Battle of the brands in web3

Unpacking fraud, real engagement and the early Web3 adopters: D&G, Tiffany

Today, we dive into the world’s top fashion houses and analyze their Web3 affinity. Looking at 4 of the world’s top fashion houses - there is a clear emerging winner. Dolce & Gabbana is leading the pack followed by Tiffany’s, Gucci, and Prada.1 Thanks to our friend Yuxiao from Ludis analytics for the insights!

Methodology:

Scoring the fashion brands was done using the following major categories:

Purchasing Power of Wallets - As measured by the amount of liquid ERC20 tokens within the wallet. Purchasing power is our proxy for wealth and every brand wants the richest consumers. We will also sharpen this analysis by looking at wallets across a few wealth thresholds. Third consideration for this analysis will be to determine which brand is most concentrated in terms of high value customer cohorts through a clustering analysis

Impact of Frauds and Scams - As measured by the number of scam / fake / phishing tokens that were purchased by the brand’s customers. This tells us which brand’s consumers are likely to have negative web3 experiences.

Engagement of Wallets - As measured by Daily Active Wallets (DAWs). More engagement, more potential.

Diving into each of the categories, we rank each fashion brand to come up with an overall winner. Here’s how it broke down:

Purchasing Power of Wallets

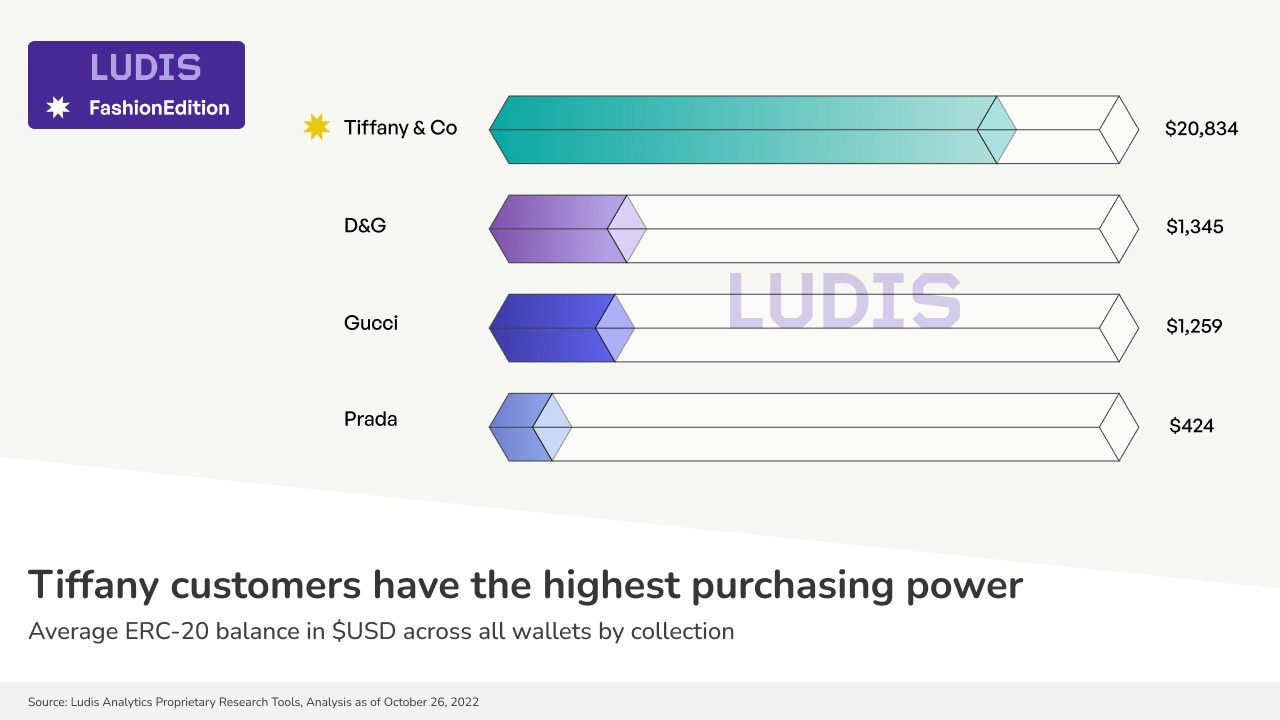

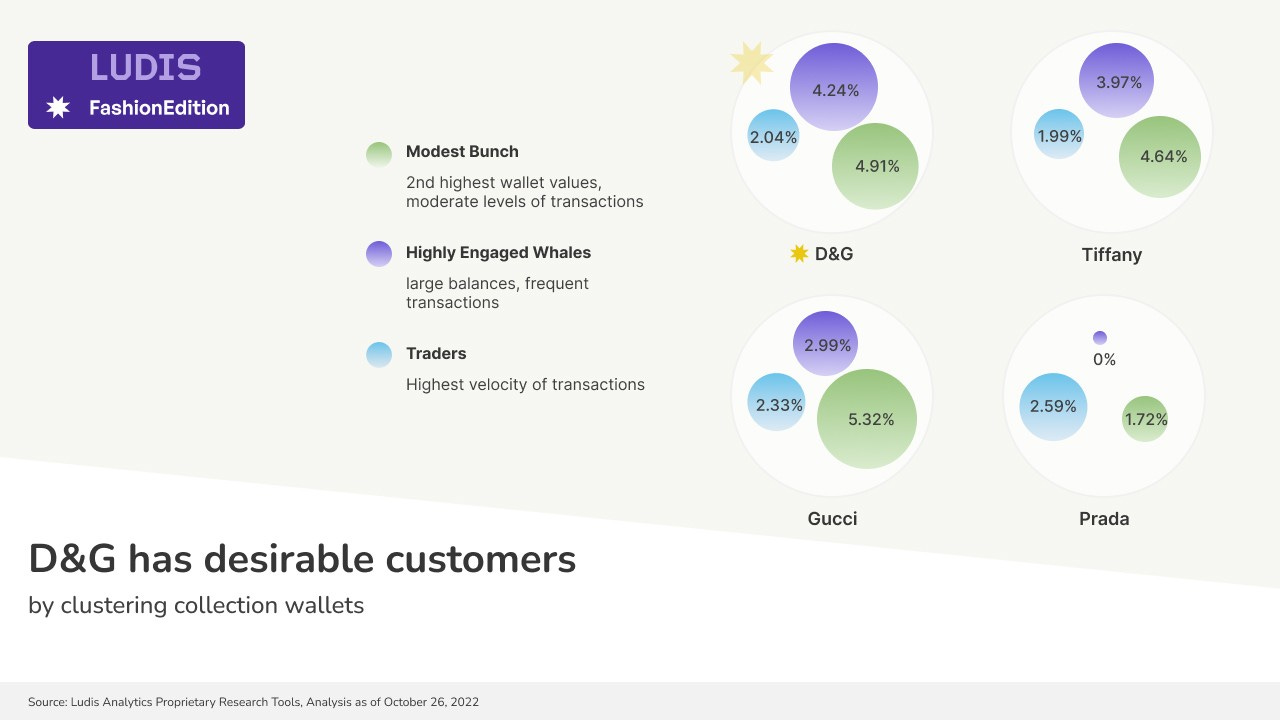

Tiffany’s dominated this category with a staggering ~$20k average USD balance in collection owner wallets. The next leading brand, D&G, wasn’t even close, coming in at $1.3k. Gucci follows with $1.2k and Prada comes home dead last with a whimpering $400. If you want to know where the rich wallets play, it’s Tiffany’s!

