Y Combinator '21: Startups to watch out

Top 15 promising Fintech & Crypto startups in Summer 2021 batch

This Y Combinator S21 Demo Day batch has 377 startups presenting over 2 days. Out of this ~30% are fintech & crypto startups!

This was one of the hardest exercise to do, but we sifted through 102 amazing companies and founders in the Fintech & Crypto space to shortlist Top 10 Startups in summer 2021 you need to watch out for! Without further ado, here is the list:

💡 Top 5 Crypto & Blockchain Startups

1. DigiBuild: Building construction software powered by blockchain

Robert Salvador, CEO. Former Founder/President of a national construction company. Managed more than $500 million worth of construction projects over the last 20 years. Early to the crypto scene & has worked as an analyst for blockchain-focused investors. Named to Crain's Chicago “25 Rising Stars in Tech”. Experienced Builder l Project Manager l Construction Technologist

Ivan Franco, VP of Engineering. Full stack and blockchain developer with 6+ years of experience. Currently being considered for Thiel Fellowship. Has worked on projects with Coinbase, Iota, IBM.

April Moss, COO/Customer Success- 20+ year corporate executive with P&G. Built national sales teams for P&G, Starbucks, and large sales/marketing brokers. Previous experience at Construction Specifications Institute.

April and Rob have known each other for 12 years. Ivan and Rob have known each other for 4 years. All 3 founders have been working together for 3+ years.

2. Walrus: Neobank for Young Indians

Founders have previously worked in banking, consulting, technology. The holy trinity to build a fintech firm. Bhagaban - (BB) - is an IIT alum and has been a serial entrepreneur for last 10 years. Sriharsha - (Harsha) - has been working in startups as director of engineering & CTO positions for the last 10 years. He has built products that have scaled to millions of users. Nakul - is an IIM Ahmedabad alum and has extensive background in consulting.

