Your guide to DeFi: From Beginner to Advanced

Step-by-step compilation of all crypto & DeFi resources to take you from 0 to 1

Hi readers!

The article on How DeFi is eating financial services (exploring the DeFi stack, use cases, benefits, risks and the ecosystem) generated 13K+ views with hundreds of new subscribers signing up. I am humbled and awed by the response from the community and daily messages pouring in to learn more about DeFi and how to get started.

As a supplement to the main article, above I compiled below a comprehensive Guide and resources publicly available that will be useful to a beginner or advanced user to get more hands on with the world of Crypto and DeFi.

Please remember - the most important section below is learning by doing. So flip through slides, watch some videos below and then dive straight into doing! Happy reading!

I also created a special offer in the spirit of making DeFi knowledge accessible to all!

Summary

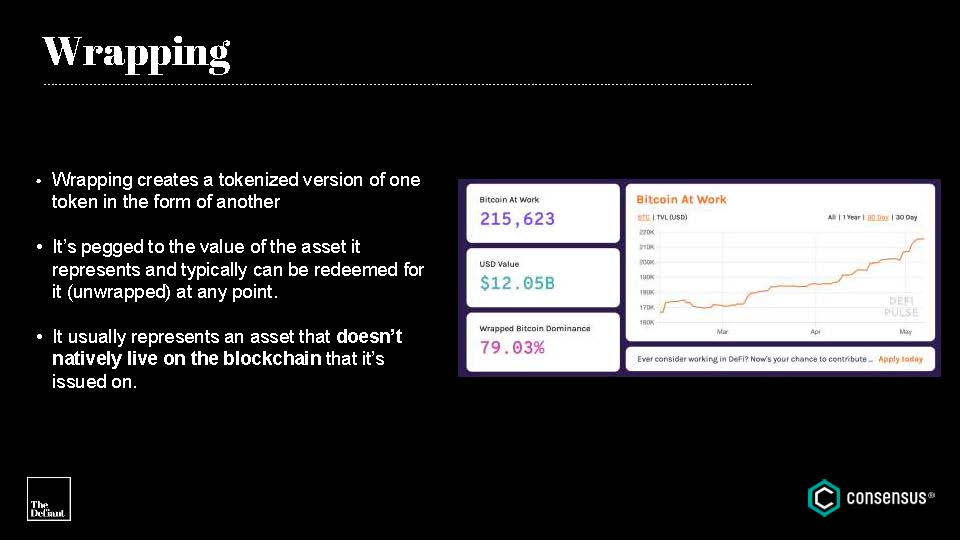

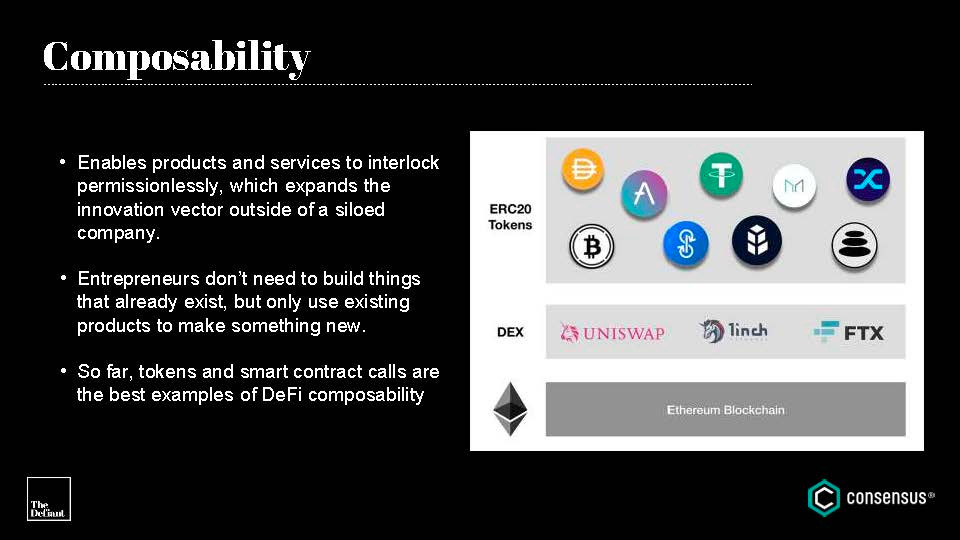

Step 1: Flip through high-level slides to get familiar with terms

Step 2: Watch a video course

Step 3: Learning by doing DeFi (basic)

Step 4: Bookmark resources to read every day/week

Step 5: Learning by doing DeFi (advanced)

Step 6: Learn Solidity, Smart contract etc. (Technical Skills)

++ Additional resources at the end!

