How VCs make fintech bets

Dissecting the investment memo of one of the hottest fintech SPAC listing

Fintech funding is on a tear these days; Q2 2021 was 3X YoY AND 22% of all venture dollars went to fintech. As per CB Insights, ~$35B went towards VC funding Q2 2021 which implies a $100B+ annual run rate!

The usual suspects remained the same globally: Sequioa, Accel, Ribbit, a16z and Index Ventures were some of the most active investors in the space

Many of these fintechs are now choosing the SPAC route to get quicker exits at unheard of valuations - a mega-trend that may last through 2022 until we see some retail investors left picking up the pieces

But the big question is, how do Venture Capital firms gain enough conviction to invest in some of these fintechs?

What does the investment thesis and memo look like?

We use the case study of one of the most disruptive fintech companies and look at the investment memo to start understanding how VCs think about these larger deals.

Investments memos are a powerful tool that can be used to power fundraising narratives, project guidelines, product pitches, and much more. They have 3 main reasons: forming conviction, relationship building and stakeholder alignment

Case Study: Investing in Hippo, $5B fintech darling

As per Forbes, Hippo is among the most innovative fintech companies of 2021, raising $700M+ capital to date, going to SPAC with a $5B valuation and with an impressive roster of global investors.

So what gave VC titans such as Ribbit Capital and Reid Hoffman enough conviction to invest in Hippo, a company just 5 years old that offers homeowners insurance in a faster, cheaper and more convenient way? Let’s dive in and look at deal memo from the eyes of these investors1

1: Exec Summary of Investment Thesis

Clear articulation of the key reasons investors believe that Hippo is poised to win

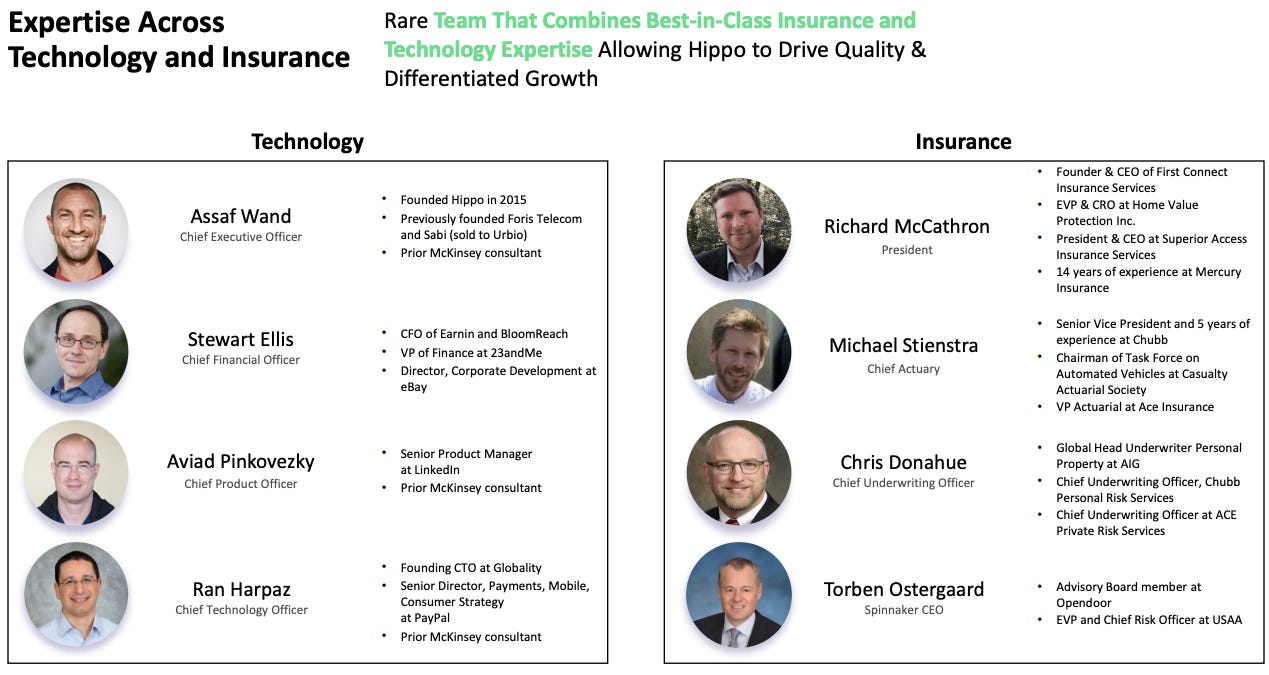

2: Strength of Founding team and ability to attract talent

Ability to show the depth and breadth of relevant experience of the founder, the team and ability to attract talent is imperative. VCs will often do extensive reference checks and assess founder & team fit before investing (domain knowledge, prior track record, ability to execute, passion and hustle).

