7 promising Crypto projects to watch

Overview of top tokens & communities solving problems creatively

The recent market volatility and calls for a ‘bear’ market continues to bring more new investors in while turning some away. As always, I focus on being a long-term investor in the space by evaluating projects on the basis of fundamentals and merit.

As the crypto market goes through a cycle of volatility, the optimal way to invest is to spend some time doing research. Try to study projects and learn some of the fundamentals before putting any significant amounts into them. A basic approach on how to do some high-level research when it comes to DeFi tokens or NFT projects:

#1 find token in CoinGecko

#2 check market cap, fully diluted valuation, volume and Mkt Cap/TVL ratio

#3 check website

#4 study tokenomics & pre-sale

#5 analyze team

#6 check github activity

#7 visit telegram/discord rooms

#8 search ticker on twitter

#9 check reddit/4chan

#10 analyze holders

#11 chart & trade history

For NFTs, determine how on-chain the NFTs are and analyze on-chain activity (using tools like OpenSea's Rankings page and NonFungible.com's Market History hub).

Here are a few projects I have been tracking that are trying to solve real problems and have an interesting approach:

1. Lido: a non-custodial, liquid staking service ($LIDO)

Problem Statement:

It currently costs ~$100K to become an Eth2 validator! That’s insane. The 32 ETH threshold has priced out a lot of people.

It’s an issue—the current requirements go against Ethereum ideals and the notion of open, democratized access to financial services. Adding to it, running an Eth2 validator requires a fair amount of technical knowledge. You need hardware, you have to run the software, keep it maintained so you don’t get slashed, etc. It can be a lot.

So how can anyone expect the average individual to stake ETH?

Luckily, there are two main options out there.

The first is staking ETH through a centralized exchange like Coinbase and Kraken. This is the most beginner-friendly approach as they’ll abstract away all the complexities and allow you to stake any amount of ETH (not just the fixed 32 ETH required!) while earning a decent return.

The problem is that it’s centralized. You have to trust the exchange to hold your ETH and they usually take a hefty cut on the rewards you earn. Obviously, this isn’t an ideal solution for those that align with bankless values.

The other main option is decentralized staking providers. This is the holy grail for staking ETH and the one that we like to advocate for. These open protocols democratize access to staking, providing you with an easy UI to stake any amount of ETH while also giving you a tokenized representation of your deposit to use elsewhere. The best part is that these protocols are designed to hold the deposits in a non-custodial fashion—you don’t have to trust anyone! Lido is the key contenders in this area. They’ve already accumulated hundreds of thousands of ETH in deposits, valuing the total outstanding stETH (the protocol’s tokenized staked ETH derivative) to over $2.3B.1

How LIDO is solving it:

Lido simplifies staking ETH to make it as easy as using any other DeFi protocol, transferring the technical and slashing risk to world-class operators. Importantly, due to the pooling of user funds, holders with less than the 32 ETH required to run a validator can now stake and earn passive income on their holdings.

The stETH token—Lido’s staking derivative—also provides a major benefit for users by allowing them to access liquidity on their underlying Ether. Traditionally, staked assets are locked and unable to be used for other purposes. This is especially true at the current moment, as the Beacon Chain will not enable withdrawals until after the PoS merge.

Through stETH, Lido users can earn staking yields, maintain their share of the network, and also unlock the value of their tokens. In other words, stETH can be used as collateral for other DeFi protocols, drastically improving the utility of their staked position.

Source: Token Terminal

Since its launch in December 2020, Lido has nearly $10B in total value locked (TVL) and is generating $2.5M in protocol revenue each month, about $30M when annualized. Interestingly, we can also see that Lido did not experience as severe a decline in revenues compared to some other projects during crypto’s recent market sell-off. Lido’s revenue may not be as susceptible to influence from market and DeFi activity when compared to other projects. It also illustrates how Lido benefits from the secular nature of staking: Holders are going to want to stake their Ether irrespective of market conditions, meaning that Lido will be able to grow from within any backdrop

Competitive Advantages of LIDO:

Due to the “liquidity begets liquidity” nature of staking derivatives, Lido benefits from strong network effects.

The integration of stETH within DeFi is critical to Lido’s success and helps reinforce its network effect.

