It is this bank account that then serves your organization's fiat banking needs.

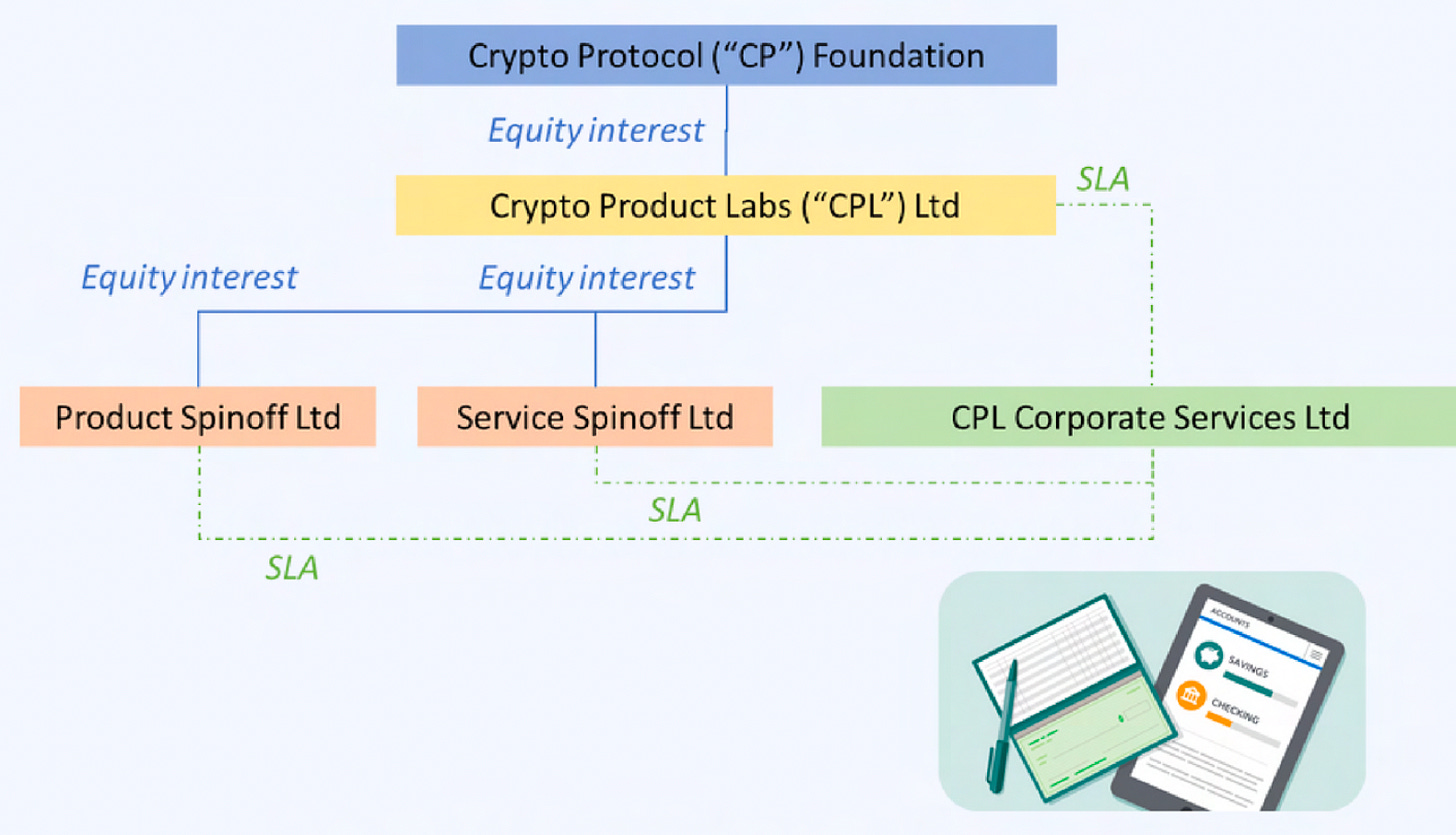

Consider the following hypothetical Web3 organizational chart, reminiscent of many others in the space (Chart below). At the top is a non-profit foundation that manages the protocol layer. Below that is an affiliated, or wholly-owned subsidiary that develops dApps or other spinoff technologies on top of the protocol. CPL Corporate Services Ltd could be a distinct SPE. It is not a subsidiary of any companies that deal in crypto. Instead it can have service-level agreements (SLAs), and covenants with all the other entities in the chart.

Contracts with employees, service providers, or investors that wish to deal with the main organization in fiat can be either novated to, or signed with this SPE instead

For example, employees wishing to work for CPL Ltd could be hired under the SPE, which in turn has an agreement to be an employer of record (EOR}, and manage payroll services for CPL Ltd.

This SPE could also have debt covenants that extend interest free credit lines to other entities, effectively allowing it to pay operating expenses in fiat like cloud-hosting fees.

Note: seek advice from relevant Qualified Persons concerning your organizational structure, and other related matters like banking, trusts, subsidiaries, etc.

2. USE NEOBANKS & FINTECH BANKS

Smaller, regional or local banks may be more open to on-boarding companies that deal in crypto. However, these banks may have a more limited range of services that may hamper your banking needs. For instance, a smaller bank may not have convenient online banking services, or may not support international payments.

Alternatively, you can consider Non-Bank Financial Institutions (NBFls) like fintech banks, or neobanks like Revolut. These companies tend to be more open to taking on risks that their banking partners, or other traditional banks would ordinarily refuse to.

For instance, AsQire is a fintech Qlatform based in Sinmmore - where many Web3 companies, DAOs, and Foundations have set up, owing to its longstanding enterprise friendly environment. Aspire has helped to incorporate and bank thousands of Web3 organizations, and even has a liquidity pool on GoldFinch - an uncollateralized DeFi lending protocol.

However, fintechs and neobanks run on traditional banking rails, and are subject to many of the same service limitations and failure points. These include:

CENSORSHIP: Nobody cares about censorship - until they become its victims. In 2020, 1,392 com12laints were made against Monzo for freezing accounts without warning. Revolut withheld tens of thousands of dollars without explaanation. Resolver froze more than 1,000 accounts, often without warning in 2021. In September, Paypal and Venmo were accused of shutting down the accounts of an LGBT organization. More recently, Paypal updated its terms of service agreement to authorize deductions of $2,500 fines from users' accounts. Around the same time, Flipper Zero, a successful Kickstarter-funded hardware hacking tool, accused PayPal of freezing_$1.3 million in backer's funds. Many NBFls also consider crypto-related businesses to be high-risk. This is typically stated in their terms of service agreements, which are subject to change without prior notice. For instance, in November 2022, Starling Bank blocked all card payments to crypto merchants and crypto-related bank transfers over alleged fraud concerns.

COST & SPEED: Fintech platforms ultimately rely on legacy banking rails, and payment networks. While they are quick to advertise low, or no fees, what is hidden in the fine print is that:

there are low holding and transfer limits on non-enterprise accounts

currency conversion rates are poor, or

same-day settlements for cross border payments will typically be far more expensive than relying on crypto rails, and other off ramp methods

SERVICE COVERAGE: Blockchain ledgers are born global: banking services are not. While a good many fintech platforms may serve most major currencies and markets, their coverage and penetration can vary considerably. In contrast, when you use blockchain rails for payment, you will never need to ask the question: "Is it available in your country?" Fintech banks and payment processors have also withdrawn service coverage from entire populations, after deciding that servicing a particular region or country is not economically viable. These can be incredibly disruptive for businesses.

3. USE UNRELATED BANKING PROVIDERS

Just as it is prudent to diversify your company's crypto inventory across multiple crypto wallets, it would be similarly wise to hold your company's fiat balances across multiple, uncorrelated banking providers.

