How big is the MEV opportunity?

Exploring MEV and if Flashbots is really worth $1B valuation

Flashbots recently raised at $1B valuation as the foundational player in the Ethereum block-building space and architect of its MEV dynamics. I went deep into MEV rabbit hole to dissect MEV and how big Flashbots could really get.

In this post, we will cover:

1. MEV - overview

2. Market opportunity & players

3. Value chain and MEV participants

4. About Flashbots

5. My thesis on MEV space: Is Flashbots really worth $1B?

1. MEV - overview

Definition: Miner (earlier PoW) or maximal extractable value (MEV) is the value extracted by miners or validators by utilizing their ability to order transactions within a block.

This new breed of high frequency trading allows savvy and technologically advanced participants in DeFi to arbitrage across decentralized exchanges (DEXs) and forcefully liquidate or draw down positions directly after a large swing in asset prices on trading and lending platforms, resulting in tidy profits.

MEV has grown more lucrative on Ethereum due to the rise of Decentralized Finance (DeFi) applications and become easier to earn due to the creation of Flashbots Auction, a dedicated marketplace for finding the most lucrative MEV opportunities.

Types

The three main types of MEV on Ethereum are arbitrage, liquidations, and sandwiching.

DEX Arbitrage

When there’s a significant price difference across one exchange to another, MEV bots will buy lower-priced tokens to sell them on another exchange at a higher value.

Liquidations

DeFi lending protocols require users to deposit some cryptocurrency as collateral. When a user can’t repay his loans, the protocol typically allows anyone to liquidate the collateral and earn a liquidation fee from the borrower.

MEV searchers will compete to determine which borrowers can be liquidated and collect the liquidation fee for themselves.

Front-running

Some searchers will use bots called “generalized front-runners” to scan the mempool for profitable transactions.

Once a profitable opportunity is detected, the bot will replicate a user’s transaction with a higher gas price so that miners will choose that transaction over others.

Frontrunning (or Priority Gas Auction) occurs when a transactor submits transaction A with a higher gas price than an already pending transaction B, taking the profit opportunity from transaction B (i.e., taking a DEX price arbitrage chance). Such actions can cause negative externalities in a network.

Sandwiching

Malicious type of front-running that is often used to manipulate cryptocurrency prices. It occurs when a searcher detects a large pending trade on a decentralized exchange (DEX) and places a trade right before and right after it to benefit from an artificial price change.

Nature of MEV: Good or bad?

Good MEV: MEV helps make the DeFi markets more efficient by creating financial incentives to rectify price inconsistencies.

Bad MEV: MEV can work to disrupt network consensus to the detriment of user trust in the Ethereum protocol and subject user trades to unforeseen slippage or attack. Network congestion and high gas prices for other users

Bidding war occurs in regular transaction pools, increasing the p2p network load and volatility in gas prices

Due to the all-pay nature of the network, failed bids revert on chain, leading to an unnecessary blockspace consumption and underpriced bids (bidder execution risk) that reduce the block proposer profit

Because gas prices determine the orders, bidders cannot express granular ordering preferences (only bid for top positions) and can lead to bid spamming