Step 1: Flip through high-level slides to get familiar with terms

Go through these slides by Defiant1

Step 2: Watch a video course

Start watching video playlist of DeFi Dad which combines DeFi explainer videos from the DeFi 101 Series I produced with the The Defiant, as well as DeFi Dad how-to tutorials. It's designed for someone to go from A to Z with DeFi.

Step 3: Learning by doing DeFi (basic)

Setting up an account at a crypto exchange

Buying ETH

Setting up an Ethereum wallet

Withdrawing to MetaMask

Use Uniswap and trade from ETH to DAI

Lend stablecoins on DeFi protcols

Connect your wallet to portfolio trackers (Zapper.fi)

Watch Step-byStep guide here 👈

Basic tasks to start out

Uniswap: Buy a token on Uniswap on Layer 1

AAVE: Lend 10 USDC on Aave to earn yield

Open Sea: Buy an NFT on OpenSea

ENS: Register your own ETH domain name in ENS

Step 4: Bookmark resources to read (1 month plan)

1. Foundational Concepts

DeFi 101:

🧑🏫 Trust, Intermediaries and Censorship

🧑🏫 What Does “Permissionless” Mean?

🧑🏫 How Does DeFi Differ From CeFi?

🧑🏫 What is KYC?

Additional Material:

📰 This is How Wall Street Becomes Obsolete

🎙 Crypto Devs Are "Building a Life Raft For The World After Fiat Falls Apart:" Erik Voorhees'

🎙 Mark Cuban: "ETH Has an Advantage Over BTC as a Store of Value"

🎙 Winklevoss Twins Say Stablecoins Are Still Missing Their "Facebook Moment"

🎙 "Fintech Can Be a 1.5 Bridge Into 2.0 DeFi:" 11:FS Co-Founder Simon Taylor

2. Wallets and Dapps

DeFi101:

🧑🏫 DeFi Wallets and Self-Custody: How to be 100% in Control

🧑🏫 What is a Dapp and How Does it Use Smart Contracts?

Additional Material:

🎙 "In DeFi My Money is Actually Mine. It's a Beautiful Concept But it Comes With Responsibilities:" Andre Cronje

💭 We're Totally F*cked If We Don't Find Useful Things to Build With Blockchain: Pet3rpan

3. Decentralized Exchanges

DeFi101:

🧑🏫 DEXs vs CEXs

🧑🏫 What are Automated Market Makers Like Uniswap

🧑🏫 DEX Aggregators; The Search Engines of DeFi Trading

Additional Material:

📰 Uniswap's UNI Instantly Becomes One of DeFi's Most Widely Held Tokens

📰 The Road to Uniswap’s $100B in Trading Volume

4. Resources & Projects

DeFi101:

🧑🏫 Top Tools to Get Started with DeFi

🧑🏫 Top Teams Building DeFi

🧑🏫 Top 10 DeFi Resources

Additional Material:

📺14 #DEFI Buzzwords in 2 minutes!

5. Common Use-Cases of DeFi

DeFi101:

🧑🏫 Lending, Borrowing, Trading, and Stablecoins

🧑🏫 Lending and Borrowing with Compound and Aave

🧑🏫 What is MakerDAO and How Does DAI Work?

🧑🏫 Algorithmic Stablecoins

Additional Material:

📰 Engineer Becomes His Own Lender in First DeFi Mortgage

📰 Cypherpunk Stablecoin RAI is Live on Ethereum

📰 The State of Stablecoins in DeFi: A Deep Dive by DappRadar

🎙 "What We're Building is Very Big and We Should Have The Least Concentration Possible:" Aave's Stani Kulechov

🎙"All the Dizzying Ways People are Farming Yield is Proof of DeFi Composability's Success:" Ampleforth CTO

🎙 MakerDAO Founder Rune Christensen On DeFi's Biggest Test Yet

📺 Algorithmic Stablecoins: Sexy AF or A Load of Pants?

