Robinhood IPO - Behind the numbers!

The wait is over for Robinhood's S1 and metrics are exploding

Stock brokerage giant Robinhood has just filed their S1 to go public on Nasdaq 🔔Robinhood has raised a total of $5.6 billion from private investors and was reportedly valued at $40 billion at its most recent funding round in February 2021.

Here's what you need to know👇🏼

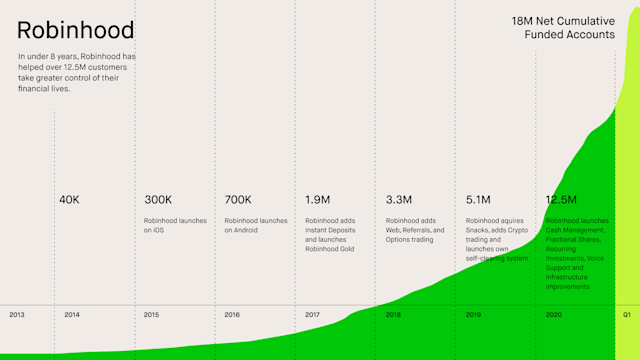

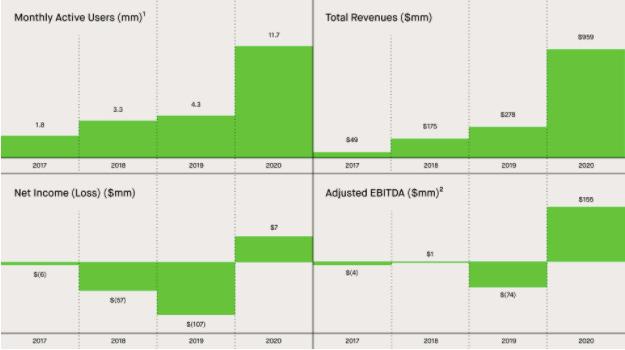

They have 18 million cumulative funded accounts, out of which 17.7 million are monthly active users. For the perspective, Chime, the biggest neobank in the US, reportedly has 10-12 million customers in total.

$81 billion in assets under custody. For instance, Coinbase, one of the biggest digital asset exchanges in the world, now has $90B in AUC and is worth north $51 billion in the public markets.

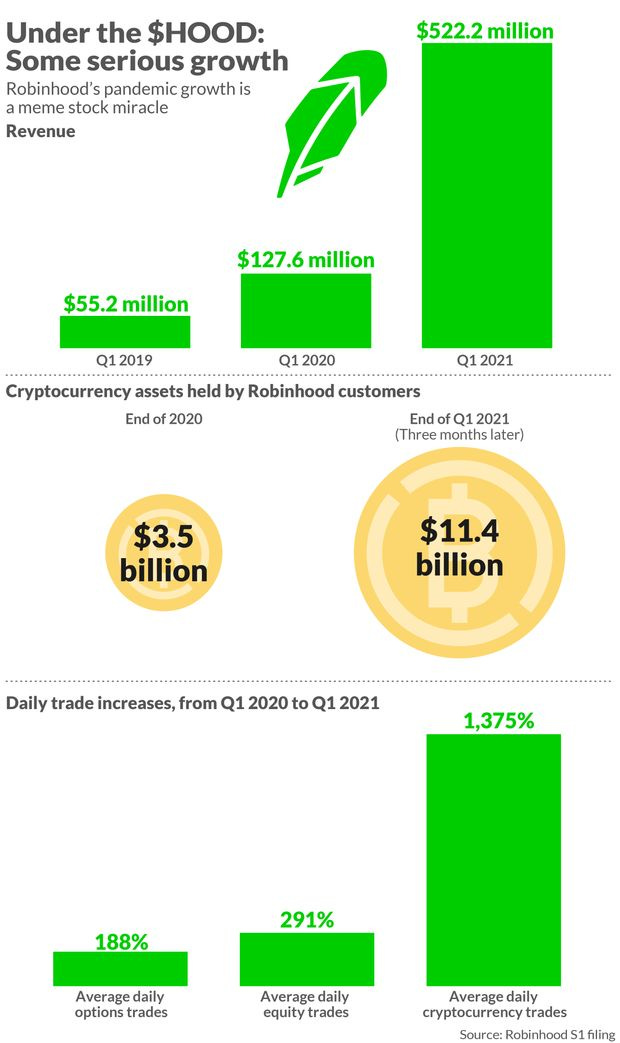

Robinhood did $522 million in 1Q21 revenue vs. $127.6 million in 1Q20. That's x4 growth over 12 months 🤯

The brokerage app did $958.8 million in revenue in 2020 reporting $7.5 million in net income. For example, Revolut, one of Europe's biggest FinTechs, reported a loss of $280 million in 2020.