Size of MEV

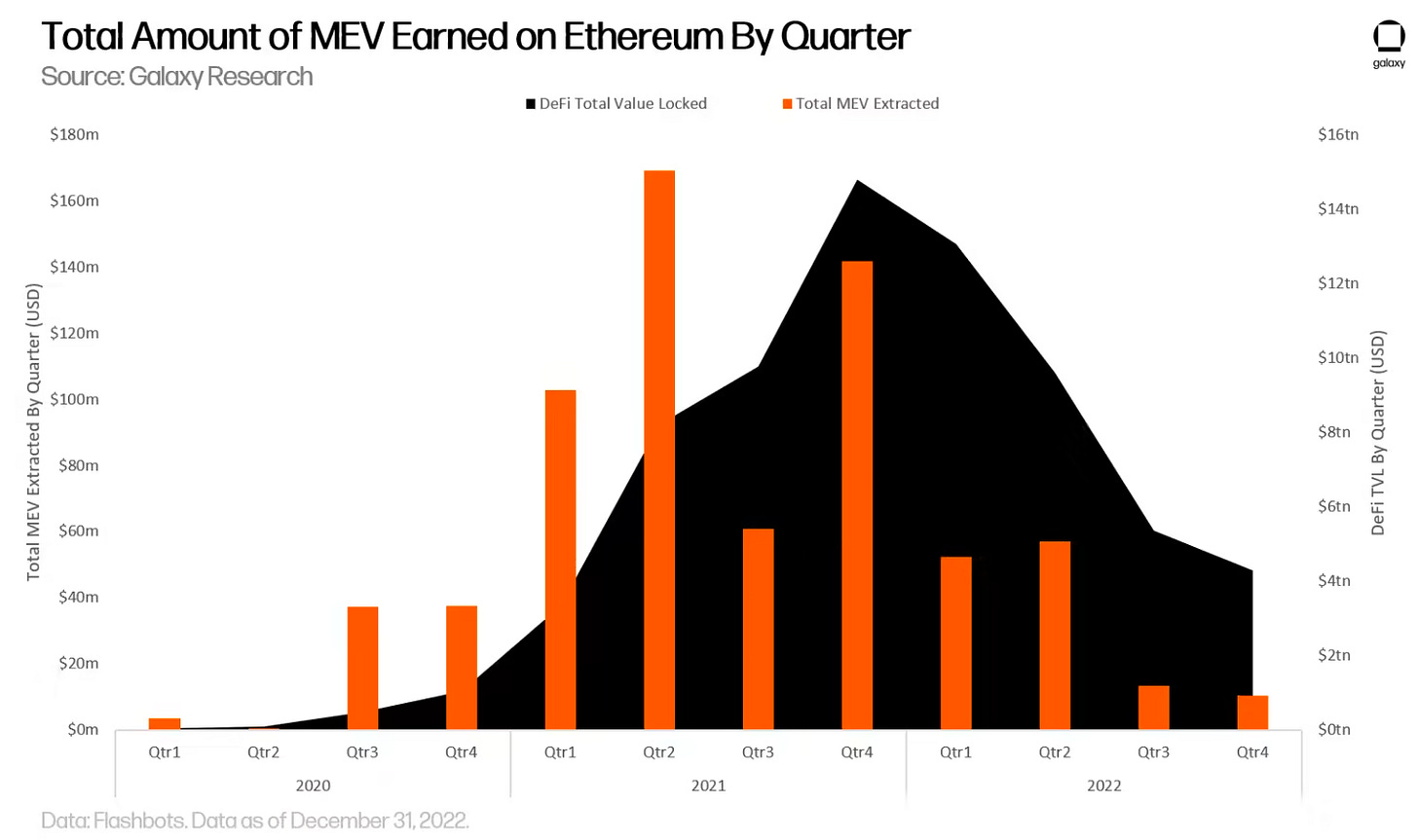

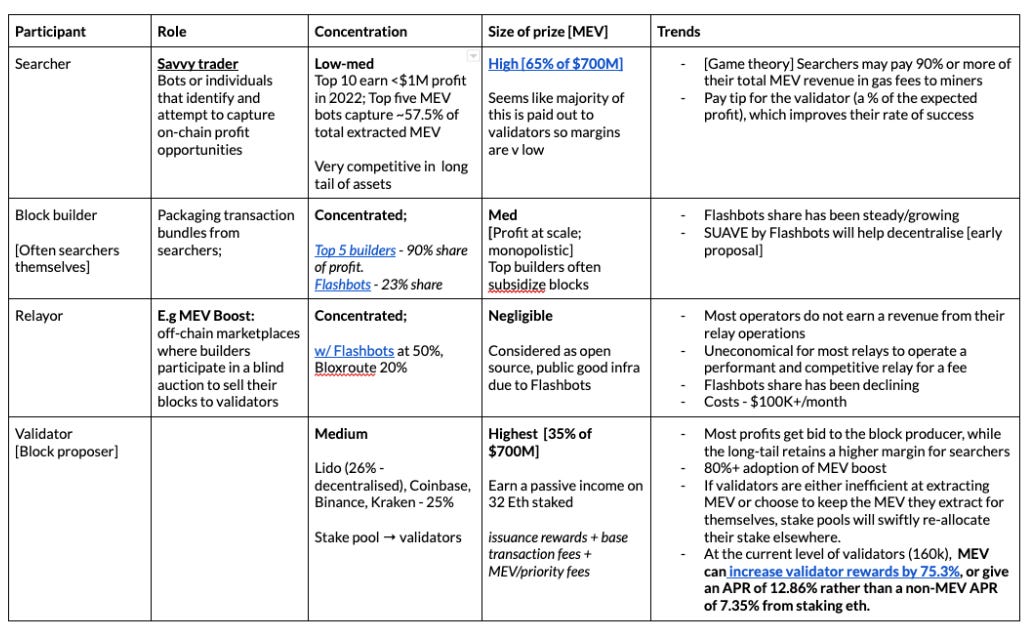

Miners and operators earned $730m in profit from MEV on Ethereum in 2021.