New staking protocols face incredibly high barriers to entry. Between the complexities of interacting with the Beacon Chain, slashing risks, and the inability to fork staked assets to go along with the active governance needed to ensure the orderly operation of the system, it’s incredibly difficult to run and maintain a staking service.

Lido benefits from an incredibly strong cohort of intellectual capital. Along with a highly skilled and competent core team, Lido boasts multiple prominent members from all walks of crypto as contributors and community members

The staking industry is expected to explode in growth over the next several years, with even TradFi institutions such as JP Morgan expecting earnings from staking to grow to $40 billion by 2025.

Risks: Control over Lido may still be highly concentrated (63.5% of the total supply was allocated to protocol insiders as per Bankless). While Lido is non-custodial, the protocol is not yet fully trustless. A substantial portion of Lido’s deposits, and therefore sources of revenue, are concentrated within a small group of depositors.

2. Olympus DAO: Crypto reserve currency ($OHM)

Problem Statement:

Over the last couple of years, stablecoins have come under a lot of scrutiny and faced increasingly strict regulatory issues. With cryptocurrencies becoming more mainstream, this trend is unlikely to reverse. On top of this, the fact that the most popular stablecoins used today are centralized seems antithetical to crypto's value proposition of decentralization. The recent wave of algorithmic stablecoins aim to solve most of these issues using algorithms to back their stablecoins instead of reserves. Without reserves, these projects don't need to be periodically audited and can be decentralized. However, these coins still have one big issue: they're still pegged to a fiat currency which is controlled by a central government. Even if algorithmic stablecoins are able to maintain a perfect peg to their fiat currencies, which has already proved difficult to do, they are still at the hands of various governments who control the fiat currency.2

The relatively new category of "non pegged stablecoins" is the market's answer to this issue. What if you could have a stablecoin that was less volatile than other cryptocurrencies, and therefore more suitable for everyday transactions, but had no reliance on any fiat currencies? Olympus aims to achieve this with their OHM token.

Through a treasury of assets as well as minting and burning, Olympus' long term goal is to become a currency that is stable enough to be used in daily transactions with the reasonable expectation that prices will remain the same over time while not relying on a traditional peg.

The project was originally proposed at the beginning of February and held an Initial Discord Offering to community members in the middle of March. The project officially launched shortly afterwards and has seen tremendous growth in the first couple of months of its existence. Less than a month in, the team successfully proposed and implemented a core change to the protocol, introducing DAI bonds to replace the old sales contract, in order to grow the treasury faster and take advantage of the large premium of OHM price at the time.

How OHM is solving it:

So how do we get a digital currency that is stable, collateralized, and decentralized? That's where Olympus comes in. The Ohm token is a decentralized reserve currency maintaining a floating market driven price.

Source: Olympus Dao dashboard

Olympus is a "non pegged stablecoin" that attempts to be less volatile than traditional cryptocurrencies while not being pegged to any fiat currencies. Instead, the value of its OHM token is meant to float based on the value of its underlying treasury of assets and parameters set by the DAO. It achieves this through minting OHM when it is greater than its intrinsic value and burning OHM when it is less. The end goal of the project is to become a crypto-native currency that is used as an alternative to the USD or other fiat currencies.

As of this writing, Ohm is at ~$1,150. You can buy Ohm for market price on Sushi Swap. Or you can purchase them at a cheaper rate through two different bonds: reserve & liquidity.

With reserve bonds, you purchase assets like Dai, Frax, etc. and trade those in to the treasury. You receive the Ohm at the end of the vesting period which is every 15 epochs or 5 days. This keeps the Olympus treasury and the Risk Free Value (RFV) growing.RFV are the funds the treasury guarantees to use for backing OHM. This is the intrinsic value backing Ohm that bitcoin and Ampleforth don't have. The key here is that Ohm is backed, not pegged!

If you're on crypto twitter, you've probably seen (3, 3). This is essentially the HODL for Ohm. It's based on the idea that rewards are the highest for everyone if people perform positive actions (staking & bonding).

There is also a sOhm pool on Pool Together - this essentially is a lottery model where you can forego your staking rewards (8000% APY as of today) but get a change to win everyone else’s staking rewards every 3-5 days (quite a big prize pool). Legal or not, this is the ultimate gamification of money reserves!