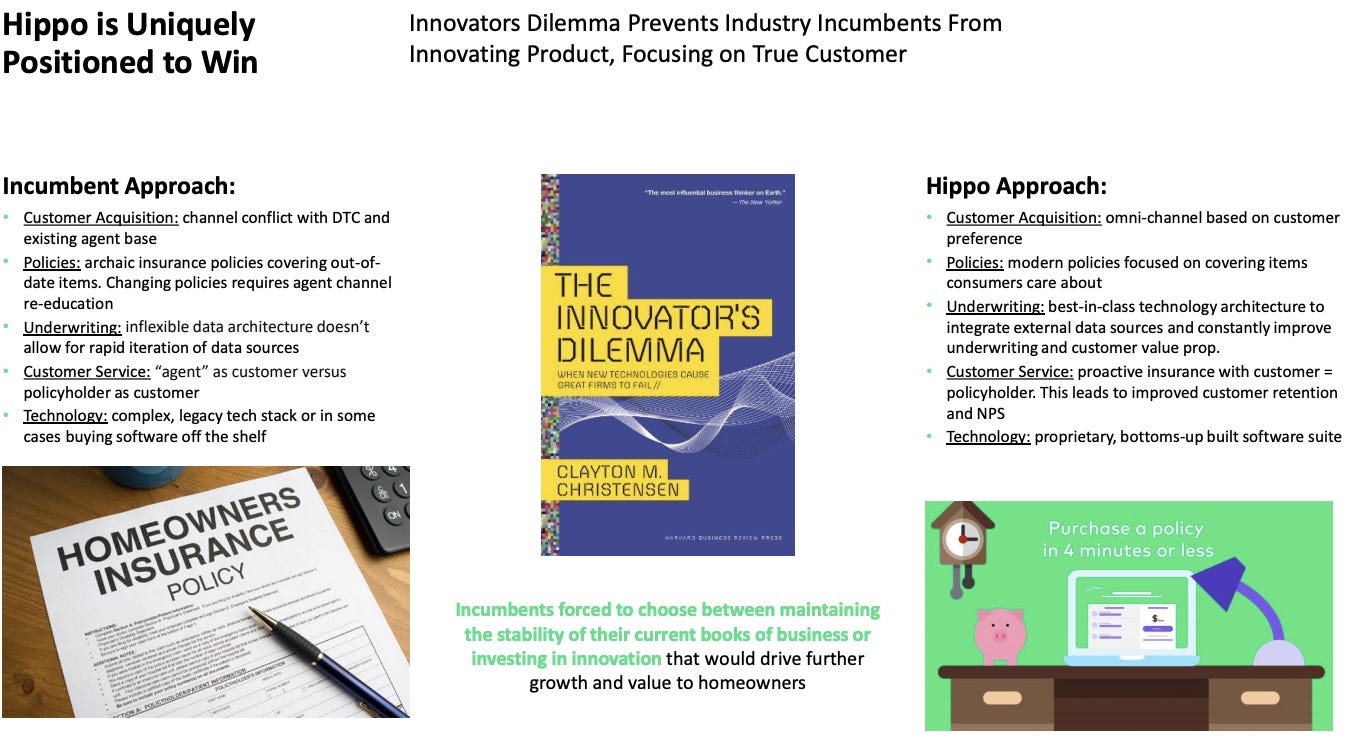

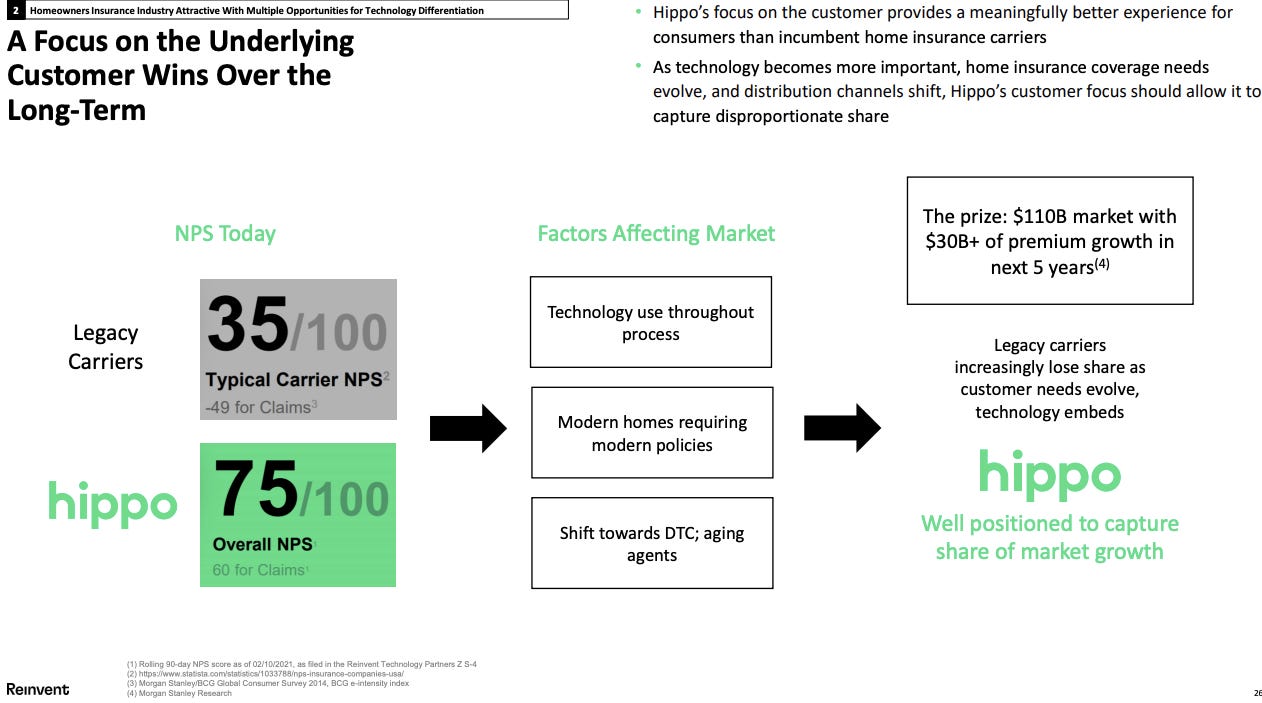

3: Market dynamics, inflection points and how the Fintech is positioned to win

Turns out, home insurance is a large, growing AND fragmented market with enough complexities to create sufficient barriers to entry.

Next big question is: so how can our fintech company Hippo create a moat in this industry ripe for disruption? Read the 3 slides below and you will be impressed