6. Decentralized Derivatives

DeFi 101:

🧑🏫 Trading Every Asset Class with DeFi Derivatives

🧑🏫 Decentralized Perpetuals Trading with dYdX and MCDEX

🧑🏫 DeFi On-Chain Options

Additional Material:

📰 DeFi Stocks Trading Climbs After Robinhood Fail

🎙 "There's the Opportunity to Make Really Complex Financial Instruments More Accessible”: Opyn's Alexis Gauba

🎙 DEX Progress to be a "Landmark Event" Over the Summer: Framework Ventures

📺 How to trade stocks if your Robinhood account is frozen (Mirror.Finance)

7. “Yield Farming” & Investing

DeFi101:

🧑🏫 What is Yield Farming and Liquidity Providing

🧑🏫 What is yearn.finance

Additional Material:

📰 Top DeFi Yield Farmers Share Secrets to a Profitable Harvest

📰 Hotdog & Kimchi Coins Flash Million-Percent Yields

📰 Results Are In: DeFi10 5x-ed in 2020

🎙 "You Can Wake Up With an Idea for a Fund and Deploy it in Minutes:" Melon's Mona El Isa

🎙 Balance Sheet as a Business Model for DeFi Platforms: Framework Ventures

🎙 "It Was Exciting But it Was Also Terrifying:" Dan Elitzer and Clinton Bembry on Yam Finance's Backstory

🎙 "It's not just about money; it's touching a very primal desire to connect with others:" ParaFi's Santiago Roel

🎙 "We're at the Early Stages of a Truly Novel Structure That can Organize Humans and Money:" Polychain Capital’snOlaf Carlson-Wee

🎙 "Things Tend to Get Better. For Anyone Involved in Crypto, It's Obvious That This is 1,000x Better," 1kx's Lasse Clausen

📺 DeFIRE: how to retire using only DeFi with passive income

📺 The ultimate guide to Yield Farming in DeFi

💭 DeFi Will Eat Traditional Finance and Active Investors Can Reap the Rewards

8. Scaling

DeFi101:

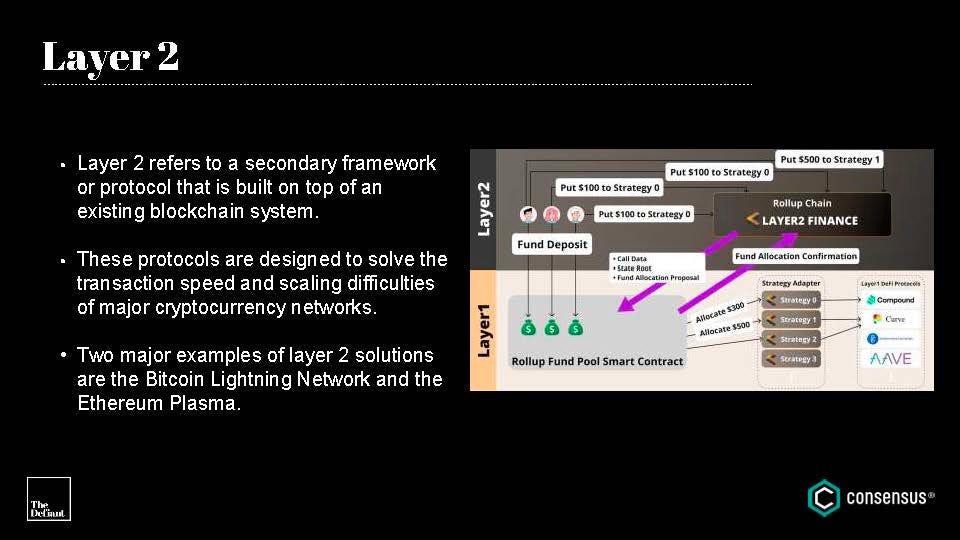

🧑🏫 What’s Layer 1 vs Layer 2?

🧑🏫 What is Gas and How to Save on Fees?

Additional Material:

📰 The State of Layer 2 With Ethereum Scaling is at Stake

🎙 "Basic Financial Services is a 21st-Century Fundamental Human Need:" OMG Network's Vansa Chatikavanij

🎙 Decentralized Money Shouldn't be Traded on Centralized Exchanges: Loopring Founder Daniel Wang

📺 Layer 2 scaling on Oculus Quest 2!? Loopring, Matic, Aavegotchi and Synthetix

9. NFTs & Digital Art

Material:

📰 The Defiant’s Guide to Digital Art & NFTs

📰 Digi-Physical Art Drives Record-Breaking $3.5M in NFTs Sales

🎙 "For the First Time, You Can Buy a Piece of the Art, and a Piece of the Gallery:" MetaKovan