Competitive Advantages of OHM:

Has been stress tested and survived due to Protocol owned liquidity: There was a dump in $ohm price exacerbated by a cascading liquidation event due to the overleverage of ohmies doing (9,9) in RariCapital pools. The price went from $1200 to $600 in a -50% dump. The Liquidity Owned by the protocol gave the exit liquidity needed for the big whales selling and also the smaller panic sellers. The dip was immediately bought by people that was waiting to get into the (3,3) train.

As the Olympus market grows, the protocol also accrues revenue from liquidity provider rewards, which are deposited into the project’s treasury (which is now massive). Ultimate application of Game Theory: whether or not a participant will stake OHM, bond, or sell their OHM

The ‘Ohmies’ have emerged as one of crypto’s most passionate communities in 2021. On a more intangible level, “Ohmie culture” is beginning to proliferate throughout that of broader crypto, with (3,3) turning into one of the most popular twitter handles suffixes, along with .eth and of course, the 🦇🔊.

Another interesting characteristic of Olympus that may contribute to the passion of the Ohmies is that it’s governed directly by OHM holders.

This differentiates it from other stablecoin protocols, such as DAI, FEI, and RAI, and of course, centralized stablecoins like USDC, or USDT, whose monetary policy is determined by holders of a secondary governance token or c-suite management, respectively. This means that the holders of the actual currency, rather than owners of a secondary governance token, are the ones who determine monetary policy.As we speak there are more than 15 forks of OHM trying to replicate its success - watch out for any rug pulls!

Olympus DAO is a fascinating project. The protocol is attempting to tackle a hugely ambitious problem through its unique design and incentive mechanisms. It’s also managed to be hugely successful at attracting rapid growth and a rabid community.

While it’s unclear if it will ultimately succeed in achieving its vision, it is clear that Olympus is a project worth keeping an eye on.

3. TokeMak (Toke): Liquidity Reactor

Problem Statement:

Standing up liquidity for a new project is costly and inefficient. Current solutions to the problem of token liquidity are:

Engaging centralized market makers, a costly affair

Incentivizing their users through yield farming, an equally costly solution

Engaging with a market makers creates a unique set of challenges. A market maker is an entity that centralizes three rare resources: capital [money], market knowledge [strategy], and trading/pricing expertise [technology]. Current examples of these organizations are very centralized, often the brainchild and property of just one individual. DeFi has yet to produce a primitive which is capable of disaggregating these three things, which is why we as an industry have been leaning on TradFi for this service. The small steps we’re about to take here at Tokemak will result in a big leap for the future of finance. Vive l’avenir de la France.

Meanwhile, yield farming introduces inflationary tokenomics to bootstrap liquidity, and has a creeping impact on the overall health of the project, often strangling the project’s resources for innovation. The budgeting of so many tokens in pursuit of liquidity is akin to early internet entrepreneurs spending their budget on armies of IT professionals and massive server farms. It’s redundant and there’s a better solution —during the era of Internet 1.0, the answer was AWS as a utility for cloud server hosting; for Web 3.0, the answer is a utility for sustainable liquidity: Tokemak.

Tokemak is a new DeFi protocol aiming to build sustainable infrastructure for liquidity—for everyone.

How TokeMak is solving it:

Tokemak creates sustainable DeFi liquidity and capital efficient markets through a convenient decentralized market making protocol. Tokemak provides a generalized liquidity aggregator for decentralized exchanges.