At current rates, Ethereum miners alone are expected to earn more than $750m annually from MEV.

2. Market opportunity & players

Industry TAM

Between January 1, 2022, and December 31, 2022, $133m in Maximal Extractable Value (MEV) was earned on Ethereum

Year-over-year, the total amount of MEV created in 2022 was significantly lower than the amount of MEV created in 2021 in part because of the steep decline of decentralized finance (DeFi) activity on Ethereum as a result of bear market conditions. In addition, increased competition between MEV searchers has also contributed to making DeFi markets more efficient and thereby reducing MEV profit margins.

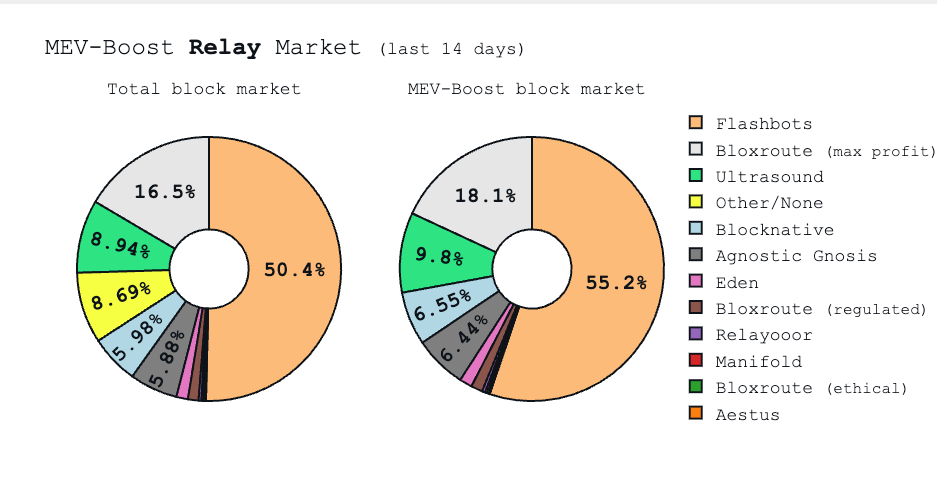

Third-party builders and relays are new entities in the MEV landscape of Ethereum made possible because of the advent of MEV-Boost software, as well as the open-sourcing of both builder and relay code. Historically, Flashbots was the only operator of a relay, and mining pools connected to the Flashbots relay to earn MEV. However, because of MEV-Boost and the open-sourcing of relay technology, other MEV relays such as the Dreamboat relay operated by Blocknative are starting to compete with the Flashbots MEV-Relay and help decentralize MEV infrastructure. The Flashbots MEV-Relay is still by far the most popular relay, producing 81% of MEV-Boost blocks.

The data from MEV-Explore sets the lower bound on MEV and actual MEV extracted would be higher due to incomplete protocol / transaction type coverage. The data also only reflects extracted MEV and not all the MEV opportunities (theoretical total extractable value is higher). MEV-Explore only covers profit for single-transaction MEV opportunities (i.e. does not cover profits made from sandwich attacks). The explorer also does not cover CEX-DEX arbitrage due to lack of public CEX data. Flashbots indicated MEV extraction is expected to grow as new ways of value extraction appear in the future