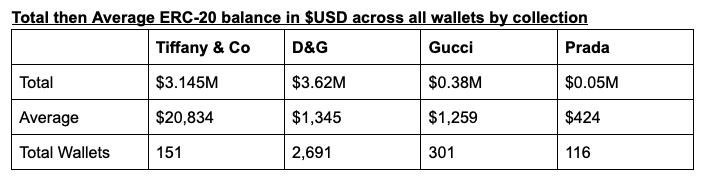

But what if Tiffany’s appears to have more wealth because of some outlier billionaire wallet? Well we thought of that too. We looked at the percentage of each collection's wallets that fall above a certain threshold in wealth and it became evident that Tiffany’s crushes the competition here as well.

% of wallets > Threshold

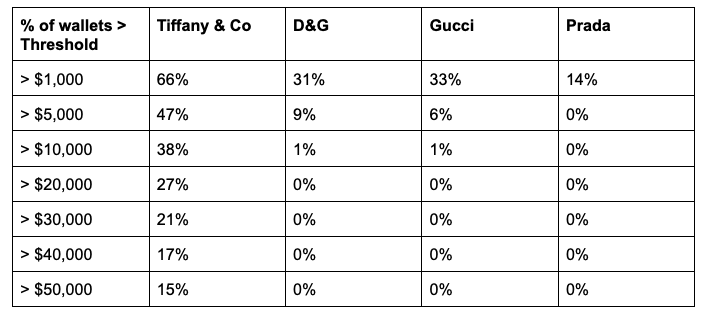

But what use is having money if you don’t use it? You can be a baller, but if you’re only spending once a year, that’s not impressive. This is where our clustering analysis comes in. We want to find high net worth individuals who spend. So, we ran our clustering algorithm on 2 variables, wallet value and transaction frequency to see which brand has the highest concentration of most valuable customers.

Some slight surprises here, but with our focus on the engaged whales, D&G comes out on top. It’s worth calling out that Prada has the most frequent traders, because (spoiler alert) that’s one of the few things they take the lead in so far.

Impact of Frauds and Scams

We all know getting scammed can feel like your soul has been attacked, and that can create negative associations with brands. So we took a look at which brand’s collection owners have fallen victim to the most scams. Out of the top collections that each brand’s owners participate in, we found that if you’re a Tiffany’s owner… chances are you have been duped into buying a “bad” NFT. That might be because you’re RICH and people are targeting you. Heavy lies the crypto wallet eh?

% of total NFTs (that are bad) owned across the top 10 collections customers participated in

This one is kind of hard to explain without too many words, but what we mean is, if you look at all the collections that Tiffany’s collection owners participate in, rank them by participation overlap, of the top 10, this is the percentage of tokens that were bad. For example, take a look at this collection on Etherscan as it’s one of the most popular collections for Tiffany’s owners. I’m not mad, I’m just disappointed.

So who wins this category? D&G. Their customers are the least susceptible to scams! Hopefully we didn’t just alert scammers to an opportunity…

Engagement

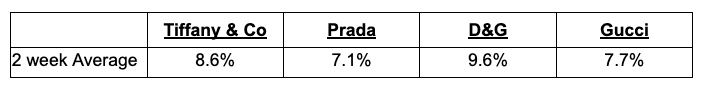

Why is engagement important? Greater engagement means greater potential for marketing and greater potential for purchases, etc. Engagement drives retention and that’s what keeps you alive. So what portion of a brand’s user base actually transacts in the web3 ecosystem over the last 2 weeks? Here’s the answer:

Winner, D&G!

Conclusion

And with that, D&G wins overall and is crowned the best web3 fashion brand. Tiffany’s was so close and we almost gave them the edge because of just how much purchasing power they have in comparison to the other brands. Prada comes in last, but, interestingly, their consumers participate in fashion collections much more than the other brands’ users. Those wallets are interested in fashion related projects whereas other brands’ users are interested in web3 more broadly.

After crowning our top web3 brand, we expected we would get questions from curious minds to better understand our analysis. So…

As a quick reminder, we measured the brands based on multiple categories (purchasing power of customers, wealth at different thresholds, persona clustering, impact of fraud, customer engagement levels). Let’s take a look at the first pillar of our analysis, purchasing power. We crowned Tiffany’s the winner of this pillar.