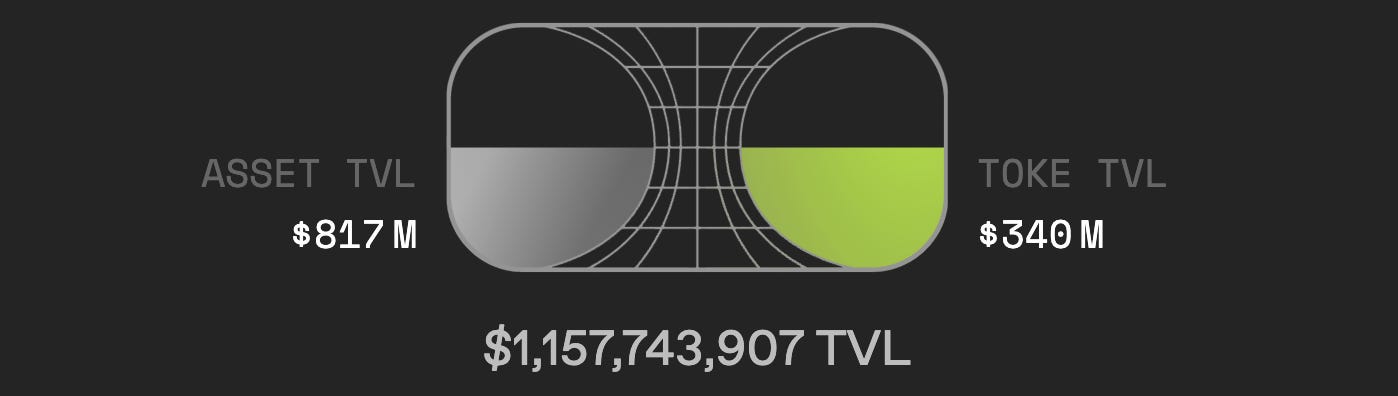

For the liquidity provider, Tokemak works as a single-sided yield platform where they can deposit reserve assets — for example, Ether (ETH), USD Coin (USDC) and Dai — as well as tokens for the projects using Tokemak. The Tokemak platform will then direct the liquidity into automated market maker pools and other market-making opportunities. Key to this concept are TOKE holders, who act as “liquidity directors,” expressing their preference on where the liquidity should be sent. Tokamak has also managed to attract significant liquidity for TOKE with a TVL of north of $1B.

Source: Tokemak Interface

Tokemak is designed to be primarily used by:

Liquidity providers and yield farmers: any user can deposit single assets into the network to be utilized as liquidity

DAOs: DAOs can harness Tokemak’s liquidity flow in order to strengthen and direct liquidity for their project, offering an alternative to traditional liquidity mining

New DeFi projects: New projects will be able to inexpensively stand up their own token reactors and use the Tokemak’s protocol controlled assets to generate healthy liquidity for their project from its inception

Market makers: MMs can take advantage of the network’s store of assets in order to direct liquidity across various exchanges

Exchanges: exchanges can also leverage TOKE’s utility in order to gain access to deep liquidity to bolster their market depth

Tokemak is a fascinating protocol, with paradigm-shifting implications on several different levels. Given its scarcity, there are only 100,000,000 total TOKE in existence, it’s also been posited that we could see something along the lines of “TOKE wars” in the future where protocols compete to acquire TOKE.

Does he who controls the TOKE control the liquidity in DeFi?

4. L1 Summer - Terra Ecosystem ($LUNA)

Problem Statement:

Ethereum transaction prices, called gas, have soared in 2021 month on month. Over the course of this year, L1s such as Luna, Avax, Solana etc. have been chipping away at Ethereum’s DeFi market share, even as TVL in DeFi overall has increased 10x to $110B+.

These platforms enable users to use DeFi apps built with smart contracts. Yet they tend to be much cheaper to use than apps on Ethereum such as Compound Finance and MakerDAO. Layer 1s achieve the lower fees through different means. Some like Binance Smart Chain process more transactions per block, and the higher supply lowers prices. Others such as Polkadot run many data structures, usually blockchains, in parallel, which also increases transaction throughput, lowering prices.

Ethereum ecosystem’s share of DeFi TVL as well as share of the smart contract platform market is decreasing rapidly (though it is still an ultra-sound triple point asset). For example, Ethereum’s share of the smart contract platform market was about 84% at the beginning of the year and has since decreased to about 65%

How LUNA is solving it:

Terras founder realized that a big barrier to entry for many newcomers was that too many crypto projects were too technically complex to understand and easily intimidated users. Rather than throwing all the complexity of DeFi at users, they instead wanted to build an ecosystem that offered a user friendly portal into DeFi.