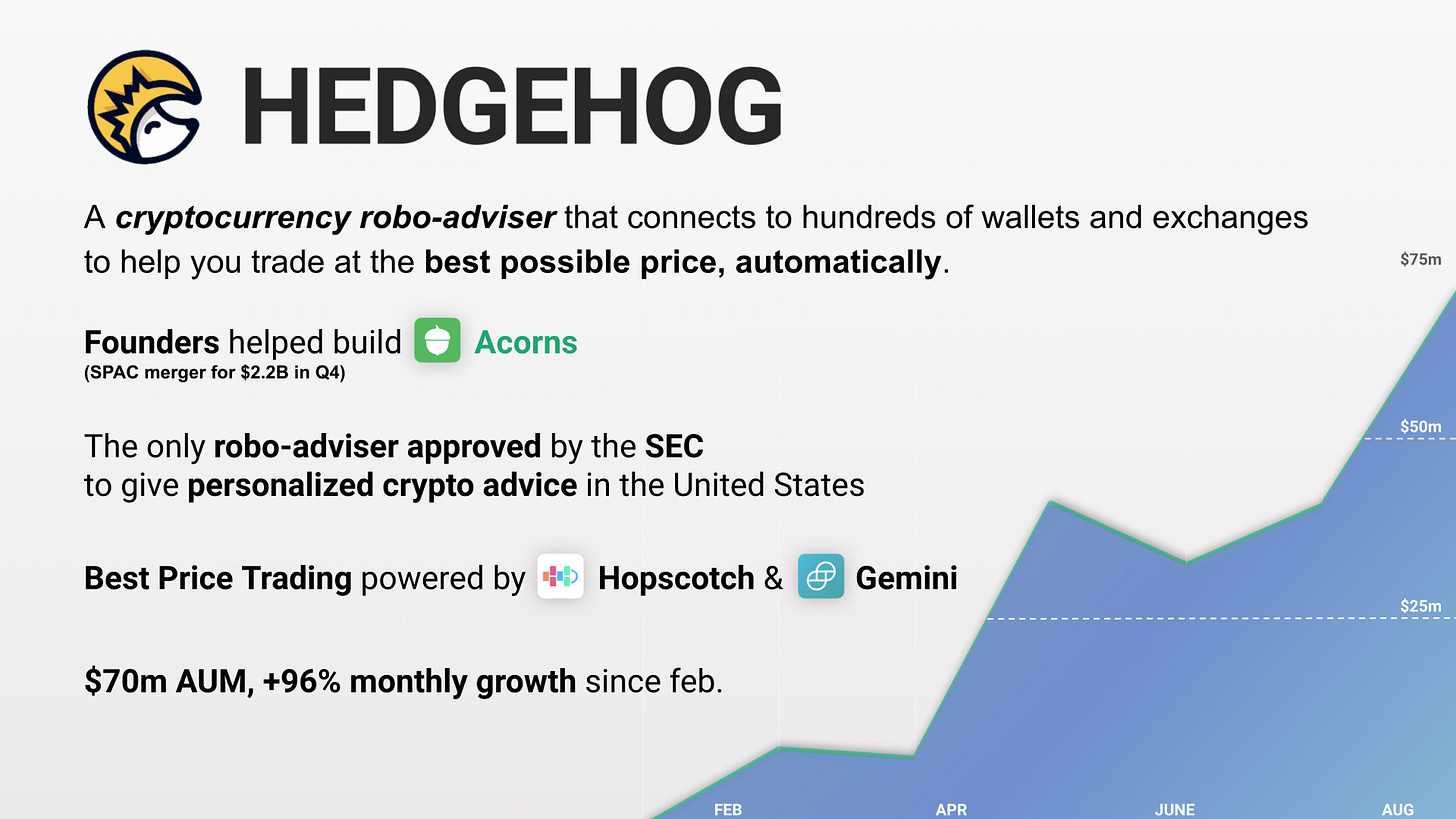

3. Hedgehog: Cryptocurrency Robo-adviser

Taylor Culbertson - Employee #10 at Acorns, designed initial web app and helped design marketing strategy to acquire the first 2 million app downloads, created branding and digital marketing materials for diverse clients including Microsoft, Hyliion, and more.

Colton Dillion - Former CMO and Global Director at Acorns, helped acquire investment adviser and broker-dealer licenses in both the US and Australia, 10 years of human-centered design consulting experience.

Jason Dillion - 5th team member at Hyliion, confirmed proof of concept, Former Program Manager at Panasonic Avionics, managed contracts valued over $200 million for China's three largest airlines.

4. Algofi: Fast, low-cost crypto lending market on the Algorand blockchain

In a previous life, Owen was a particle physicist doing research at CERN, whereas John was a CS major at MIT doing research in ML. After their studies, John and Owen worked together for two years on a four man team at Citadel. John handled trading while Owen developed strategies for a $1bn portfolio. They helped the team transform from a money losing enterprise to one that was highly profitable.

They both discovered a passion for decentralized financial (DeFi) in the fall of 2020. They quit their jobs to work on finding a solution to help DeFi go from tech-savvy early adopters to the mainstream community. They are starting by building Algofi - a fast, low-cost lending market on the blockchain. Up next are fiat railways and retail banking services powered by DeFi.

5. Coinrule: Automates Your Crypto Investments

Gabriele Musella, CEO, UX, Product Management, Leadership, Sales - International experience in the USA, Finland, Italy, and UK at leading organizations such as Vodafone, Nokia, WPP, British Government and MIT in Boston. Gabriele holds a BSc/MSc from the Polytechnic of Milan and attended business programs at LSE and Harvard University. He worked in Fintech at the Innovation Labs of Lloyds Banking Group and UBS Bank.

Oleg Giberstein, COO, Operations, Management, Economics, Business development - Oleg studied Politics and International Relations (BA and MPhil) in London and Oxford and subsequently worked in Banking and Risk roles at Citigroup London for a number of years. In his last role at Citi, Oleg was Chief of Staff to Citi's Global Public Sector Portfolio Head.

Zdeněk Hofler, CIO, Technology, DevOps, Full-stack, Team management, Agile - Zdeněk has been developing web applications for almost 20 years. A self-taught developer - he studied Cybernetics in Pilsen, Czech Republic, and dropped out to focus on programming.