It is important to ensure that your bank provider and NBFI are uncorrelated. What does that mean? NBFls like neobanks usually do not have their own banking licenses. Rather, they act as user acquisition channel partners, akin to wholesale retailers to traditional banks.

So for instance, if you already use Revolut in the United States, it would not diversify away your counterparty risk to use either Metropolitan Commercial Bank, or Cross River Bank - both of whom are Revolut's local partners.

Diversification is about not having exposure to correlated risks. In practical terms, you should ensure that your counterparties have little to no substantial dealings or linkages with one another. The string of collapsing centralized crypto platforms exposed to contagion from the Terra/Luna implosion illustrates this well.

The insolvent, Singapore-based crypto lender Hodlnaut was placed under judicial management in August after reportedly losing $189.7 million in the collapse of the Terra ecosystem. When FTX collapsed in November, it resurfaced that Hodlnaut had consolidated over 71% of its assets on centralized exchanges, with $13.3 million being held on FTX including bitcoin (BTC), ether (ETH) and stablecoins. Once bitten, twice rekt.

To effectively diversify your risk of being de-banked in fiat, ensure to check for linkages between your fiat banking services providers. Should any one of these NBFI banking services providers - or their core banking partners cut you off or go out of business, it must not dramatically impair your company's ability to conduct business operations involving fiat payments.

The fintech and banking landscape can change rapidly. Professional communities on Slack and Discord can help you access actionable intelligence from the experience of fellow web3 finance and operations professionals.

4. ON/OFF RAMPS

Put simply, how do you move money between crypto wallets and bank accounts? It is important to note here that fiat on banking rails and crypto on blockchain networks live on entirely separate technology stacks. Thus, fiat cannot literally be transferred into a blockchain wallet, and crypto cannot be stored in a bank account per se.

To move value between a crypto wallet and a bank account, or vice versa, you will have to rely on on and off ramps.

On and off ramps, as their name suggests are two sides of the same coin. On-ramps simply mean the exchange of fiat currencies for crypto. Off-ramps refer to the reverse: the exchange of crypto for fiat.

There are presently four primary means of doing so:

• Centralized stablecoins.

They are some of the most popular crypto payments options chosen by enterprises. USDC accounts for a large share of all enterprise crypto payments in the app. In effect, centralized stablecoins are tokenized deposits. Stablecoins are legally identical to the account balances on your bank statements, or a centralized exchange. All deposits are debts owed by deposit-taking institutions to you. Centralized stablecoin issuers promise 1:1 exchanges between fiat currencies and stablecoins. But it is important to note that stablecoin issuers' ability to meet redemptions is dependent on the composition and value of their assets held in reserve.

Typically, you will have to apply for a business account with one of these centralized entities. Sometimes, these are directly integrated into, and thus accessible from within crypto wallets and payment apps.

• Decentralized stablecoins.

Not all stablecoins are issued via a centralized entity. Decentralized stablecoins mint synthetic stablecoins when users deposit other crypto assets into a smart contract, rather than wiring fiat into a bank account of a deposit taking institution. These smart contracts attempt to maintain a pegged exchange rate to a reference fiat currency in a programmatic manner. They attempt to mimic the decision rules and operations of how central banks, or currency boards around the world do as part of their exchang§ rate QOlicies. For example, Curve, the second largest decentralized exchange on Ethereum, has released a whiteQaQer detailing an example of one such implementation of a price stabilization mechanism. Off- ramping using decentralized stablecoins then, is somewhat of a misnomer as it is not technically possible to deposit fiat currencies from bank accounts into these smart contracts. However, they exist in something of a middle ground between centralized stablecoins, and using CEXes. It is possible to directly off-ramp some decentralized stablecoins in a roundabout manner that still appears nearly instantaneous. Off-ramping using decentralized stablecoins is useful for enterprises that wish to conduct their financial operations using non-USD stablecoins.

Non-USD stablecoins can enable Web3 companies to have deeper penetration into specific local markets. After all, it is already challenging to spend on blockchain payment networks locally, much more so using a USO-denominated currency. For instance, Jarvis Network is an over collateralized synthetic stablecoin protocol that focuses on issuing non-USO stablecoins, and creating liquid markets for them. The list of non-USO stablecoins available on Jarvis Network includes major currencies like the jGBP, jCNY and jEUR, as well as smaller, less represented currencies like the jSEK, jPHPand jNZO. Through Jarvis' Network's partnership with Mt Pelerin Group, an authorized financial intermediary in Switzerland users can off ramp decentralized stablecoins from any wallet, on both Layer 1 and 2 blockchain networks. It also offers stablecoin off-ramps in 14 fiat currencies directly from a bank account in 172 countries. To minimize the transaction costs of off ramping stablecoins this way, enterprises can encourage payment recipients to perform the off-ramps using their own accounts with Mt Pelerin.

• Centralized exchanges.

Centralized exchanges (CEXes) offer more versatile on, and off ramps. Centralized stablecoin issuers enable on/off ramps only in single currencies. For instance, Circle only accepts USD deposits in exchange for USDC, and StraitsX only accepts SGD deposits in exchange for XSGD. Centralized exchanges typically accept fiat bank deposits via bank wires or credit cards, in many currencies, in exchange for most cryptocurrencies and stablecoins.

While this using a CEX for on-off ramps certainly seems more elegant on paper, there are four other considerations to note. Firstly, it can be costly and time consuming. Credit and debit cards are a popular way for retail users to purchase cryptocurrency via an exchange, but they come with high fees of up to 10% per transaction. This is generally unacceptable for enterprise use. Card payments are also on-ramps, but not off ramps as it is usually impossible to "withdraw" money onto a credit or debit card.

Secondly, you run the risk of being de banked. Many banks and credit card issuers still consider such transactions suspIcIous, locking or even closing accounts after learning the nature of the transactions. For exchanges, the credit cards of certain countries - including Russia and Ukraine - are automatically rejected.

Thirdly, banks that do tolerate transfers to cryptocurrency exchanges may still involve their compliance teams to ask detailed questions regarding the exact destination of funds and the reasoning behind crypto purchases. If and when transfers do go through, they can take several days. By then prices might have fluctuated dramatically.

Lastly, the counterparty risks of dealing with a CEX can often be higher. While both CEXes and centralized stablecoins are deposit-taking institutions, it is typically easier to audit the reserves, and liquidity of a centralized stablecoin issuer than a centralized exchange. Put simply, it is generally easier to assess whether a centralized stablecoin issuer has the liquidity and solvency to honor their debt obligations than a CEX.

• On/off ramp service providers.

There are an increasing number of players that offer direct payouts: both from crypto wallets to bank accounts, and vice versa. Some of these include NBFls like online brokerages like Robinhood, fintech payment processors like Stripe, and neobanks like Revolut which have now begun to offer crypto. In effect, these on/off ramp providers are acting as their own exchanges and market makers.

Within this category, are also over-the counter (OTC} desks, often operated by CEXes. They are ideal for making outsized transactions typically in the millions of dollars, in a more cost effective manner than making spot purchases on exchanges. OTC desks are valuable due to their ability to conduct large trades without moving the market against them. This effect is known as "slippage" and occurs when large-scale buying causes prices to immediately rise before the targeted amount of cryptocurrency has been purchased, while selling causes it to fall before it's all sold.

This is ideal for cases where large amounts have to be off-ramped. Examples include converting part of the capital raised in fiat from a venture funding round into stablecoins for global payroll. Or conversely, converting a portion of your organization's crypto treasury to pay bills to landlords which may require a large upfront cash downpayment.

Top things to consider for On & Off Ramps

On/Off ramping is not as easy for businesses as it is for individuals. The nature and size of corporate banking introduces significantly greater fraud, and AML risks. Traditional banks may de-bank corporate accounts which receive funds from bank accounts linked to centralized exchanges.

As local banks' risk tolerances can vary widely between countries, it is recommended that you consult with fellow professionals like those in the web3cfo.club.