🎙 "I'm Imagining a World Where Every Song Has an Investable Layer:" DJ 3LAU

🎙 "We've Been Creating Value for Instagram and TikTok With Very Little Actually Accruing to Us:" Trevor McFedries

🎙 "It Turns Out Music Does Have Value. We've Been Pricing It Incorrectly For 20 Years:" RAC

📺 The Beeple Bonanza unpacked with Trevor Jones

📺 The Defiant guide to Digital Art and NFTs

💭 NFTs Should Be Experiences, Not Just Products: IDEO CoLab’s Ian Lee

10. Risks

DeFi101:

🧑🏫 Risks of DeFi

🧑🏫 DeFi Insurance and how Nexus Mutual Works

Additional Material:

📰 Yearn Loses $11M in 2021’s First DeFi Hack

📰 For All You Degens Farming in Public: Here's Your Privacy Toolbox

🎙 "I'm Not Super Bullish on DeFi. We're Using This Tech to Enrich a Small Group of People:" James Prestwich

🎙 Blockchain Devs Are Neglecting Data-Related Risks, Chainlink's Sergey Nazarov Says

📺 You stole $37M, now what? The $CREAM $ALPHA exploit unpacked

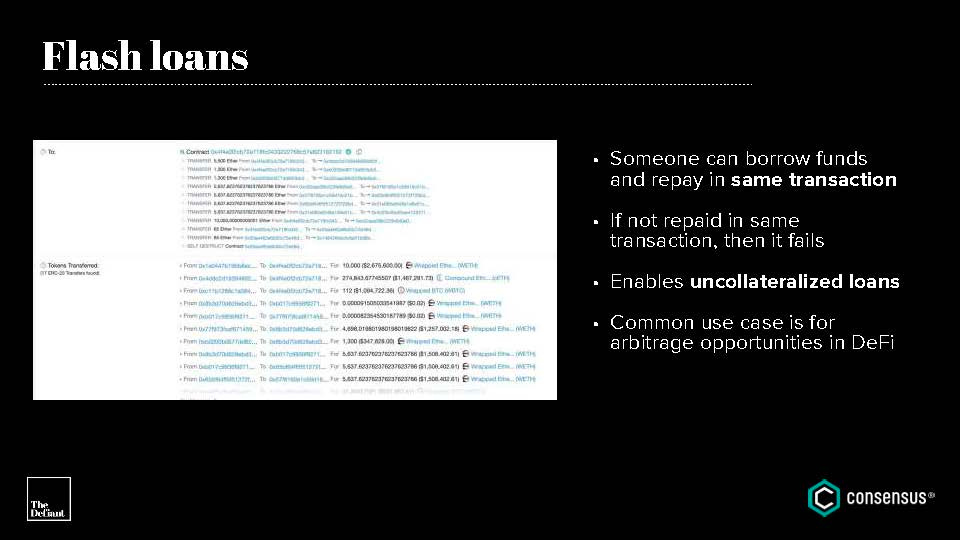

📺 Flash Loans, and Attacks -- explained

📺 DeFi Dre and the Invisible Hacked Pickles

11. Cross-Chain DeFi

DeFi 101:

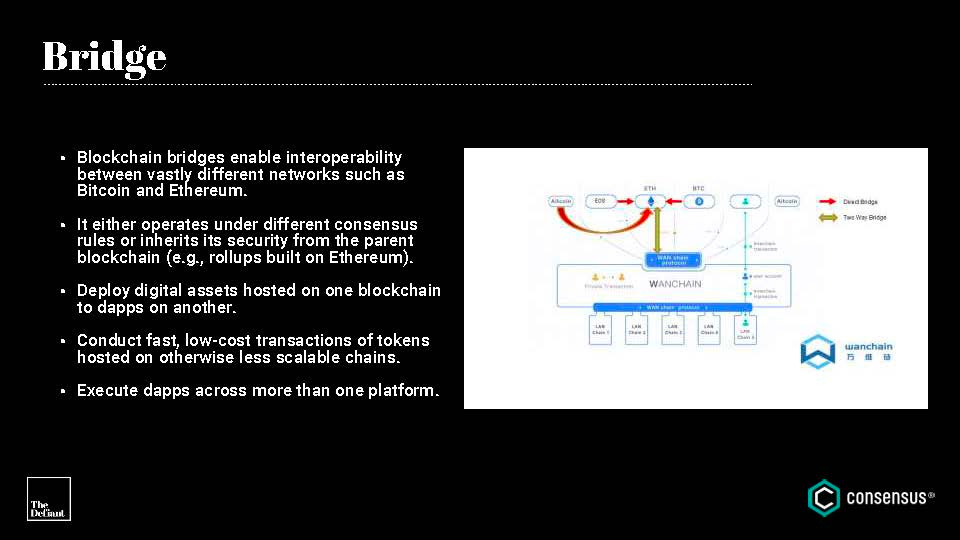

🧑🏫 What is Interoperability and Why is it Important?