🚀 Top Ten Promising Fintech Startups

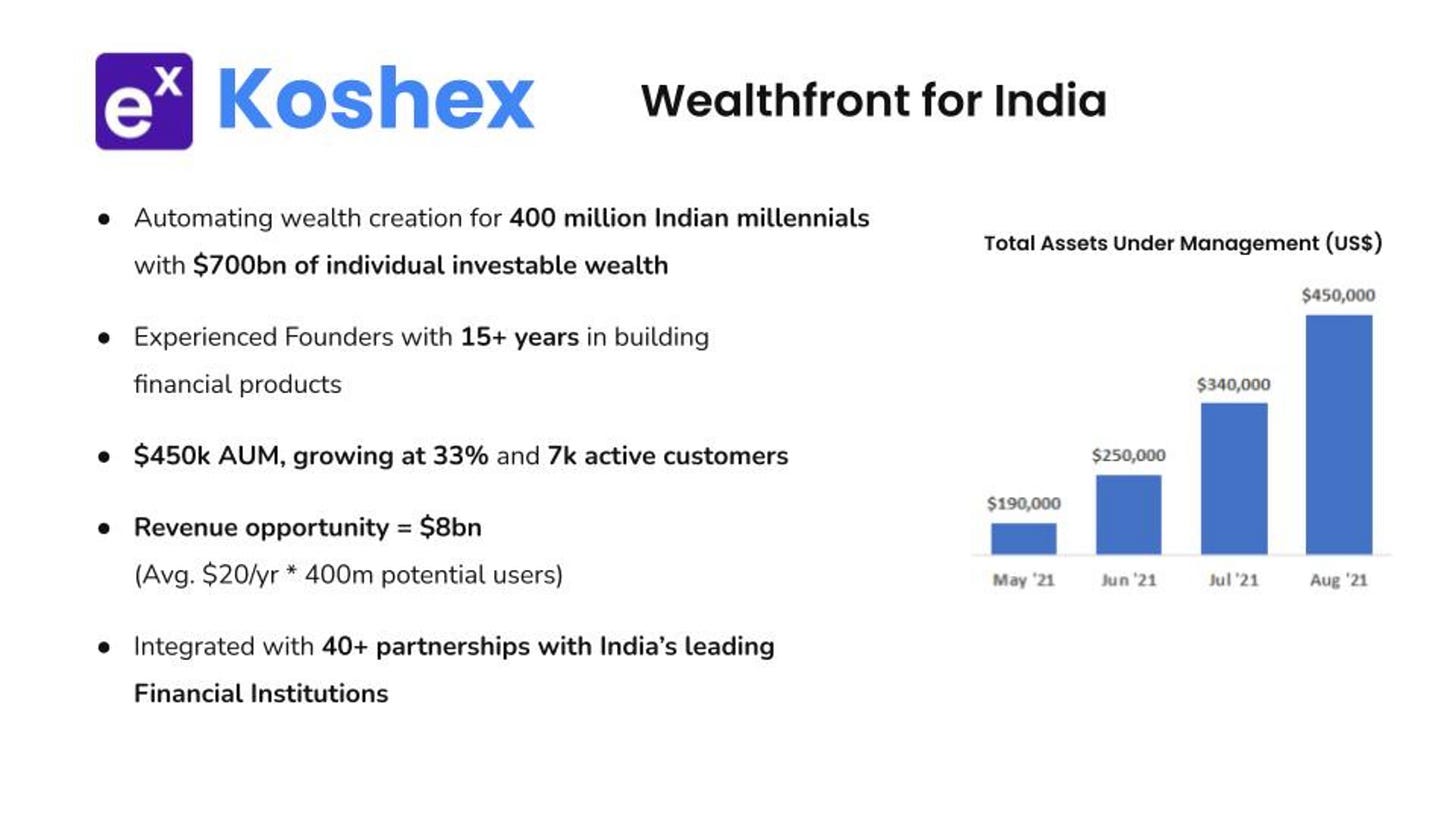

1. Koshex: Automating wealth creation for 400M Indian millennials

Founders have more than 15+ years of combined experience ranging from technology, product management, design, business and P&L management, sales & operations. The founders personally have a strong domain understanding of financial services and the product is at the intersection of personal finance and technology. The Founders bring complementary skills (Business + Tech) to the table and have a track record of building and scaling several businesses.

Akash in his 9 years of experience in Consumer Fintech (Wealthtech, Lending, and Payments) and Investment Banking. He has worked at Ola, UBS, Rothschild, and CapitalFloat. Komal has over 6 years of experience in building and leading the technology for Consumer and SaaS products in Fintech, Hiring Automation, and E-commerce and worked with Yahoo, Olx People, and CapitalFloat.