Regardless of which off-ramp methods, or specific service providers you use to convert your fiat to crypto, or vice versa, there are four best practices to consider:

Map out your on/off ramp needs by payment corridors

Today, there exist a myriad of on/off ramp methods as compared to just a few years prior in 2017.

At the enterprise level, a growing number of solutions providers are increasingly eager to peddle their latest and greatest universal on/off ramp solutions.

What most won't tell you during the pitch is that there is no such thing as a free lunch. CFOs we interviewed quickly discovered one or more of these limitations:

• Geographical coverage, or supported tokens/blockchains is highly limited

• There are serious daily transfer limits far below your organizational needs

• Settlement times are the same as bank transfers

• Fees are exorbitant if they rely on credit card payment networks

• You must open a corporate bank account with their banking partner

• Payment services licensing must be obtained as part of the on-boarding process

Remember that on and off ramps ultimately mean having to deal with geographically-bound banking networks.

• Avoid using on/off ramps to hold your treasury

On/off ramp wallets - especially third party custodial ones, should never be abused as treasury wallets, to minimize your exposure to counterparty risk from custodians.

While I already highlighted the importance of self-custody in the third chapter on crypto wallets, it is worth repeating here. Too often, crypto companies are lulled into complacency, and end up misusing CEX wallets to hold significant amounts of their treasury. Web3 CFOs should strongly avoid abusing on/off ramps - especially CEXes in this manner.

• Implement a monitoring regime to screen for de-peg and liquidity risks

Whichever stablecoins you choose to use to on/off ramp, it is recommended that you set notifications and alerts for social media activity and price action to regularly screen for de-peg risks.

Apart from screening for warning signs for stablecoin de-peg risks on your own personal accounts, consider recruiting the help of your marketing team. They likely already have tools which monitor social media regularly as part of their workflows.

What de-peg risk criteria should Web3 CFOs screen for? De-peg risks vary depending on the type of stablecoin.

If your organization relies heavily on centralized stablecoin issuers to manage your organization's on/off-ramps, CFOs can regularly review the attestation or audit reports provided by these issuers as part of their disclosure regimes. Balance sheet issues could cause fatal bank runs. This also applies to screening for liquidity risks when using other centralized entities like CEXes for on and off ramps.

On the other hand, synthetic stablecoins are also subject to similar risks of their own, largely related to the design of their price stabilization mechanisms. CFOs should review the design of these mechanisms closely, before deciding to rely on them as on/off ramp channels

There is no such thing as an unassailable stablecoin model, or indeed an infallible exchange rate policy. Catastrophic currency devaluations have happened in traditional foreign exchange markets, and have happened with on-chain stablecoins

Different stablecoin designs are subject to different risks, and Web3CFOs must implement robust due diligence in evaluating stablecoins for enterprise use, and also adopt ongoing screening for specific de-peg risks.

Regular screening can enable CFOs to react in a timely manner to protect their crypto treasury from such risks. There are numerous examples of how vigilant monitoring of fear, uncertainty and doubt, (FUD) on social media platforms has allowed individuals and companies to save hundreds of millions of dollars from exposure to collapsing stablecoins and centralized off-ramps.

• There is safety in diversity

Use a mix of on, and off-ramp channels that are as uncorrelated as possible. In the example above, if you already use a CEX to meet over half of your monthly on and off ramp volume, examine its shareholding structure, and avoid using other entities linked to it.

Instead, you can use a different CEX that is not a subsidiary or partner to the one you currently use.

Better still, use a mix of other stablecoin issuers to meet the other half of your on/off ramp volume each month.

If for example, you are already using a Circle Business Account for USDC, consider using a Paxos off-ramp for BUSD, or USDP.

Ideally, you can use different on/offramp channels for different purposes. For instance, you can consider using a CEX tooff-ramp crypto for payroll, and a centralized stablecoin issuer to off-ramp when paying SG&A expenses in fiat.

Diversification is a running theme throughout nearly all the best practices sections in each of the guide's different chapters. Web3 CFOs today also diversify their on/off ramp channels (Fig. 16).

The technical, regulatory, and market risks in the crypto industry are rapidly evolving. In this environment, CFOs at crypto companies must never allow their organization to become reliant on a single provider - for anything that could jeopardize the company's finances. That said, more is not always better

Refer here for the top 20 Fiat-to-Crypto Onramp Services provider by geography

5. CRYPTO PAYMENTS

DAOs, enterprises, and foundations have very different crypto payments needs, including:

• Billing or invoicing clients for goods and services rendered

• Processing bills and invoices for goods and services consumed as operating expenses

• Managing payroll, equity and token allocations

• Submitting, approving, and reimbursing travel & expense (T&E) claims

• Issuing and managing corporate expense cards

• Disbursing grants and bounties, airdrops and prizes, or investment capital

And perhaps most importantly of all, keeping accurate transaction records is a matter of personal finance for the individual retail consumer. In contrast, Web3 CFOs need tools to manage their crypto payments in a manner that facilitates easy financial reporting for internal stakeholders like management and investors, and external parties like tax, audit, and AML authorities.

Thankfully, there are a number of applications which are specifically designed to address the crypto payment needs of organizations like DAOs, enterprises, and foundations.

A. Billing in crypto

1. CRYPTO INVOICES

Invoicing clients in crypto is especially relevant for companies that provide services to crypto-native organizations. Examples include smart contract audit firms, software development houses, media and marketing agencies, or corporate services providers.

Crypto tools are designed to meet the operational and compliance needs of enterprises accepting payments in crypto, by simplifying the invoicing process.

You can automate recurring invoices for billing your clients monthly, weekly, or even on a streaming basis. Or schedule email reminders to chase upcoming bills, or even late payments past due.

It also lets you know when you have been paid. You can also enable email notifications to let you and your clients know when your invoices have been sent, rejected, accepted, or paid on chain.

It also serves as a deterministic proof of income. Suppose you receive a call by law enforcement agencies, suspecting you of laundering money for an international scam ring. Or the tax authorities accusing you of unlawful tax evasion.

Sending them your Etherscan wallet history does little good. The pseudonymous nature of crypto wallet addresses, and the long alphanumeric strings of transaction hashes are ill-suited for financial reporting, or calculating tax liabilities.

With crypto tools, all this is documented easily, and in a human readable format. All wallet addresses are also linked to real world identities in a deterministic manner. There is almost no chance that a wallet, or payment is mislabeled by accident

On the other hand, you may also be a CFO of a DAO or crypto-native company that pays contractors, contributors, freelancers, and other service providers in crypto.

Most crypto organizations have substantial proportions of their treasury in crypto from fundraising events, and will prefer to pay for their operating expenses in crypto as well. Your organization needs a tool that allows you to easily pay bills and invoices in crypto.

Most organizations send and receive PDF invoices - in different layouts and formats, across different communication channels like email, and messaging apps.

This is problematic for several reasons:

Firstly, there is the issue of operational efficiency when making crypto payments. Most companies manually copy the payment information from PDF invoices, or a spreadsheet when paying the invoices. This is time-consuming, and incredibly prone to human error.

With crypto tooling, all wallet addresses are linked to names and emails. There is no chance of paying the wrong amount or to the wrong person. With batch payments feature, you can also review, approve, and pay hundreds of different wallets, in different tokens in just three clicks.

Secondly, there is also the issue of finance operations. With crypto tools, you can spare yourself the endless back-and-forth of unnecessary communications between freelancers and your company's finance department.

A common nuisance companies experience with invoices is that mistakes sometimes occur with the wrong billing information like the company's name, Tax ID, or address. This can cause needless delays in processing payments.

Crypto tools allow you to send your freelancers or contractors a QR code or link. This will automatically create an invoice that's already pre-filled with your business information. They will just need to fill out the rest of the invoice. Now anyone can invoice you correctly in just a few clicks.