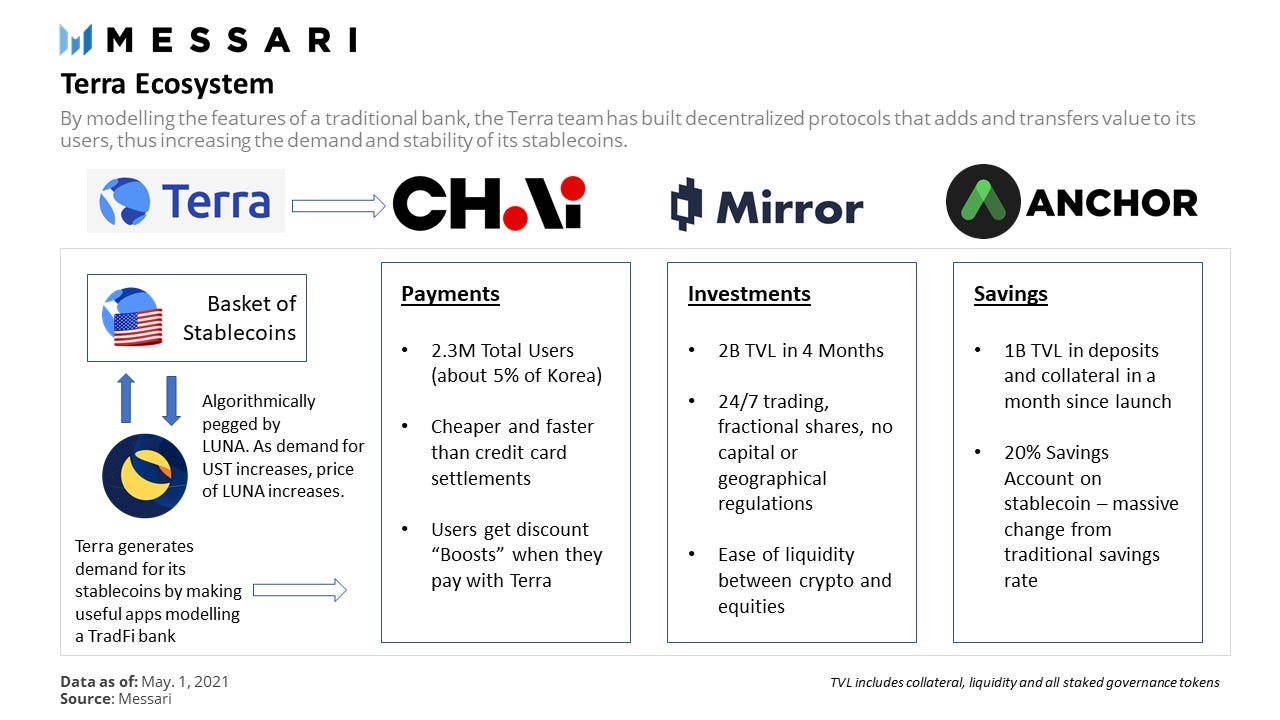

The easiest way to understand Terra is to think of it similar to a traditional bank that facilitates payments, transfers, investments, loans and savings, but automated. It is implemented as a public blockchain and is community owned, community governed, and accessible to anyone in the world with an internet connection. Users enter the ecosystem through Terra stablecoins and access the above banking functions through a suite of apps and protocols. Terra improves on the existing banking model by being globally accessible and non-rent seeking.

Terra supports stable programmable payments and open financial infrastructure development. It is supported by a basket of fiat-pegged stablecoins which are algorithmically stabilized by its native crypto asset, LUNA

To date, one of the most successful applications utilizing Terra includes CHAI, a Korean-mobile payment app that allows consumers to pay for items online by simply adding their bank account. According to the analytics provider Chaiscan, the application has nearly 2.4 million users and slightly more than 72,000 daily users. Aside from payments, Terraform Labs, the firm behind the development of Terra, is working on other financial solutions to bring decentralized finance (DeFi) to its ecosystem. These DeFi products include Anchor, a money market protocol to earn yield from stablecoins, and Mirror Protocol, a protocol for creating and trading synthetic assets.

Anchor is quite a game changer. It stakes collateral from borrowers to offer lenders a fixed 20% annualized return on UST deposits. By staking on major PoS networks, Anchor is able to maintain a steady, cashflow-generating stream of revenue for depositors.

With the triple functions of payments (CHAI), savings (ANCHOR) and investments (MIRROR), Terra has built up a vibrant ecosystem with multiple uses for its stablecoins. It removes the basic issue of having to convert crypto back to fiat because there are merchants already willing to accept stablecoin payments on CHAI. As demand for these services grows, demand for UST and subsequently, price of LUNA grows.3

5. Chainlink: The Oracle of Choice ($LINK)

Problem Statement:

Mass adoption of interesting smart contracts will require data feeds that are secure, external to the blockchain (i.e. interest rate data from a bank), and maintain privacy when incorporated into a smart contract. Data feeds that meet these conditions are not currently available for a number of reasons. Broken down, the problem lies with the following:

Blockchains (and smart contracts running on the blockchain) cannot directly fetch and incorporate external data; they lack the networking capabilities necessary.