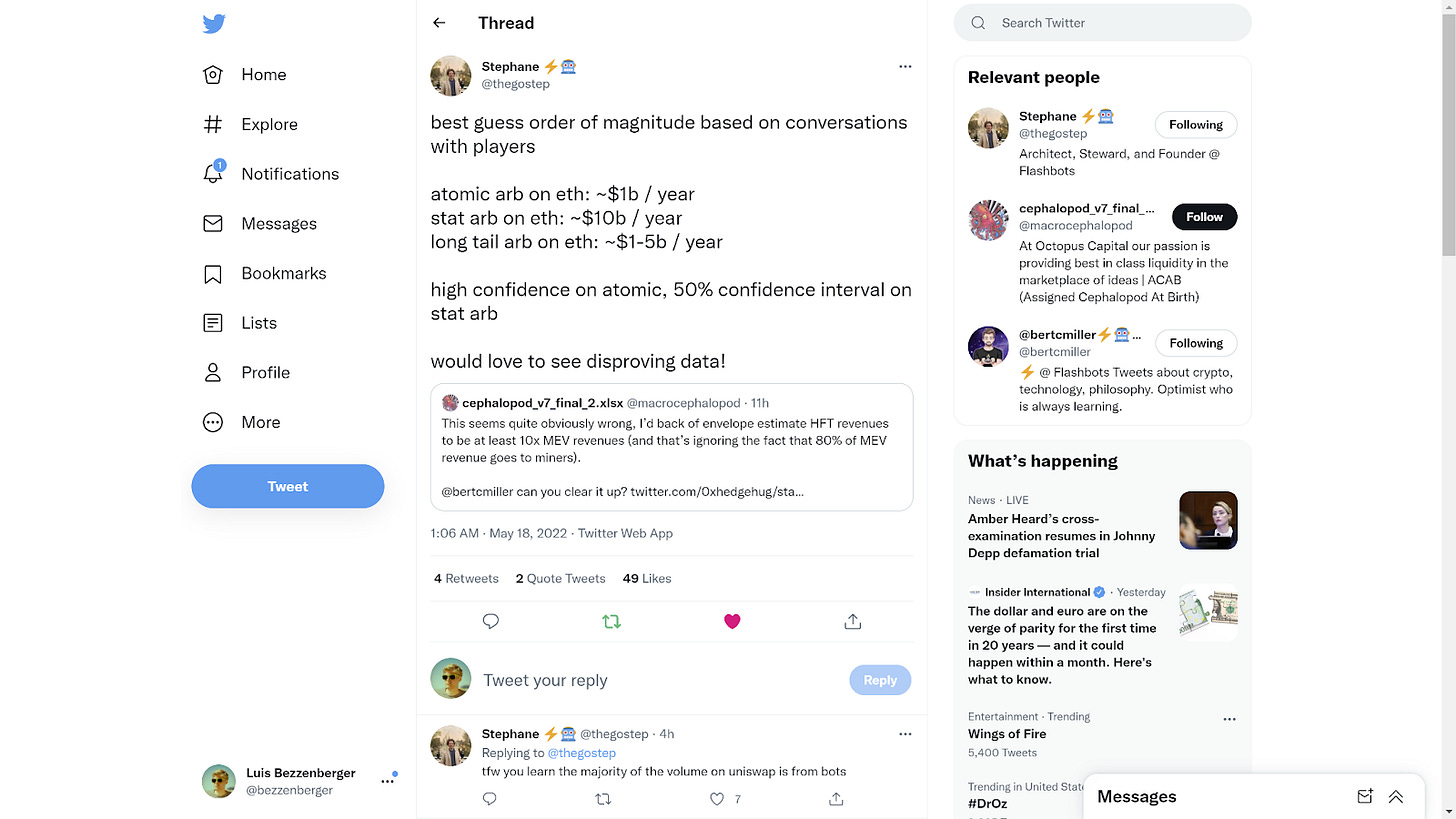

Is MEV bigger than we think?