Thirdly, there is the issue of bookkeeping. PDF invoices typically come in different layouts, which must be manually downloaded, properly named, and stored into files.

Their data must be extracted, compiled, and uploaded into some bookkeeping or accounting software like Xero.

But how do you account for the historical exchange rates of invoices denominated in volatile cryptocurrencies, or even fiat exchange rates? What about gas fees?

All of this is automated with crypto tooling companies where you have a single clean dashboard where you can see all your invoices in chronological order, filter by names, addresses, or payment status.

All this data, including historical exchange rates and gas fees, can be easily exported to tax or accounting software in a few clicks.

2. SUBSCRIPTIONS IN CRYPTO

Subscriptions in crypto is another topic that may be relevant if your organization accepts crypto payments.

Invoices are good enough for most B2B billing workflows - especially if there are lags between delivery of the service and payment.

Even for companies that wish to offer subscriptions in crypto, invoices can also be used to offer subscribers discounted lump sum payments for packages or bundles.

But companies like blockchain analytics tools, news, or media and other content platforms may prefer a crypto billing method that supports direct debits at regular intervals from customers' crypto wallets.

There are currently very few elegant blockchain-based solutions for merchants to pull funds away from their subscribers' crypto wallets on a regular basis.

True subscription on the blockchain is technically challenging. The blockchain was built with decentralization and security in mind.

Every transaction has to be signed and approved by the wallet owner - a "push" payment. This does not lend itself well to "pull" payments like subscriptions.

There are three approaches that currently exist to support subscriptions in crypto:

• Streaming payments

Payment streaming protocols like Superfluid allow your organization to bill subscribers or users every second. This would be ideal for on-demand, sharing economy platforms like a car, or bike-sharing dApp.

In a single transaction, a subscriber could agree to transfer a fixed amount in a constant stream over a pre-defined duration. Every second, a tiny amount of the total bill will flow out of the subscriber's crypto wallet, without any need for additional gas fees. Similarly, cancellation is also only one transaction.

But in order to use Superfluid's payments streaming, a subscriber will need to wrap their ERC20 tokens into a Super Token, which are then used for payments. For instance, our hypothetical bike-sharing dApp could accept payments using Request Finance, in the USO-pegged stablecoin, DAI.

• Token allowances

Token allowances are the equivalent of direct debit authorizations in traditional finance. It allows your subscribers to provide a one-time approval for recurring payments, enabling businesses to provide subscription-based services in a hassle-free manner.

Merchants can automatically deduct subscription fees directly from subscribers' wallets at regular intervals, over the subscription duration (e.g. 30 USDC per month). Once the smart contract uses up the allowance for the given period of time, it cannot pull any tokens from the user's wallet, until the periodic allowance is reset at the next time interval.

For instance, Suberra is developing a subscription payments standard through periodic allowances, which are time-gated smart contracts with pre-defined transaction values.

• NFT subscriptions

Another approach would be recurring billing using NFTs that serve as digital membership cards. For instance, Unlock Protocol enables NFT-based recurring subscriptions and memberships that don't need to be manually renewed.

In comparison to the payment streaming method above, Unlock can allow your product to automatically enable, or disable a user's access to your services depending on the NFT's validity, which is tied to whether a member has paid their bills.

Additionally, billing subscribers via membership NFTs can also allow you to easily develop commercial partnerships with other merchants to offer incentives, discounts, and other loyalty rewards that enhance the value of your membership plan.

For instance, our hypothetical bike-sharing dApp that uses Unlock Protocol's NFT membership to bill its users for the use of its bikes, could also partner with coffee chains like Starbucks to offer a 10% discount on in-store purchases to members who have the bike-sharing membership NFT in their crypto wallet.

Comparing crypto billing methods

B. Compensation in crypto

Compensation at Web3 companies is also typically processed in crypto tokens and stablecoins - at least in part, if not entirely. There are good reasons for this. This section will cover how to manage three different aspects of compensation in crypto:

• Payroll

• Expenses, and

• Token Allocations

1. CRYPTO PAYROLL

The Benefits of Using Crypto for Payroll

As mentioned before, stablecoins offer a fast, cheap, globally available, universally accessible, internet-native means of payment. Being able to pay anyone, anywhere, anytime greatly expands your organization's ability to hire the best talent, and enter new markets around the world.

How to Set Up a Crypto Payroll System

• Employer of Record (EOR)

One of the complexities of global payroll for remote teams also involves the need to have localized entities or subsidiaries which act as employers of record (EOR). On top of incorporating local entities wherever you wish to hire, you will likely also need to deal with local labor laws which cover things like pension schemes.

There are global payroll services providers like Deel, or Remote.com that do all of these for you for a monthly fee per employee. They also allow payouts in crypto - albeit only to US residents, and employees must open an account with Coinbase.

• Contractor Payouts

Using an EOR to manage global payroll can be costly, and there are typically serious limitations when paying salaries in crypto or stablecoins. To address this, crypto companies such as Request Finance introduced a crypto payroll module. Choose from over 150 different crypto or stablecoins to pay your team in, and from 14 different payment networks of your choice. You can also schedule recurring salary payments, according to the frequency of how often they get paid in a month. Best of all, you also can pay hundreds of salaries in just a few clicks. You can also view the history of your salary payouts, or which team members have yet to be paid.

2. EXPENSES IN CRYPTO

Expense management is a big deal for DAOs and crypto companies. For one, it is closely tied to how an organization manages its burn rate - especially given how most crypto organizations' operating expenses are financed with investors' capital. After payroll, travel and expenses (T&E) is typically the second-largest spending category for companies. When these expenses aren't properly tracked and processed, that can interfere with a CFO's ability to accurately budget and forecast for the future.

Also, T&E can be used to reduce corporate tax liabilities. Under most tax regimes, T&E is also tax-deductible - insofar as proper records are kept to demonstrate that they are business-related. By maintaining the right documentation for the right period of time, and ensuring that all deductions are valid, companies can be confident they can maximize their allowable tax deductions.

Automating your organization's expense management can simplify the claims submission process, simplify documentation when claiming tax deductions, and enable employees to be reimbursed faster. No one wants to pay $1,000 in travel costs out-of pocket for a business trip and then wait around for months while those expenses are reviewed, approved and reimbursed.

Additionally, for the sales and business development teams who attend conferences and events frequently, they will find themselves having to claim expenses like conference tickets, or sponsorships that were paid in crypto.

There are many corporate expense management solutions in the market: but few allow expense reimbursements to be made in crypto. For instance, one of the most popular corporate expense management apps is Expensify - but the only cryptocurrency it supports for reimbursements is Bitcoin. Look for crypto companies which have an expenses module that allow CFOs to easily track, review, and reimburse expense claims in crypto, stablecoins, or fiat.

3. TOKEN ALLOCATIONS

In addition to ordinary wages being paid in stablecoins to meet the team's fiat expenses, many companies have governance, or utility tokens as part of their compensation packages. It is important to note that these tokens are distinct from equity. Unlike equity, most tokens do not represent a claim on the future cash flows of an operating entity.

Token allocations - typically done as part of an initial coin offering (ICO) - serve to align the incentives of the team with the long-term success of the platform. This inspires confidence in external stakeholders like users and early investors.

Token allocations have significant differences when compared to traditional equity.

The decision to offer tokens as compensation will depend largely on how the organization generates value, and where does the value accrue to. It is also possible to offer a combination of both tokens and equity as part of the compensation package.

In addition, you'll also need to consider:

• Payroll taxes and tax withholding

• Accounting and tracking token-based awards

• Legal documents and processes to ensure compliance with tax and securities laws

Note: seek advice from Qualified Persons like a local tax advisor or accountant with experience around token compensation plans.