Current solutions are powered by a community of centralized oracles, software that connects external data feeds to blockchains for smart contract functionality.

Relying on single sources of data for a smart contract is inherently insecure; the single entity is left vulnerable to tampering or data corruption. The self-executing nature of smart contracts makes data integrity paramount.

Lastly, data requests transmitted through the blockchain are publicly available; observers can see any data fed into a contract which possibly leaks sensitive information.

These conditions result in extremely limited smart contract functionality and low adoption rates. If you are a large enterprise, the tamperproof value of smart contracts is effectively nullified if contracts are public and the underlying data feeds are insecure.

How LINK is solving it:

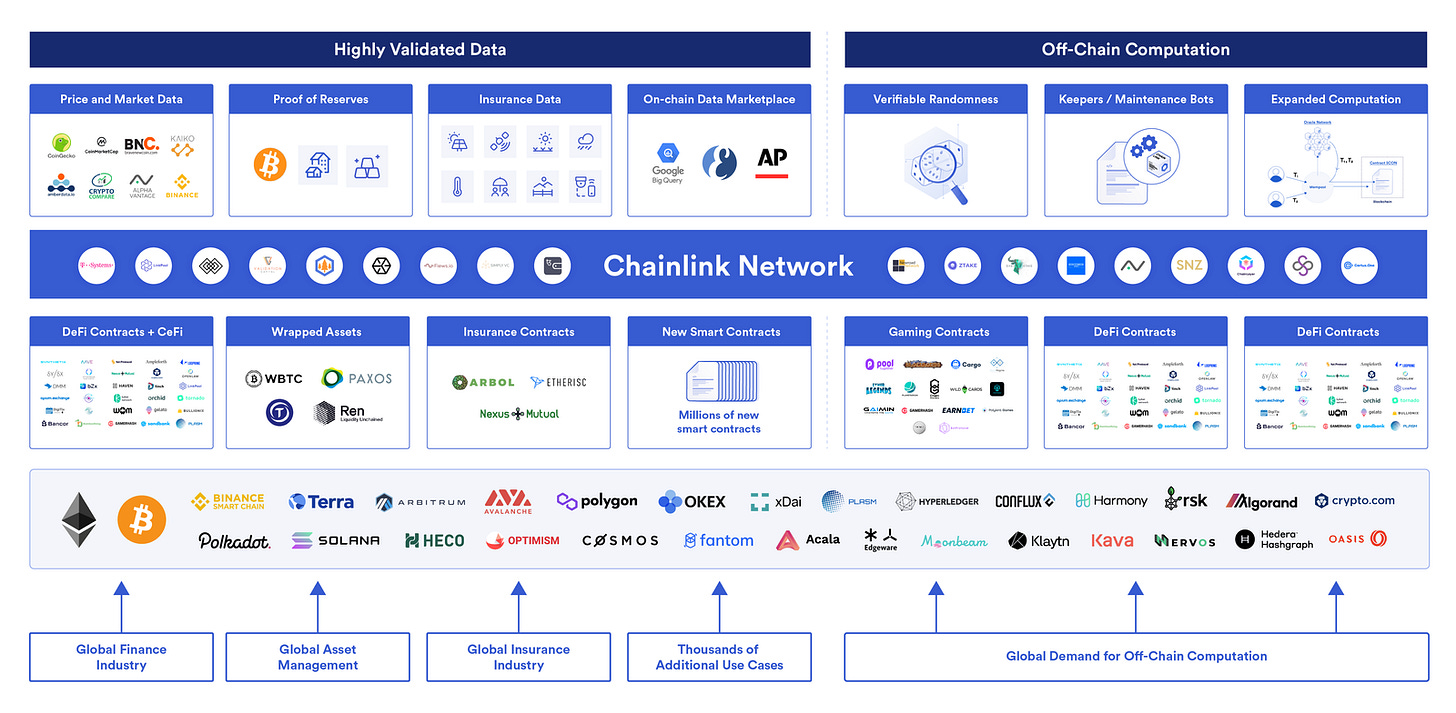

So, how do we ensure that the data feeds that trigger smart contracts maintain their integrity? The high-level solution is that ChainLink employs decentralization & reputation scoring to set up and maintain data feeds.