Komal and Akash met while building a consumer lending business and scaling it to $15m in book size in less than 6 months. That’s when we realized that most Indians would rather spend more than their disposable income than save it for things they need. This is turn led us to the biggest insight for Koshex which is designing a platform around Individuals rather than financial products.

2. Shopscribe: Subscriptions for local shops

Lorenzo (CTO) is a full-stack Software Engineer who grew up in a family of small business owners and experienced firsthand the struggle of competing with online retailers. Alex (CEO) went to the #1 school in the world for hospitality, is a 2x YC founder, and spent the last 3 years selling B2B2C tech.

3. Nomod: Square minus the hardware for international merchants

Omar founded JadoPado in 2010 which started as an online store in the UAE, and morphed into a regional Amazon-style marketplace platform. For five years, we bootstrapped, invested whatever we could, and survived on the cash flow from supplier credit. In 2015, through sheer determination we raised a $4 million venture round. In May 2017, a couple of months after Amazon entered the UAE, Noon’s billionaire founder acquired JadoPado, to use its technology stack to launch and fight back!

Omar graduated from the University of Warwick with a BsC in Electronics Engineering and Business Studies.

4. Trii: US and local equities for retail investors in Latam

Esteban and Carlos met seven years ago, working as investment bankers.Esteban was a private equity banker while Carlos worked for Citigroup- Luis was a senior engineer for Firefox. We are second-time founders, and we have over 20 years of combined experience working in fintech.