6. TREASURY MANAGEMENT CHAPTER

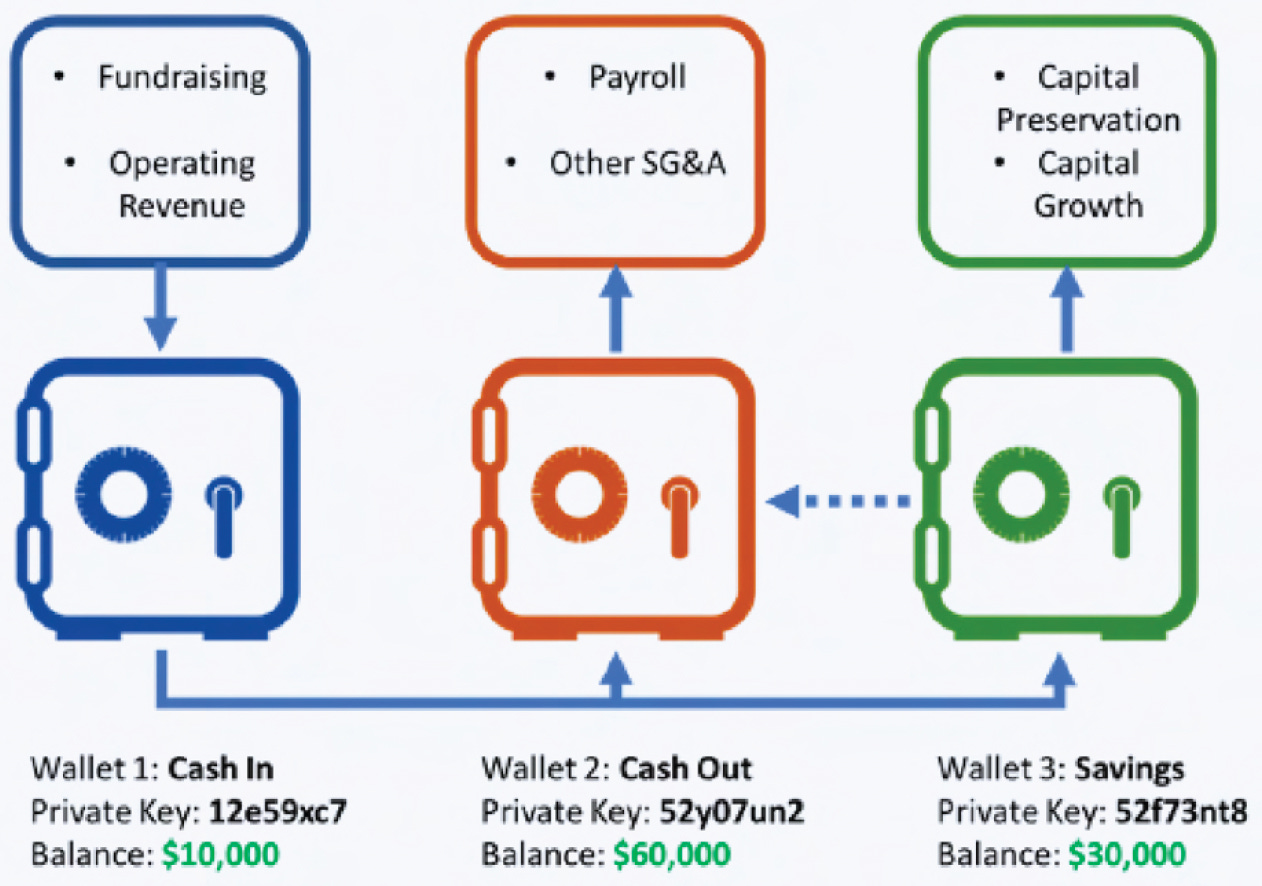

As explained earlier, you should consider maintaining at least three different crypto wallets:

• one for receiving payments,

• another for paying expenses,

• and a third wallet that acts like a savings, or investment account

The assets comprising these accounts are derived from multiple sources, primarily from fundraising or operating revenue. Fundraising in crypto typically takes the form an Initial Coin Offering ("ICO"), which lists a newly-minted token for sale on a decentralized exchange for sale to retail investors. The company receives cryptocurrencies like ETH, or stablecoins in exchange for its native token.

This fresh capital is typically directed to the treasury. Ideally, organizations or dApps that have sound fundamentals will aim to generate revenue from fees. This operating revenue represents a recurring source of income to the treasury. While other ancillary sources of income may exist, this piece will focus on those fundraising and operating revenue, with an ICO being the primary source of treasury capital.

Typically in an ICO, the token issuer will retain a significant portion of the supply of its native token in its own treasury account. These tokens are usually pre-allocated for a variety of uses as outlined in a public offer document like a White Paper. Allocated uses often include staking rewards, compensation for advisors and other core contributors, ecosystem development grants, or future working capital needs.

Often, the organization's treasury will be composed largely of its own native token; effectively seeking to align the interests of investors and the token issuers. Messari illustrates this in its report, Crypto Theses for 2022, showing the breakdown of top organization treasuries. Shown below, some of DeFi's largest treasuries are largely, if not entirely, composed of the issuer's native tokens.

Treasury Capital Allocation

BEST PRACTICES

For proper organization treasury allocation, as with a traditional finance investment strategy, there is no "one size fits all" solution. There are, however, some best practices and a framework for approaching treasury allocation.

A16z Crypto states that "the goals are capital preservation, liquidity, and income, in precisely that order" for a Web3 CFO's treasury asset allocation and management strategy. Building off of this framework, let us dissect each component and build a hypothetical treasury basket assuming a profitable organization with a native token.

1. CAPITAL PRESERVATION

Large exposures to a single asset are a significant risk factor to the organization's treasury.

Regardless of economic fundamentals, token prices are highly susceptible to exogenous shocks.

Proper asset allocation and defensive diversification are fundamental pieces of traditional investing that carry into the DeFi realm as well.

An investor holding an S&P 500 ETF will almost certainly fare better than the investor holding one individual technology company stock in the face of a tech sector bottoming such as the Dot-Com Crash.

Narrowing the focus, holding that one specific stock introduces direct, unmitigated exposure to a sole company: if it goes under, the investor goes under. These same principles can be applied to the DeFi ecosystem and specifically to treasuries.

At its core, a treasury should be a fortress of capital, walled against market gyrations and certainly impenetrable by the malperformance of one individual asset. This approach, as seen in the Messari chart, is not always taken, however. So how should a treasury be composed? What is the proper asset allocation?

As highlighted by the cryptocurrency market's volatility and overall 2022 performance, capital preservation can be a challenging target. However, focusing less on the market movement of an investment, an investor may look to the underlying organization's health and likelihood of survival. In other words, what is the chance of it blowing up?

Without naming specific tokens, some assets within the ecosystem are generally respected as "blue-chip" investments with the largest market caps, they are foundational to the industry; if they go under, we all go under. Additionally these assets have shown massive historical price appreciation since launch which more than preserves purchasing power.

Capital preservation can also be achieved by holding industry-standard, dollar pegged assets. For example, and not providing recommendations, Circle's USDC or MakerDAO's DAI might fit this approach.

Assuming operations as usual, a treasury of 100% these two assets would have the exact same balance in thirty years as it does today. This is essentially a "leave it under the mattress" approach.

So which approach to choose? While the former comes with volatility and a litany of organization-specific risks, the latter delivers no possibility of price appreciation and loss of purchasing power when off-ramped to a fiat currency due to off-chain inflation.

This leads back to the basics: Diversification. Including a mix of both types allows an organization to know its treasury will have a floor value of the dollar-pegged assets while also aiming for capital gains from the industry's top coins or tokens. Capital is preserved and maintained.

2. LIQUIDITY

This is the cash in the checking account used to cover expenses. An organization will have a list of basic cash expenses such as compensating core contributors, audits, server hosting, marketing at events, and so on. Without immediate liquidity, the project could potentially renege on contracts or miss payments.