🧑🏫 How Bitcoin, Ethereum, and Other Blockchains Fit Within DeFi

Step 5: Learning by doing DeFi (advanced)

Advanced tasks

Maker: Mint DAI by creating an ETH based CDP on Maker

Uniswap: Supply tokens to Uniswap

AAVE: Borrow against your collateral on Aave

Nexus: Purchase insurance on Nexus

Polygon: Delegate Polygon tokens

Web3 Infra: Try out Uniswap v2 subgraph here to find how many tokens called “USDC” are there

Your Yield Farming Guide2

Starting Wallet

Make sure you have your stablecoins in your Metamask wallet along with some ETH (for gas fees) before starting.

1. Go to Curve.fi

If you scroll down, you will see the different curve pools with their different yields for providing liquidity. As you can see, the sUSD pool is yielding 6.69% for the stablecoin deposits and a large number (113%) in CRV tokens

Lets head to the Curve sUSD pool : https://www.curve.fi/susdv2/

2. Connect your wallet and “Deposit” your coins

Go to Deposit → Connect your Metamask Wallet → Select the amount of coins you want to add.

In my case, I have $2518 USDC and $400 USDT which I will be adding to this pool. In return, curve says I will receive 2826 Curve susdv2 LP tokens reflecting my ownership share in the pool.

Click on Deposit

3. Approve Transactions

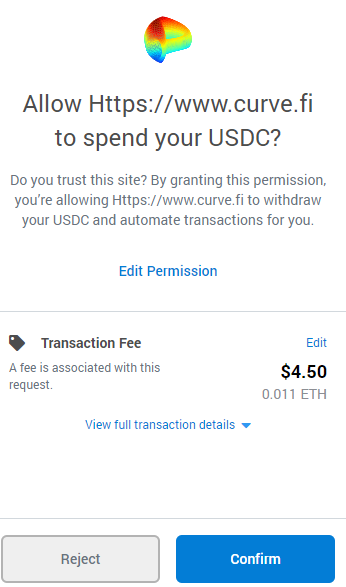

Metamask will popup a window asking you to allow curve.fi to spend your USDC and USDT (2 different transactions). Based on current gas fees, each of these transactions will cost~ $4.5Click on Confirm

4. Add Liquidity to Curve

You will now see a metamask window asking you to allow curve.fi to run the add liquidity smart contract. My estimated gas fee to run the smart contract is $26.98 !

Click on Confirm !

Here is the actual transaction. As you can see, the actual gas fee was $13.28 (small consolation !) and I’ve received 2855 Curve sUSDv2 LP tokens into my Metamask wallet

5. Check your MetaMask wallet.

Most times, these LP tokens dont directly show up in the metamask wallet display. You will need to ‘add’ it as follows:

Go to Metamask → Add Token (at bottom) → Custom token → Paste the smart contract address in the Token address field.

In this case, I pasted “0xC25a3A3b969415c80451098fa907EC722572917F” which is the Curve CRVPlain3sUSD smart contract address. I had to edit the token symbol field (since Etherscan only allows 11 characters), and renamed the tokens to crv3sUSD

Click on “Next”, you should see the tokens in your wallet

6. Head to the Curve Guage to stake the Curve tokens

Now, if we stopped at step 5, we will earn a 6.89% APY yield (acc to the curve.fi data). In order to see the large returns, we need to stake our liquidity pool tokens.

Go to https://dao.curve.fi/

Connect your wallet, scroll down to the susdv2 liquidity guage and hit “Deposit & Stake”

7. Approve the transaction

Once again, you’ll need to approve the transactions (with crazy possible fees).

Hit confirm. You have now staked your tokens !

8. Check the Curve Gauge

Go to https://dao.curve.fi/minter/gauges. Scroll down, you should see your gauge allocation.