Historical context

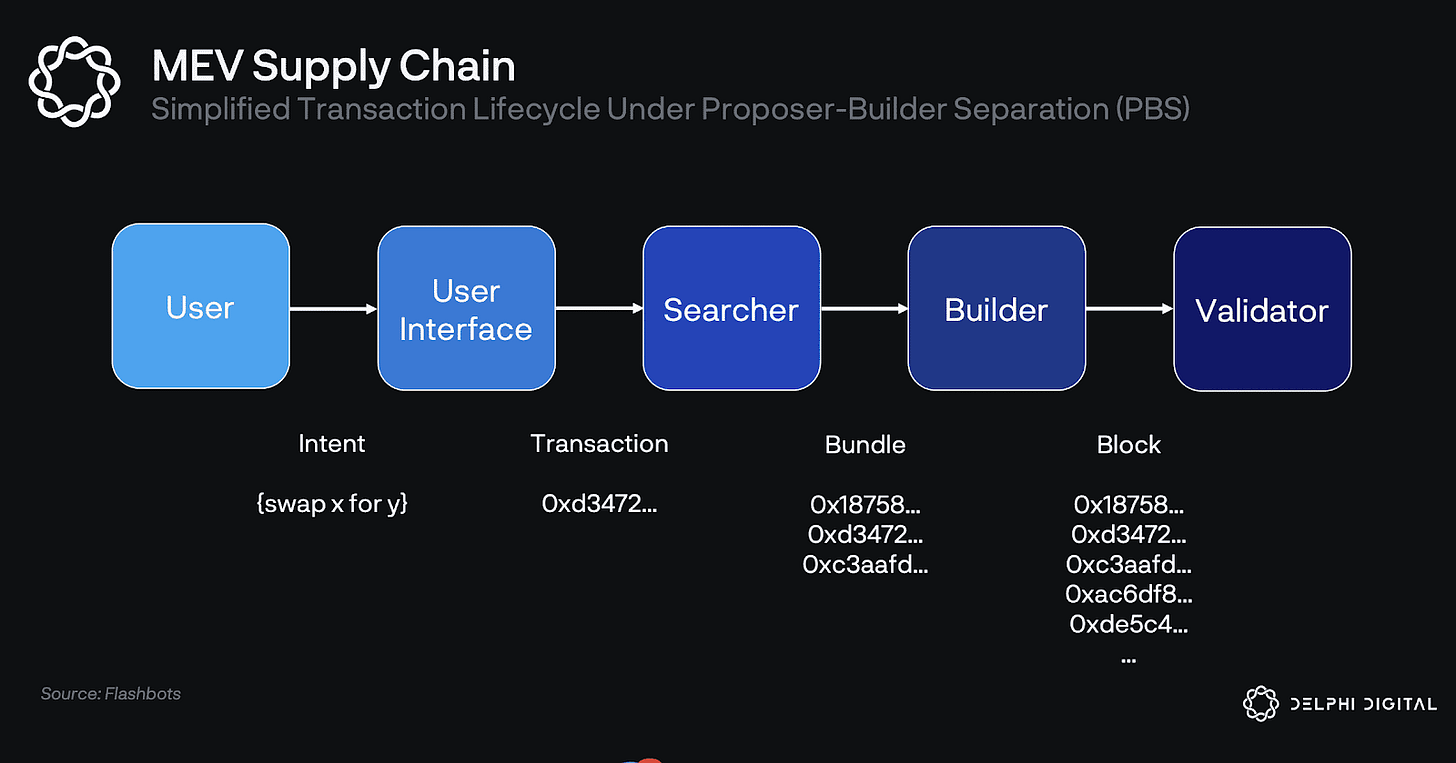

After The Merge in PoS Ethereum, miners are no longer part of the consensus process, and validators have taken their place as network security providers. The process for adding new blocks to the chain has been broken into two separate roles: block builders and block proposers.

Block builders are not part of the base layer infrastructure of Ethereum post-Merge but are the optional MEV add-on that covers the building process on their behalf. Block builders scan the mempool for transactions and try to assemble the most profitable blocks for proposers to include. All else equal, the blocks assembled with the most profitable MEV transactions will earn the proposer a higher rate of reward.

Block proposers simply stake 32 ETH to have a chance to propose a block. At the network level, the average reward per block is ~0.2 ETH, but this average varies based on the number of active validators, slashing penalties, and other network-level factors. At the individual validator level, rewards vary greatly based on the number of blocks they are selected to propose.

Block building is a complicated and data-intensive process. The builders with the fastest connections and best algorithms create the most profitable blocks. In a handful of seconds, builders must be able to simulate the most profitable bundles of transactions, as submitted to them by searchers. Although there are over 400,000 validators on Ethereum, many of them are running fairly basic technology. For this reason, block building has been outsourced by validators and has fallen into the hands of a few entities.

Flashbots addresses this issue as well, using a feature called MEV-Boost. MEV-Boost creates a marketplace for block builders looking to sell bundles of transactions to block proposers. The block builders submit full blocks of transactions, but the proposers can only see the block headers. In doing so, block proposers can’t see individual transactions, thus preventing them from censoring blocks because of any specific transaction.