Immense Potential TAM → Small Penetration = Large Outcomes

4: Healthy unit economics & strength of business model

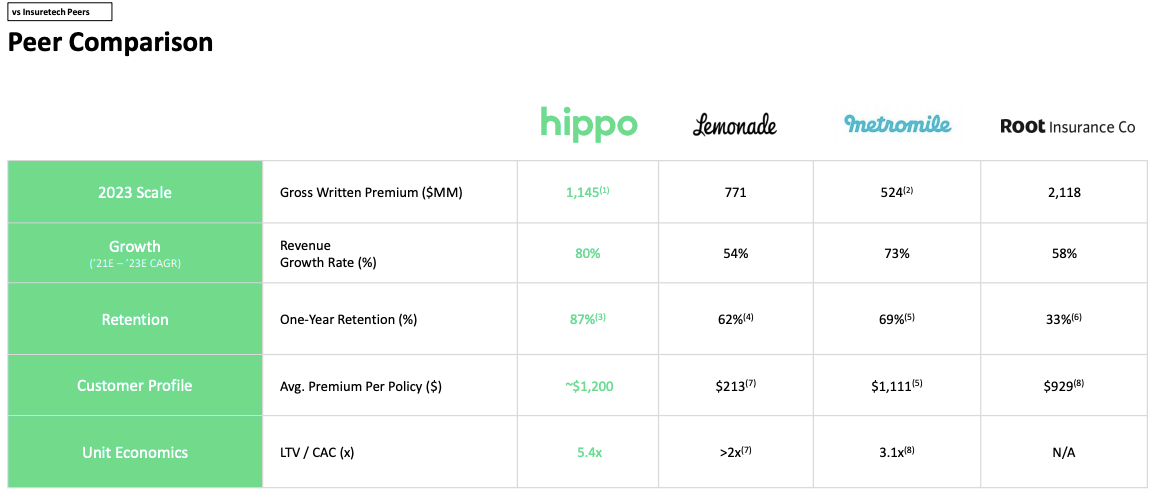

The age of loss making neo-banks raising billions may be passing, as VCs look for attractive customer dynamics (Hippo earns $1,200 average premium with a 8+ Years customer life) and compelling unit economics (Hippo has a sound 5.5 LTV/CAC ratio)

Hippo focuses on partnering with best-in-class reinsurers to cede risk and sophisticated reinsurance structures optimize volatility of earnings against attractive returns from holding premiums.

Ability to de-risk the business model, show healthy gross margins and improve unit economics with scale are a winning combination as we can see below.

Achieving standard loss ratios as the business and insurance book scale creates a very compelling outcome for Hippo. The flywheel effect:

Over calendar year 2020, Hippo launched services in 12 new states, bringing the total to 32 states.

In the fourth quarter of 2019, 55% of Hippo new policy premium came from sales to customers in Texas. By the fourth quarter of 2020, the percentage of Hippo new policy premium from Texas had declined to 13%

Greater diversity will reduce the impact of catastrophic weather events in any one geographic region on Hippo’s overall loss ratio, improving the predictability of financial results over time as the Company scales

Increased geographic diversity will also improve Hippo’s ability to secure attractive terms from reinsurers, which would improve overall cost structure and profitability

5: Unfair advantage over competition: Customer and Product focus

Best fintech companies win over their customers from competition with superior product-led functionalities or experiences that delights them while solving core pain points effectively. Hippo’s product does this 10x better than legacy solutions.

Doing this effectively, naturally leads to rapid adoption of the product as we can see in Hippo’s superior growth rates and retention rates (~90% one-year retention)

6: Distribution is key for startups

The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation - a16Z

Finding 1-2 distribution channels that scale well at a low-cost can make or break a fintech. For Hippo, an omni-channel approach provides strategic flexibility in trading off capital light growth versus higher LTV of DTC channels.

Hippo’s vertical focus provides several advantages such as compounding know-how in core insurance product in data aggregation for underwriting, and diversification of risk portfolio

7: Risks and trade-offs: know your base outcomes, downside & upside

Make sure to capture any strategic risks - VCs play the devils advocate all the time - and know your upside drivers as well. There are always trade-offs to be made as only hindsight is 20/20.

We believe there are few true network effects in the home insurance business today… but that may change in the future

As data availability expands, Hippo will have an edge over incumbents in integrating data into the underwriting process and driving down loss frequency and severity. Over a long time horizon, we believe Hippo can realize loss-ratios below incumbents using technology

8: Valuations & business projections that make sense!

Valuation is always more an art than science in the fintech space for VC funding. However, unit economics, gross margin efficiency and how much capital a business will consume are key considerations for a VC during fundraising.

Hippo commands reasonable valuations based on AV/gross written premium or AV/revenue given the growth rates and projected margin expansion at scale.

That’s all for Hippo - but there are many such well-know startups today that VCs had to gain enough conviction early on to take the plunge.

Here you can see the early pitch decks of 25 unicorn companies (and exited unicorns), including Coinbase (when the price of bitcoin was around $6.25) and Airbnb (when it was AirBed&Breakfast). You can also see Revolut in its early pitch deck, the fintech company says it gained 4,800 pre-product subscribers within a month and asks for £1.5M ($1.9M). Now, it boasts more than 15M personal customers and 500,000 business customers, and it has garnered $916M in funding to date 2

If you liked this post from Cryptechie, please subscribe and share!

https://www.sec.gov/Archives/edgar/data/1828105/000119312521217485/d183028d425.htm

https://www.cbinsights.com/research/billion-dollar-startup-pitch-decks/