Going back to the need for diversification, an organization with 100% of its treasury in its native token would need to sell that token in order to generate short-term liquidity.

This raises three, of multiple, primary complications.

• Downward pressure on the token's market valuation. Selling large blocks into an otherwise stable market reduces the token's price, all else equal.

• Capital loss when selling into a down market; if the token has declined in price then selling for liquidity results in a loss.

• Invites the appearance that the organization offloading its own token has lost faith in its own project. Other sellers may follow, cratering the token price, or users may abandon the platform.

Liquidity exists in the form of cash. Cash, in the cryptocurrency ecosystem, exists in the form of dollar-pegged assets. Thus, liquidity is best maintained by holding a diversified basket of the most battle-tested such stable assets.

This selection may include the aforementioned names USDC and DAI or introduce other well-known dollar-pegged assets with transparent collateral reporting.

3. INCOME

DeFi platforms can offer a range of treasury management services, including decentralized exchanges, lending and borrowing platforms, and yield farming opportunities. From these different avenues, a treasury may generate income through two methods:

• Capital gains, highlighted above, strives for the "buy low, sell high" approach. However, as seen in the case of my investment portfolio, this approach does not guarantee positive returns and often results in massive losses. It is a high risk strategy. That does not mean organizations must eschew asset speculation entirely, but rather that they should diversify to protect against market or asset downturns.

• Yield bearing investments, present an income strategy that, if selected properly, is insulated by market dynamics.

On Lido, for example, ~$5.8 billion ETH is staked earning 5.5% APR (as of 30 November, 2022). Similar options exist for other proof of stake chains such as Solana or Polygon.

Staked assets must be appropriately balanced against available liquidity due to lockup periods on many staking platforms and organizations. Lido and others do afford investors the ability to sell the staked assets on the secondary markets, but these assets are subject to the same risks as highlighted in the "capital gains" strategy.

A further, more stable, and often higher yielding option is investing in a yield generating platform such as Credix. On Credix, institutions and accredited individuals may generate ~12% targeted APY on USDC by investing in the Liquidity Pool which represents the Senior Tranche of all active deals in a marketplace. Credix deploys capital to traditional, off chain FinTech lenders in emerging markets which then issue loans to SMEs and consumers.

This type of investment relies on a pegged-dollar asset, USDC, and extends the lion's share of risk outside the cryptocurrency market. Thus, it is a market diversification from holding an asset such as Bitcoin. Neither should comprise the entire treasury, but balancing one against the other helps mitigate risks.

This three-pronged approach to treasury management ultimately fails without proper diversification. A treasury focused 95% on capital gains income fails in capital preservation and liquidity as nearly all of its assets are in the riskiest strategy thus putting its capital at risk and limiting dependable liquidity. Likewise, a 95% idle USDC treasury is not generating income

Diversification is the backbone of proper treasury management. Without a diversified allocation, a treasury puts the entire organization at risk of failure.

Regardless of whichever chains your organization uses, there is safety in diversity. While many Web3 teams may build on specific chains, and thus rely predominantly on one particular chain, Web3 CFOs should note that over exposure to one particular chain presents its own risks.

For instance, the collapse of Luna and UST wiped out many companies building dApps on Terra, and who held a large proportion of their company's treasury in assets on the Terra blockchain.

Web3 CFOs owe a fiduciary responsibility to its organizations core stakeholders, especially its team, users, and investors to protect the company's financial health- not a particular ecosystem or ill-defined sense of "community".

Balancing these three different concerns is a task that rests in part on the good judgment of Web3 CFOs, whom the management team can count on to act in the best interests of the company as a going concern. Hedging your crypto treasury's exposure should never be left to convenience, inertia, or an excess of blind optimism in any one particular chain.

Chains and their ecosystems are like countries. Failed chains are like failed economies in the real world: poorly governed banana republics where no one wants to visit, invest, or build in. The history of national economies - and blockchain economies is littered with gravestones to both.

Blindly trusting in a particular chain or assets on that chain would be the same as deciding to move your business, and all its assets into a newly-formed country in an emerging market. If doing so sounds like a terribly risky idea, Web3 CFOs at crypto companies building on particular chains should reflect on the prudence (or lack thereof) in doing so in the world of DeFi.

7. FINANCIAL REPORTING & COMPLIANCE

7. FINANCIAL REPORTING & COMPLIANCE

The string of collapsed crypto companies culminating in the fall of FTX & Alameda has sent shockwaves through crypto. Despite the damage, the turmoil presents an opportunity for new standards in financial reporting to emerge for enterprises and DAOs.

For internal stakeholders like employees and management, financial reports are like a health screening. It can be used to align teams, and inform decisions throughout the organization. For external stakeholders like investors, users, and regulators - financial reporting is a matter of compliance with local laws, but also to inspire public confidence in the viability and financial health of an organization.

In this section, we will review key issues in financial reporting in crypto like:

• Financial Statements

• Proof-of-Reserves (PoR)

• Accounting Standards for Crypto Assets

1. Financial Statements

The financial health of a web3 company or DAO should be measurable through consistent financial reports and statements that can be crafted on a regular basis. Just as a traditional company would regularly bookkeep and produce monthly/ quarterly/ annual financial statements, why should web3 companies and DAOs be any different?

If anything, CFOs can signal quality by a proactive commitment from a Web3 firm or DAO to produce regular financial statements internally and or to investors.

But producing financial statements can be a frustrating affair without the right tools. There are available enterprise grade crypto accounting solutions designed for web3 projects and other companies looking to incorporate crypto assets into their balance sheet.

Essential tools for setting up the complete back-office system for a web3 CFO include a solution for crypto accounting, AR/AP & payments, and payroll.

Ideally these solutions should integrate with one-another to maintain everything in one place.