Based on filings about 72% of the revenue (=$690M) came from PFOF (Payment for Order Flow). In other words, routing its clients' trades to a market maker.

34% of their entire cryptocurrency transaction-based revenue for the three months ended March 21, 2021 came from dogecoin. And during that quarter, 17% of total revenue came from cryptocurrency transactions.

Robinhood's famous referral program that promises users "up to $500 in free stocks''? It turns out around 98% of customers receive a reward in the much-less-enticing $2.50 to $10 range.

Robinhood lost $1.4 billion in the first quarter of 2021!

Despite all the negative publicity and challenges, Robinhood is seeing immense growth!

Robinhood released its long-awaited S-1 filing, required for an initial public offering, on Thursday, July 1. The filing came one day after Robinhood settled with FINRA, the brokerage industry's self-regulatory body, paying a record $70 million fine. The S-1 dropped months after Robinhood revealed it had confidentially submitted documentation to the SEC, with Bloomberg reporting that regulatory concerns had held up the filing.

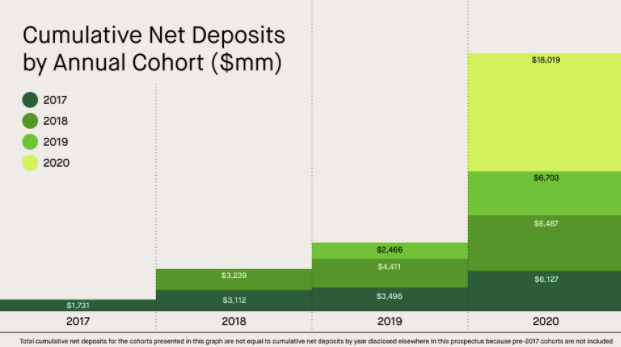

Revenue. Revenue by cohort is an important indicator of customer usage of our platform. We categorize our customers on a cohort basis based on the month, quarter or year they first funded their accounts. We track the annual revenue from those cohorts over subsequent one-year periods. On average, revenues per user increased nearly three-fold in the first 24 months for both our 2017 and 2018 annual cohorts. While not all forms of customer engagement with our platform directly contribute to revenues or otherwise impact our financial results, as more users join our platform (increasing our Net Cumulative Funded Accounts) and engage with new and existing products (contributing to our DAU and MAU), we expect to generate increased amounts of revenue over time. The chart below illustrates our revenue by annual cohort, reflecting our customers’ increasing activity on our platform.In terms of KPI's they are focused on Net Cumulative Funded Accounts, MAUs, AuC, and ARPU. The knock on & other "free" trading products has always been monetization but at $137 ARPU in 1Q21 that's above nearly all "neobanks" who depend on lending / interchange.

Risks to consider in Robinhood's IPO1

"If demand for transactions in dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected," Robinhood writes in the S-1.

Robinhood cited a concern that analysts have highlighted: its heavy dependence on revenue from payment for order flow. Such payments have been heavily criticized by regulators and lawmakers, especially in the wake of the GameStop trading frenzy. Robinhood disclosed that 75% of its total revenue in 2020 came from market-maker payments and other "transaction rebates." That number jumped to 81% in the first quarter of 2021.

Robinhood said any major change in payment for order flow due to regulation "could have an outsize impact" on its operations and results. The company even noted a key criticism of payment for order flow, saying that if that belief becomes more widespread, Robinhood could lose business to competitors. One of its main rivals, Public, dropped payment for order flow in favor of tips in the wake of the GameStop controversy.

The new SEC chairman, Gary Gensler, is not exactly a fan of payment for order flow. And Robinhood acknowledged in its filing that there is "no guarantee" that the SEC or other agencies would not put out new rules that "could substantially limit or ban" the practice.

Robinhood had a first-mover advantage, but there are now dozens of new competitors looking for a piece of the market. The company writes: "We operate in highly competitive markets, and many of our competitors have greater resources than we do and may have products and services that may be more appealing than ours to our current or potential customers."

https://www.protocol.com/robinhood-ipo-s-1?rebelltitem=4#rebelltitem4