Needless to say, these rewards wont last forever since the returns are dependent disproportionately on the price of the CRV token. Keep checking this site to see your rewards (in CRV and SNX tokens) to claim them.

Note: I spent around $41.86 in Gas fees on the above transactions. If the 110% APY returns on CRV holds, I’ll recover this in 5–6 days !

Eventually, you will need to unwind these transactions (unstake, etc) to get your original stablecoins back.

Step 6: Learn Solidity, Smart contract etc. (Technical Skills)

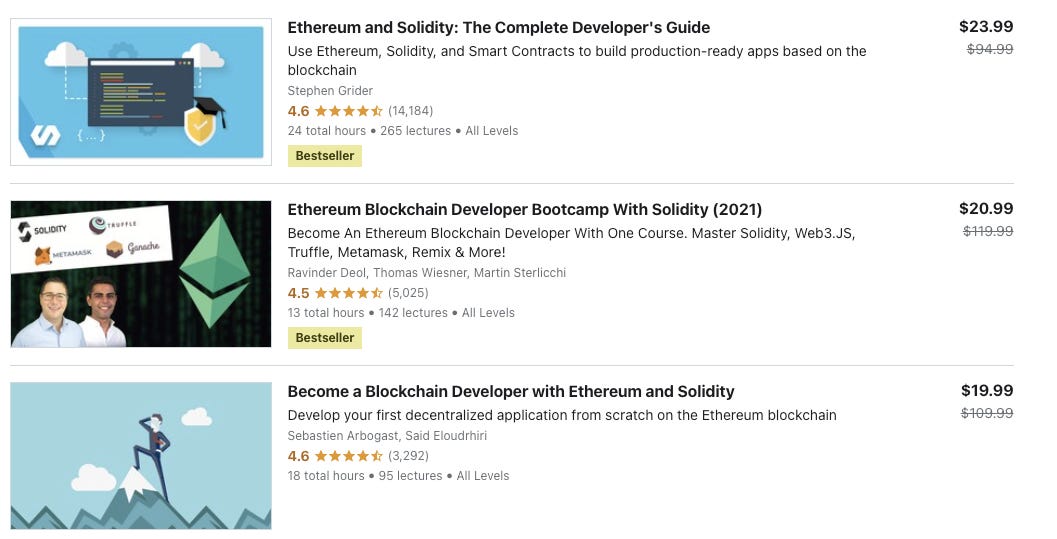

I would recommend this course on Udemy - for $20 it will be best investment you will ever do :)

Ethereum courses are becoming more popular than ever for developers, as web3 and a decentralized ecosystem are slowly beginning to adapt to global blockchain adoption. As blockchain technology is only 12 years old, there are still a lot of developments and adjustments needed as the space continues to grow at an exponential rate.

Learning Ethereum is quickly becoming a necessity for developers in the tech industry to keep up with the innovation and stay ahead in their careers. Get in the know now – we are still in the ‘early adoption’ phase of the blockchain technology life cycle, and once it becomes mainstream with the majority of the population on board, there will be more people learning these skills. Therefore, if you can get ahead of the game now, you will be ahead in the future. 3

Be able to program money – create your own smart contracts to move money upon specified conditions being met.

Learn the programming language for smart contracts to be deployed through the EVM (Ethereum Virtual Machine)

Create decentralized applications – there are limitless opportunities as to what you can create!

Know the most in-demand hard skill in 2020, according to LinkedIn there is a global need for this knowledge to be shared.

Earn between $150-$300k per year – the demand for these skills pays very well and will vary between how you choose to work.

Be able to travel the world with your work, through programming or educating.

Additional resources

Complete reading list library: Decentralized.co

Best DeFI research and deep dive reports: Messari

Videos

Dashboards

Yield trackers

Defirate.com

https://www.stakingrewards.com/

Other tools

Newsletters / blogs / Crypto resources

Token Economy

Dark Pools (Amazon or ask someone on team to borrow)

Podcasts

Follow me on LinkedIn

Nakul

If you liked this post from Cryptechie, please subscribe and share to our 1 year offer!

https://thedefiant.io/defi-101-a-visual-guide-to-definitions-and-data-sources/

https://medium.com/@gammapoint.capital/a-step-by-step-guide-to-yield-farming-on-curve-a125aaff62ce

https://academy.ivanontech.com/blog/ethereum-courses-why-you-should-learn-solidity-and-ethereum