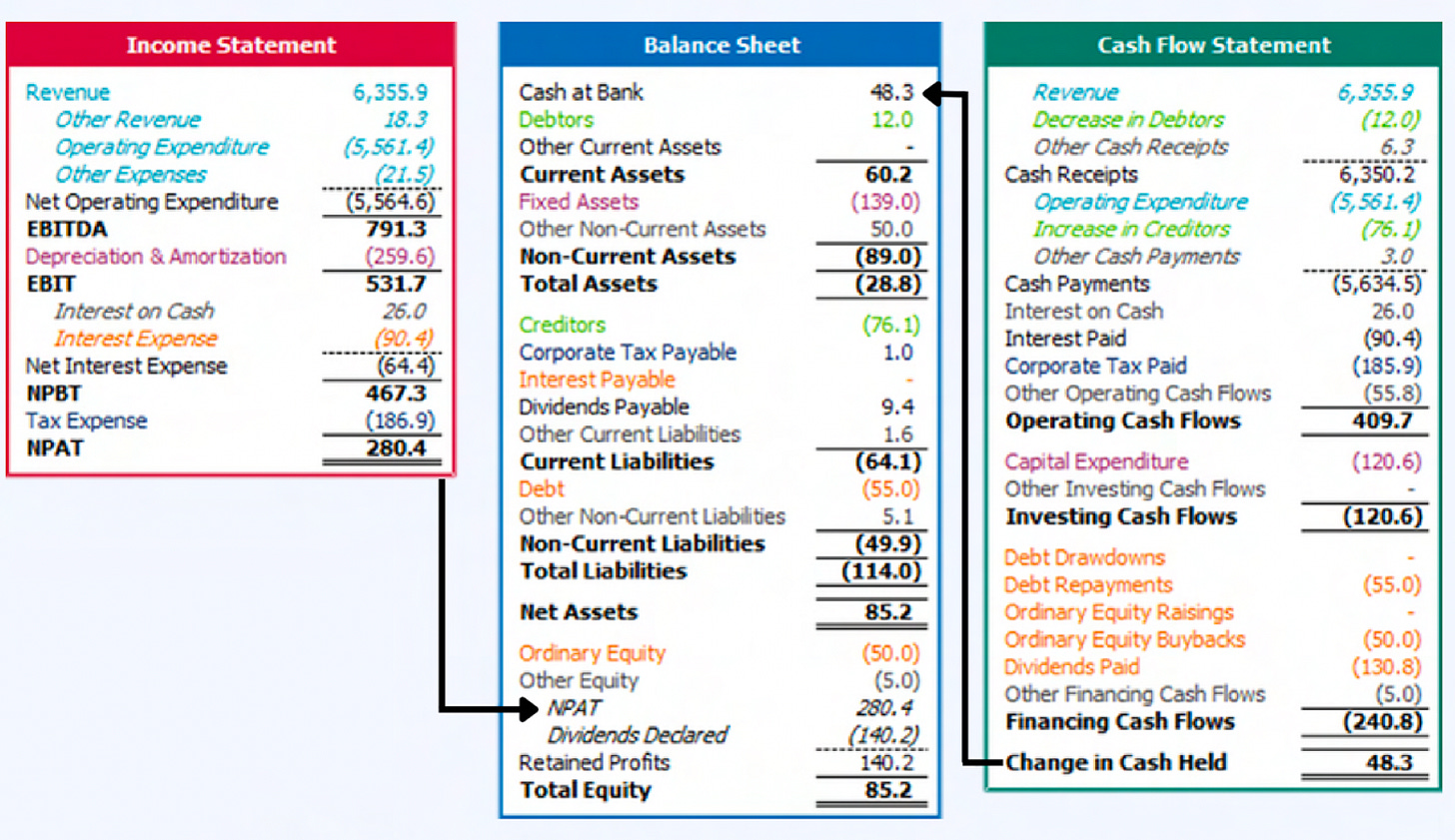

For simplicity, the most basic financial reporting consists of three financial statements: income, balance sheet, and cash flow (Fig. 14). The populating of the content within the financial statements then involves the systematic linking of information from each of the areas within the model, starting with revenue and working through expenses, debtors, creditors, assets, etc.

The practice of maintaining consistency in the creation of regular financial statements and thorough financial reports will prepare Web3 companies for auditors when they come knocking at the door.

Alternatively, Web3 CFOs at smaller organizations that may lack the in-house capabilities to manage financial reporting can consider outsourcing the work to crypto-native corporate services providers like BlockOffice.

2. Proof of Reserves

Proof-of-Reserves (PoR) Is an independent audit performed by a 3rd party to validate that a centralized entity's, or smart contract platform assets equal clients' funds. PoR allows the market to verify that industry giants are acting honestly, and are solvent.

A competitive advantage can be achieved by an on-chain PoR that matches assets against liabilities and details equity. The same is true for decentralized stablecoins. It's not enough to list assets.

PoR should detail cryptographic proof of client balances & wallet control. The public should also be able to see the sum of client liabilities, user-verifiable cryptographic proof that all wallets were included, & signatures showing a custodian has control.

Currently, PoR is most popular amongst exchanges, and other centralized deposit-taking institutions or platforms given that cryptoassets are often opaquely held In these centralized entities.

Of the largest centralized exchanges, Kraken Digital Asset Exchange has been known & respected for its a semi-annual PoR. Binance recently also announced plans to perform routine PoR audits in light of FTX imploding.

PoR should be an industry standard for DeFi, especially stablecoins & real world assets (RWA). If individuals/entities can't be certain that a protocol or stablecoin is backed as it claims to be, the market remains susceptible to systemic risks that harm DeFi adoption & innovation.

For example, Chainlink's PoR service provides smart contracts with the data to assess collateralization of any on-chain asset backed by both: (i) off-chain and (ii) cross-chain reserves. Operated by a decentralized network of oracles, it enables the autonomous auditing of collateral in real-time, rather than forcing users to trust paper guarantees made by custodians. This can give DeFi platform users transparency into an asset's underlying collateralization

Chainlink Proof of Reserve verifies the collateralization of any on-chain asset backed by off-chain or cross-chain reserves.

Read here how ‘How crypto companies can provide proof of reserves’. As a public company, Coinbase already proves our reserves using our audited financial statements. Coinbase is also exploring various novel ways to prove reserves using more crypto native methods and are announcing a $500k developer grant program to encourage others to do so as well. On-chain accounting is the future, bu there are pros and cons to the various ways this can be implemented today.

3. Accounting Standards for Crypto Assets

Accounting for crypto assets remains a highly-debated topic among bookkeepers and investors today.

While innovation in the crypto space is moving at a rapid pace, standard setters in the accounting industry have not had the same stamina to keep up. With new crypto assets emerging all the time with varying properties, the task is monumental, to say the least.

Current accounting standards had not been written with crypto assets in mind, and therefore, one must look at the existing accounting standards and apply a principles based approach.

The two prominent standard setters today are the IASB and FASB, responsible for the development and publication of International Financial Reporting Standards (IFRS) and US GAAP accounting standards, respectively. While both seek to improve the transparency of financial reporting, the accounting treatment of crypto assets will slightly differ under IFRS and US GAAP, and should be applied according to the jurisdiction of the underlying entity.

A Web3 CFO needs to learn how to approach each of the following:

• Initial recognition and subsequent measurement of crypto assets

• Fair value measurement of crypto assets

• Tax: calculating capital gains/losses

• Disclosure for crypto assets

DIFFERENT ACCOUNTING TREATMENTS UNDER IFRS AND US GAAP

With different exchanges quoting different prices, it's important that you maintain a consistent approach with regards to the pricing source of your crypto assets where the greatest volume are being traded. Given markets never close, the recommended practice would be to use the same time for pricing the assets.

Crypto assets like Bitcoin, Ethereum are actively traded, and therefore will have an active market or a 'principal market'. An active market is one in which transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis. The accounting standards do not define specific thresholds that need to be exceeded with regard to frequency and volume to determine if an active market exists. As such, the determination is subject to professional judgment.

Therefore, if an active market exists for that crypto asset at the measurement date, a Level 1 valuation can be performed. In the absence of an active market, the prescribed guidance is to use a valuation model that can be applied consistently from period to period.

TAX: CALCULATING CAPITAL GAINS & LOSSES

To make more informed investments and better manage risk, most finance managers actively track the unrealized gains/losses of their digital assets.

Calculating capital gains or losses also may be relevant where taxation on capital gains is levied. In some cases, capital losses may be used to offset your tax liabilities. Typically, only realised gains are relevant for tax reporting purposes.

Capital gains are usually calculated by taking the fair market value at the time of sale, minus the cost basis at which the crypto asset was acquired.

Thus, if your organization is domiciled in a jurisdiction where capital gains taxes are levied on crypto assets, it is important to understand how to assess your cost bases (i.e. what did it cost to acquire the asset) when calculating the profit or loss of transferring, selling, or spending a digital asset.

There are several methods to calculate cost-basis, including:

• First In, First Out (FIFO)

• Weighted average cost (WAC)

• Last In, First Out (LIFO)

• Highest in, first out (HIFO)

Below, I will illustrate the impact that each of these methods have on the gains/losses. It is important to note that the explanation below is referring to cryptocurrencies that are fungible.