Oracles are critical components of nearly all DeFi protocols in use today, most commonly as reporters of token prices. At the basic level, oracles are bridges between on-chain and off-chain data, allowing smart contracts to act upon data from the world outside of the blockchain.

ChainLink is a decentralized oracle solution. At a high level, the project aims to provide secure inputs (data) for smart contracts, and secure outputs (payment functionality) for those smart contracts to settle once triggered. An example would be ChainLink providing interest rate inputs for banks for a bond coupon payment contract, and facilitating smart contract outputs — in this case paying USD out to the corresponding bank account stipulated in the contract.

Chainlink is the leading oracle provider in the DeFi space today. Its oracles are used throughout popular protocols such as Synthetix, Aave, and dYdX, among many others.

Chainlink has demonstrated the applicability of comprehensive and dedicated oracle providers, which is likely why it is used in many of the top DeFi protocols today. It has been successful in integrating a host of third-party node operators and external APIs, which has allowed it to build a significant network effect and remain the market leader for oracles.

Chainlink provides a wide range of oracle services for the smart contract ecosystem:

6. Genie: The NFT Aggregator of Aggregators

Problem Statement:

While OpenSea acts as an aggregator of data and NFTs, OpenSea users aren’t able to instantly purchase NFTs listed on other marketplaces instead they are required to bid and wait for acceptance of the purchase. What if users were allowed users to instantly buy NFTs listed on other marketplaces. While OpenSea remains the largest NFT exchange, there are a variety of marketplaces for dozens of categories of assets including pfps, IP, art, sports, collectibles, and more. Currently, the liquidity between marketplaces remains fragmented. Listing assets across a variety of exchanges is time-consuming and purchasing NFTs of the same collection from a variety of exchanges has been tedious.4

How Genie is solving it:

Genie’s core focus is on aggregating marketplaces enables it to potentially become an aggregator of aggregators.

Genie offers two features, Genie Swap and Genie List.

Genie Swap: Instant Liquidity & Floor Sweeping: Genie Swap enables anyone to buy and sell multiple NFTs across a variety of marketplaces in a single transaction. Genie users can purchase NFTs using a combination of Ether and/or NFTs.

Genie List: In the event that instant liquidity isn’t available, Genie List enables users to batch list NFTs on Rarible and Opensea within the same transaction.

Genie Swap users leverage four major benefits:

All major marketplaces in one interface

Batch buy and sell in a single transaction

Gas savings when batch buying and selling

More efficient routing when buying and selling

To date, Genie has facilitated over 6,500 ETH (~$26 million) in Swap volume, notable considering the protocol experienced significant volume while in beta.

7. Community Token: Friends with Benefit ($FwB)

Problem Statement:

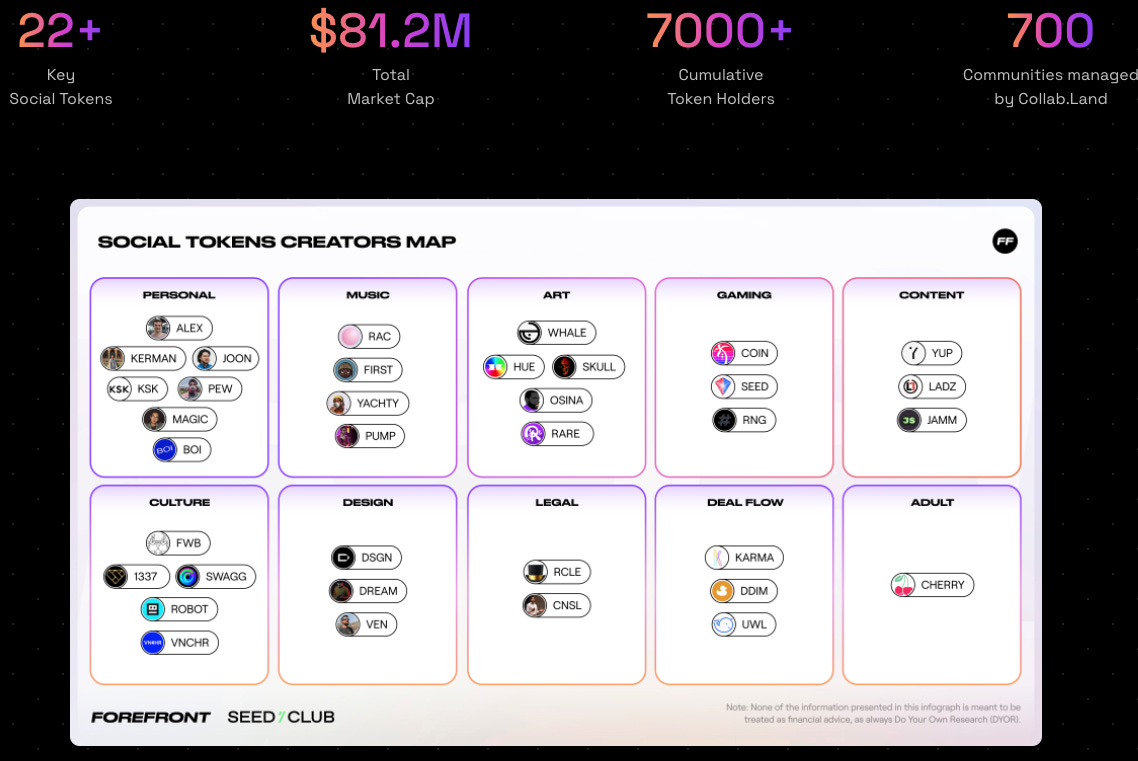

In portending the modern landscape for Community DAOs, social media was an obvious canary within Web 2.0. Twitter and Facebook amplified the growth of digital tribes, but also extracted most of the value of these tribes for themselves. Shifting to Web 3.0, digital communities leveled up by introducing native monetary units: tokens.

As exciting as superfan clubs may be, they are inherently uni-directional. Members may trade in and out of their RAC tokens for profit. Maybe token holders retain exclusive non-monetary privileges like stage passes or opportunities to collaborate with the artist. Dapper Labs plans to enhance the utility of TopShots clips by integrating them into a fantasy sports game, Hardcourt. But ultimately, in most of these cases, one party creates and the rest follow. The next evolution of community tokens need to be more generative and inclusive, weaving a symbiosis between tokens, members, and creation. Instead of top-down, the model should be bottom-up.5

Just like with the growth of digital NFT art marketplaces, COVID-19, and really, the internet, has forced artists and creators to rethink how they can connect with their fans and monetize online.

How FwB is solving it:

Tokens that provide access rights to online communities are now possible because of new tools like Collab.Land. Collab.Land acts as a bridge between chat applications like Telegram or Discord and your MetaMask wallet. One such community, Friends With Benefits ($FWB) uses Collab.Land, which to users appears a chatbot that ensures community members are holding enough $FWB tokens in their MetaMask wallet to access various Discord channels. FWB is now also using SourceCred to distribute $FWB tokens commensurate with upvotes on discussions ranging from music production, NFT discussions, breaking news, memes, Substack articles, and trading tips.

Community DAOs like Friends with Benefits (FWB), BanklessDAO, and PleasrDAO flip the script. Instead of a parent organization dictating the community’s ethos and capturing the value, community DAOs self-organize, plot their own guiding principles, and generate/capture their own value. Just as children mature into adults, so have digital communities.

Since its humble beginnings as a social experiment in September 2020, FWB has grown to nearly 2000 members and its community has driven an outsized portion of the cultural value in web3. DAO members have launched a (now canonical) token-gated events app, an NFT gallery, a web3-focused editorial venture, a virtual music studio, and a real-time community dashboard, in addition to a series of parties around the world. Their next venture, FWB Cities, aims to scale the DAO’s IRL footprint, partnering with city-specific spaces, communities, and experiences to bring real world benefits to the FWB membership. In this way, FWB Cities offers a glimpse into the very first IRL metaverse and will make the entry fee even more accessible to more people.

Because of FWB, it’s now possible to envision a world where the first time you interact with crypto is when you walk into a bar or attend your friend’s concert. Our goal is to offer guidance as FWB navigates the complexities that come with the next phase of DAO maturity. We plan to actively participate in governance and we will empower key community members through delegation. We’re thrilled to be a part of the FWB community as they lead the charge toward mainstream adoption of web3. - a16z on its $10M investment in FwB

If you liked this post from Cryptechie, please subscribe and share!

This is not investment advice. Crypto currencies and tokens are highly volatile. Only invest what you can afford to lose. You must decide how much of your investment capital you are willing to risk. No warranties are expressed or implied.