The easiest way to understand purchasing power is simply by looking at which brands’ customers have the most capital to purchase goods with. So we took all ERC20 balances of the participating wallets and summed and averaged them. Here’s how it shook out:

Now, one might argue that D&G should be the winner here given the total amount of purchasing power their community has, but that’s purely a side effect of having nearly 9x the amount of wallets. What brands should care about is the average because that shows who’s got the most liquid wealth. In this regards, Tiffany’s dominated.

What if Tiffany’s appears to have more wealth because of some outlier billionaire wallet? Well we thought of that too. Here’s a distribution of the percentage of each brand’s wallets at various wealth thresholds. It’s evident that Tiffany’s crushes the competition here.

All signs point to Tiffany’s at this point, but being the curious minds that we are, we also wanted to run a clustering algorithm on consumers to see if we could isolate high value customer groups and determine what portion of each brands’ users qualify as high value. The results came back more surprising than we expected. D&G and Tiffany’s have similar customer personas, but D&G came out ahead.

Segmenting Users by Key Characteristics:

Highly Engaged Whales - large balances, frequent transactions

Traders - Highest velocity of transactions

Modest bunch - 2nd highest wallet values, moderate levels of transactions

Tiffany’s has won 2 out of the 3 initial categories so far with D&G claiming one victory. We’ll dive deeper into the other analyses (fraudulent activity) and (engagement) in our following posts this week.

Fraud and real engagement

As you know, the web3 space has been rife with scams and hacks, so we wanted to take a look at how they impacted fashion brands.

A big part of brand strength is brand image and how consumers perceive their experience with the company’s products. Any brand looking to grow brand strength should try to minimize events that could harm their customers’ experiences. In web3, that means minimizing spam, phishing and counterfeit tokens.

We’re not looking directly at how many customer wallets were hacked because that’s not something the fashion brand can really control as it’s more of a layer 2 front end issue. Just like if you saw an item on Nike’s homepage but bought the item through Amazon and Amazon is where the hack occurs.

Instead, we looked at the top 10 other collections that each brands’ wallets participated in and dug into each contract to identify potential bad assets. The results were surprising. Out of all the tokens in the top 10 other collections for Tiffany’s owners, 71% of them were tagged as spam, phishing or fake by Etherscan.

Example of a bad asset tagged (red box) by Etherscan:

It’s clear to see that D&G is our winner in this category and while it’s going to be hard for any of these brands to secure their users’ wallets on their own, they should keep this metric in mind as a barometer for their users’ experience in web3. It is not a direct reflection on the brand, however we believe it could make their customers more likely to churn from web3, causing brands like Tiffany’s to lose influence in the space. Advice, track it and try to influence it.

Engagement

As we round up our Battle of the Fashion Brands in web3 analysis, we turn to our final metric, engagement.

When it comes to customers, companies should care about acquisition, engagement and retention. We’ve decided to focus on engagement for our analysis as we believe continued engagement levels results in better retention and is a sign of good customer experience. That positive experience will then drive acquisition through word of mouth creating a flywheel effect. At least, that’s what we believe, but we’re open to your thoughts :)

We use Daily Active Wallet (DAW) to measure engagement by taking every wallet in each of the 4 brands and tracking whether or not they made a transaction with a web3 product. Then we took that number and divided it by the total wallet population of each brand to find out what percentage of their users are engaged. Here were the two week results leading up to our analysis.

D&G was our winner over this time period, having captured the top spot 9 out of the 14 days in the past two weeks.

And with that, we conclude that D&G was our winner having claimed top spot in the majority of our analysis areas. Stay tuned for our next analysis and if you have ideas for us, we’d love to hear them!

Ludis Analytics’s proprietary data analytics for blockchain tools. Data as of October 26, 2022. For more information please visit our webpage and contact at www.ludisanalytics.com