Consider the following example of Janet Saylor, CFO of MacroTactics, a Web3 fund:

• Janet bought 1 BTC in Jan 2017 for $1,000 per BTC

• Janet bought 2 BTC in Jan 2018 for $14,000 per BTC

• Janet bought 5 BTC in Jan 2019 for $3,500 per BTC

• Janet sells 2 BTC in Dec 2021 for $47,500 per BTC

With FIFO method, Janet would set her cost basis for the 2021's sale as $15,000:

• Capital gains on 2021's sale= ($47,500 x 2) - $15,000 = $80,000

With WAC method, Janet would set her cost basis for the 2021's sale as $11,625:

• Capital gains on 2021's sale= ($47,500 x 2) - $11,625 = $ 83,375

With LIFO method, Janet would set her cost basis for the 2021's sale as $7,000:

• Capital gains on 2021's sale= ($47,500 x 2) - $7,000 = $88,000

With HIFO method, Janet would set her cost basis for the 2021's sale as $28,000:

• Capital gains on 2021's sale= ($47,500 x 2) - $28,000 = $67,000

As seen above, HIFO often leads to lowest capital gains and hence tax liabilities. However, the FIFO methodology is the most widely accepted cost basis method. This is because it accounts for the frequent points of purchases and sale of crypto assets across accounting cycles. Discuss with your professional accountant when deciding on your preferred cost basis method.

OBTAINING CLEAN DATA FOR YOUR COST-BASIS CALCULATIONS

When maintaining your ledger of digital assets transactions, it is essential to review the following data points across each wallet type:

• Transaction fees

• Timestamping of transactions

Not accounting for these may result in erroneous data being used in calculating the cost basis of your team's digital assets.

1. TRANSACTION FEES

When calculating the cost-basis of your digital assets, it is essential to account for the fees incurred in the transaction. It is essential to deduct the transaction fees when determining the cost of the said digital asset. Some of these fees include:

1. Gas fees charged by the blockchain protocol

2. Fees imposed by the wallet provider (usually by centralised wallets)

For each of these activities, it is important to understand the relevant fees involved in the process and account for it. See table below.

2. TIMESTAMPING OF TRANSACTIONS

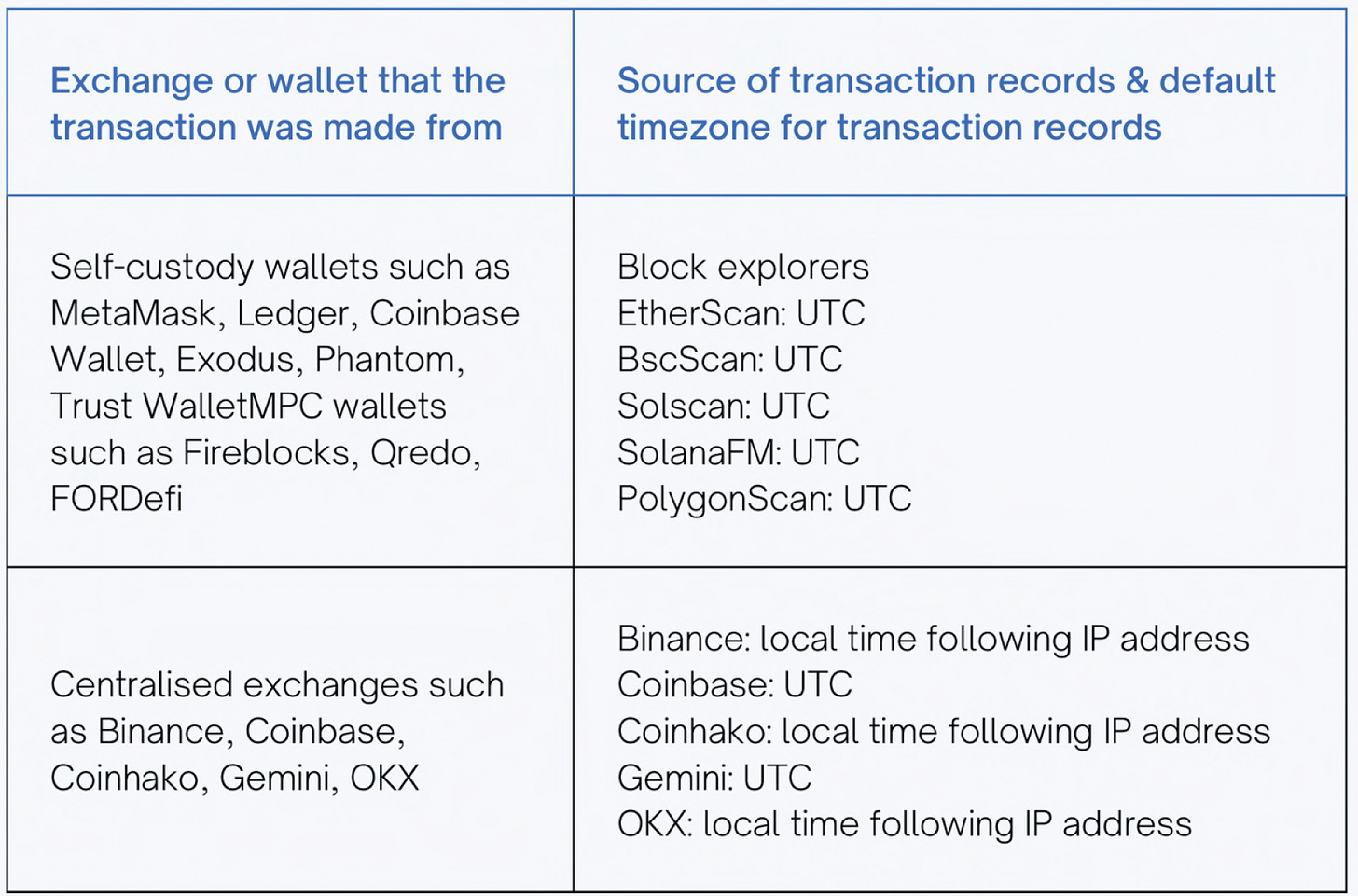

It is common for Web3 teams to have transactions involving both centralised exchanges and self-custody wallets. The good news is that for both centralised exchanges and self custody wallets, users can quickly export their transaction records (e.g. via the central exchange's records or block explorers such as Etherscan).

However, centralised exchanges and block explorers often mark the timestamp of transactions in different timezones.

When compiling a chronological record of transactions across centralised and self custody wallets, finance managers have to ensure the transactions are in the same timezone before compiling them into a master journal. This matters because cost basis methods such as FIFO require an accurate chronological order of transactions.

It is best to keep all transactions to be in the same time zone, be it UTC or the local timezone of the entity in which financial statements are prepared for.

Here are the default time zones for popular block explorers and centralised exchanges. (Updated as of Dec 2022)

When choosing a crypto-native accounting software, ensure that these adjustments for fees and timestamps are accounted for. For instance, Headquarters (HQ.xyz), enables CFOs to generate automatic records of the cost-basis, fees, and time-stamp adjustments for crypto transactions - across wallet types.

DISCLOSURE FOR CRYPTO ASSETS

As there are no explicit IFRS and US GAAP standards for crypto assets, the presentation and disclosure of crypto assets and crypto asset transactions should follow the entity's approach about the accounting model to apply to the crypto asset, i.e. as an intangible asset, inventory, a financial asset or otherwise.

However, such disclosures require significant judgement and a thorough understanding of the underlying facts and circumstances.

For example, below are the summarized disclosure details of Microstrategy for their Bitcoin holdings in the annual report 2021 (note (g) to consolidated financial statements);

• The Company determines the fair value based on quoted prices on the Coinbase exchange, the active exchange that the Company has determined is its principal market,

• The Company performs an analysis each quarter to identify indicators for impairment,

In determining if an impairment has occurred, the Company considers the lowest price of 1 Bitcoin quoted on the active exchange at any time since acquiring the specific bitcoin held by the Company.

LEVERAGING TECHNOLOGY FOR FINANCIAL REPORTING

Implement robust accounting and tax systems that are capable of handling cryptocurrency transactions.

This may include integrating specialized software or hiring external experts like BlockOffice to assist with the accounting and tax reporting of cryptocurrency transactions.

Web3 companies can take advantage of accounting software such as QuickBooks or Sage lntacct to manage their corporate financial reporting. This software will allow companies to handle their accounts payable, accounts receivable, and payroll quickly and efficiently.