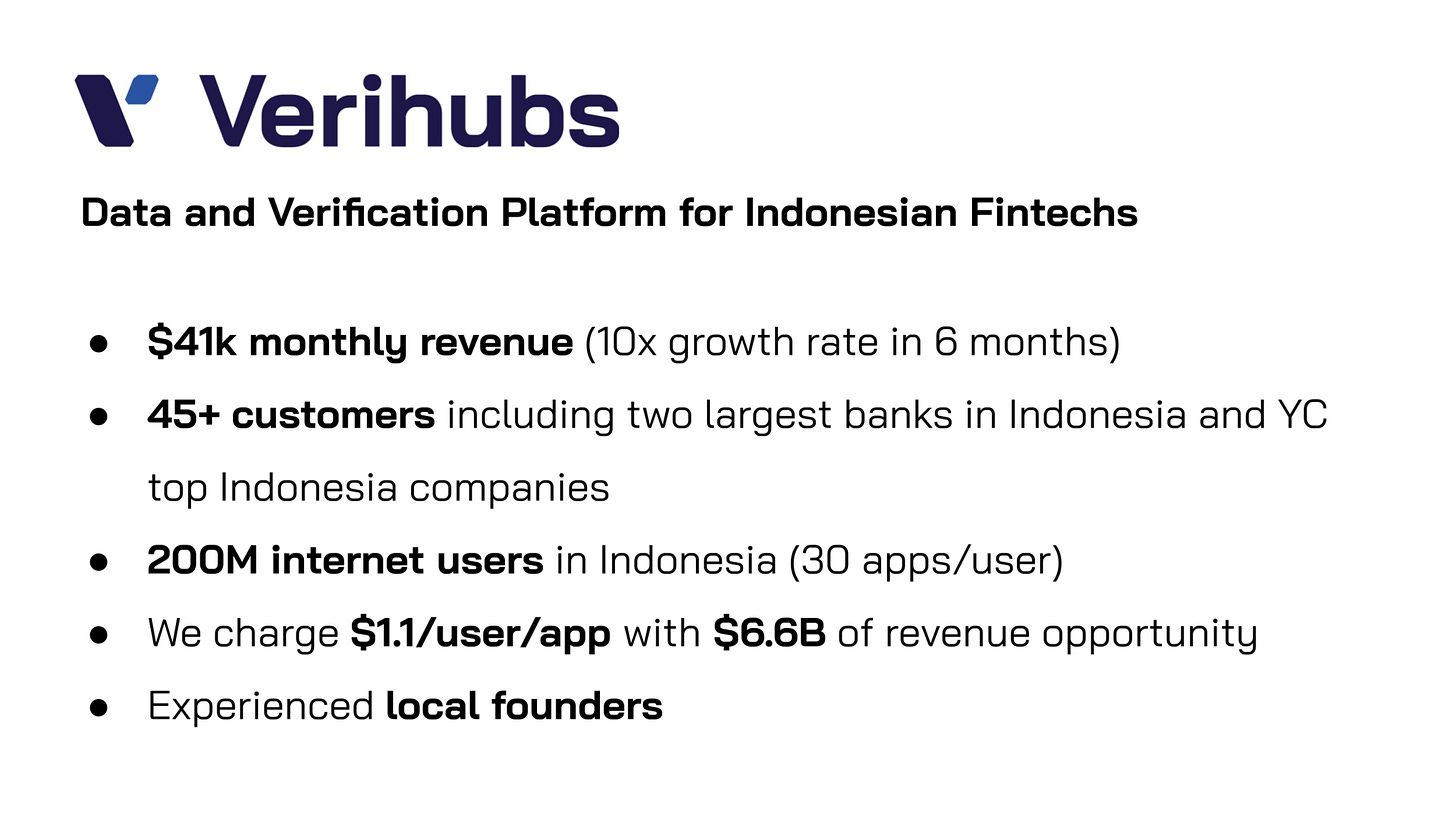

5. Verihubs: Data and Verification Platform for Indonesian Fintechs

Both founders are local Indonesian. The CEO, Rick is an experienced B2B expert with ~8 years of experience. He previously worked at an SMS gateway company in Indonesia.

Williem is one of the very few computer vision experts in Indonesia, with a Ph.D. in Computer Science and more than 10 years of experience. He holds a Ph.D. in Computer Vision from Inha University, Korea. During his studies, he has done various industrial projects, from Samsung and SK Telecom Korea, while publishing papers at Top Tier Computer Vision conferences and journals (CVPR, ICCV, TPAMI). He is also acknowledged as Top Paper Reviewers in Top Tier Computer Vision Conferences.

6. Swipe: Simple billing and payments for 75M+ Indian SMBs 🇮🇳

Aditya (CEO) and Sri Teja (CTO) known each other from past 7 years. They are repeat founders and co-founded Swipe after they found it hard to send bills and collect payments to their customers at their last startup. Aditya has done his Masters from University of Washington and ex-Amazon. Sri Teja has done his Masters from IIIT Hyderabad and is one of the early members of the Data Science team at Great Learning (BYJU's).

7. Contalink: Help Accountants automate work and serve their customers online

Contalink is a SAAS to help accountants in Mexico automate bookkeeping and serve their clients online. We help accountants do bookkeeping 5x faster. 2700 paying users managing over 10,000 companies, making $50,000 in MRR. Focus on Mexico, where 80% of SMBs and accountants still use windows desktop-based legacy software, and companies are required by law to operate using electronic XML documents ( invoices, payroll, collections, and beginning October 21 Shipments). There is a $2.5 billion market plus a significant opportunity to establish itself as the biggest financial data source for SMBs in Mexico. Contalink is a 500Startups, and Y Combinator backed company

8. Chari: B2B e-commerce and fintech platform for traditional proximity stores

Ismael & Sophia are a married couple: they have two kids together, and Chari.co is their third (Digital) baby. They are both ex-strategy consultants. Ismael worked for BCG for 3 years before funding several successful tech companies in Morocco. Sophia worked for McKinsey for 4 years before joining the Chari adventure.

9. Mentum: Investment management API for fintechs in LATAM

Gus, the CEO, recently left his position as a quantitative researcher at BlackRock’s leading AI investment team. Prior to that, he built investment platforms for asset managers that are trading hundreds of millions of dollars. He graduated Summa Cum Laude with an Msc. in Data Science and a Bsc. in Finance from Hult.

Daniel, the CTO, worked at Confluent in SF as a backend engineer in the Kafka Connect team where he integrated data-streaming solutions to multi-national companies. At Apple, he worked as a backend engineer at the iCloud Photos team, building one of the worlds largest cloud infrastructures. He graduated Summa Cum Laude with a Bsc. in Computer Science from RIT.

Simon, the COO, worked at Wish in SF, where he helped expand digital payments and fraud detection across 10 countries in LATAM. He graduated with a Bsc. in Finance from Hult.

10. inai: Segment for global payments

..and that is a wrap! Check out the list of all companies👇

Follow me on LinkedIn

Nakul

If you liked this post from Cryptechie, please subscribe and share!