Market share & competition

MVP boost Relay market: Flashbots share has been declining from 64.3% total block market share and 76.3% MEV-Boosted block market share (in Nov 22) to 50-55% in Feb 23

Flashbots competitors include Blocknative, Eden Network, BloXroute and Manifold. As seen from the MEV-Boost Relays market data, Flashbots is a clear winner in this race (64.3% total block market share and 76.3% MEV-Boosted block market share)

Source: mevboost.org, mevboost.pics as of November 13th,

Blocknative

Blocknative provides one MEV relay that validators can connect to. This relay is:

Publicly available

Publicly listed & maintained

Open-sourced

Transparent about address filtering

Blocknative currently has only one trusted builder, but the company noted plans to expand to multiple external builders in the near future.

BloXroute

BloXroute currently offers three types of MEV relays:

Max profit: Relay that propagates all available transactions/bundles with no filtering

Ethical: Relay that propagates non-frontrunning bundles and private transactions – BloXroute tries its best to filter out MEV bundles that execute strategies like generalized frontrunning and sandwiching

Regulated: Relay that propagates all available transactions/bundles except the ones sent from/to wallet addresses that are sanctioned by OFAC

Builders must be whitelisted by BloXroute. Builders must support the builder specs, either by using builder geth or developing customized software and then contact BloXroute support for builder registration. Builders must have Ultra tier in order to connect to BloXroute relay in Mainnet, or Introductory tier in Ropsten.

Eden Network

Eden Network has three products devoted to minimizing the negative externalities of MEV:

Eden RPC: A set of endpoints that protect Ethereum users from malicious MEV (i.e. frontrunning, sandwich attacks)

Eden Relay: A suite of tools for Ethereum validators and builders to maximize their revenue

Eden Bundles: An endpoint for sophisticated MEV searchers to submit bundles to a network of builders

MEV on other chains

Solana

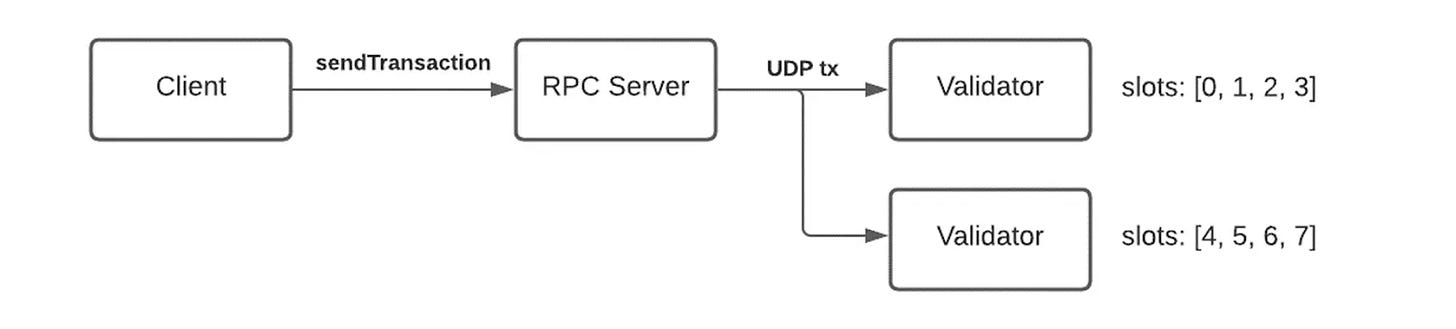

MEV on Solana is very different because it lacks an external mempool. In Solana’s design, each validator has its own mempool where it must evaluate MEV opportunities. Leaders are scheduled to propose blocks. When submitting a transaction, the transaction is routed to an RPC server, which keeps track of the time and schedule of the upcoming leaders. The server then sends the transactions to the next handful of leaders in the queue, hoping one will process the transaction. Transactions are therefore only effectively sent to a handful of validators rather than every validator on the network like on Ethereum.

Source: Jito Labs Medium

MEV on Solana is much less prevalent in dollar terms than Ethereum. Over the past six months, there has been less than $15 million in total MEV profits. Over 98% of both liquidation and arbitrage attempts fail. The failure results from the lack of penalties for failed transactions (i.e., gas costs), which creates an incentive for MEV opportunities to be exploited by interested parties spamming the network. Because of this dynamic, MEV-induced spam takes up huge amounts of blockspace and results in degraded performance for normal users.

Cross-chain MEV

Cross-chain MEV is a nascent market. MEV across chains involves the complex management of many currencies and data streams. It also requires knowledge of the intricacies of multiple developing chains. Cross-chain MEV also carries an additional risk factor in bridging assets. Today’s opportunities primarily center around arbitrage, and in the future, the market will grow as chains gain more DeFi activity.