The next Supercycle, and why it will bring trillions on-chain

How new US regulation will unlock trillions in stablecoin adoption and why a massive institutional yield vacuum is forming

Executive Summary

The US is on the verge of its largest monetary transformation since the birth of the Eurodollar system. New regulatory frameworks like the Genius Act and the upcoming Clarity Act formalize a clear path for banks, funds, asset managers, and corporates to issue and hold stablecoins at scale.

Every major institution will use stablecoins to reduce costs, re-engage customers, control distribution, and create new flywheels in their core business models.

But there is one major restriction that almost nobody is talking about:

Regulated stablecoin issuers are prohibited from passing any yield or interest to users.

This single clause creates the largest structural vacuum in digital finance. Many institutions will issue stablecoins that must be without any yield - these stabelcoins also cannot be easily used in decentralized finance given the opaque listing process, legal restrictions and liquidity fragmentation. Consumers and global markets will push these stablecoins, yet they will all earn 0 percent which will slow down adoption.

This vacuum is the trillion dollar opportunity.

Central Thesis

The combination of global dollarization, Eurodollar erosion, new US regulatory clarity, and a fragmented on-chain liquidity landscape will drive an unprecedented surge in institutional stablecoin issuance. But the inability of issuers to offer yield and the inability of DeFi to absorb institutional scale will create the need for new financial infrastructure layers.

Below are the four structural drivers.

A. Emerging Markets Are Dollarizing at Record Speed

Stablecoins have already become savings accounts in emerging markets

Standard Chartered estimates that 1 trillion dollars of EM retail deposits could migrate to stablecoins by 2030.

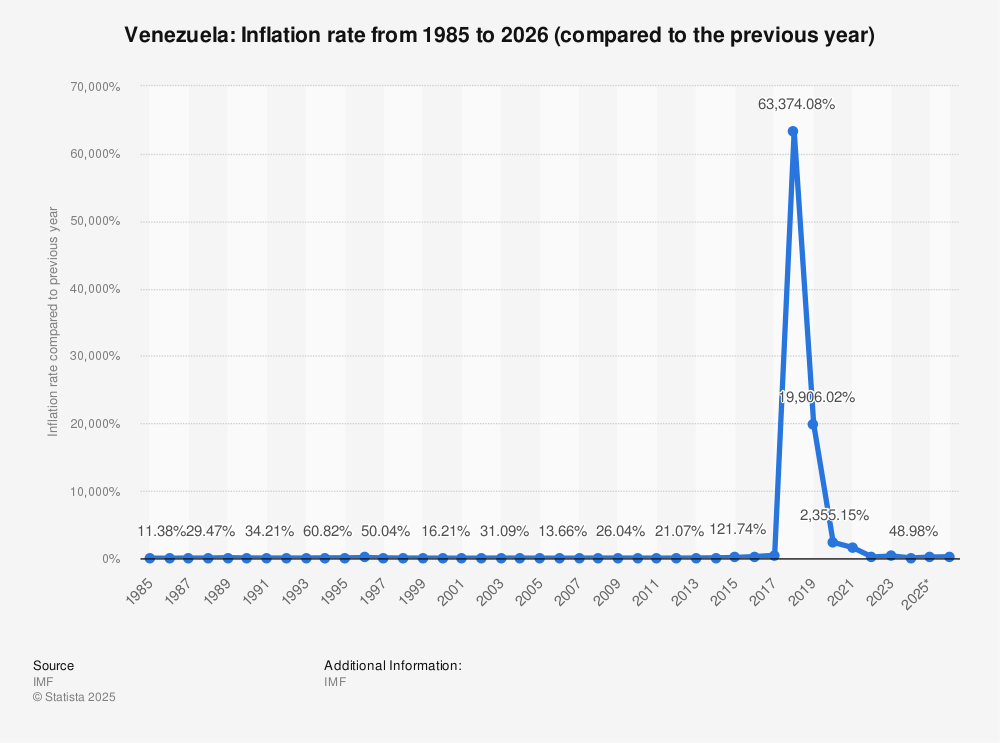

In countries like Nigeria, Kenya, Egypt, Venezuela, Turkey, and Argentina, stablecoins provide:

A dollar hedge against inflation

Protection from bank instability

Instant global transfer rails

A portable store of value in places where financial infrastructure is weak

Local currencies are losing trust

In many emerging markets, stablecoins already function as de-facto savings accounts, because the US dollar is no longer viewed as a transactional currency but as an investment instrument that protects households from inflation, devaluation, and banking instability. In Argentina, where annual inflation exceeded 200 percent in 2023–2024, users convert pesos to USDT/USDC weekly using on-ramp APIs to preserve purchasing power. In Nigeria, the naira lost over half its value in 18 months, making stablecoins the digital equivalent of a “treasury bill” for SMEs and freelancers who hold balances on wallets like Binance P2P or local agents. Technically, stablecoins provide instant custody, near-zero transfer friction, and immunity from local capital controls, unlike cash dollars which require physical storage or black-market dealers. In Venezuela, families hold savings in USDT on mobile wallets because it avoids currency seizure risk and maintains value across borders. In these markets, the dollar is treated as a yieldless but stable investment, and stablecoins are the most accessible form of it.

For younger populations, USDC or USDT is effectively a “checking account” and a source of truth.

This consumer behavior aligns perfectly with regulated US institutions entering the market. Once US banks and corporations begin issuing stablecoins at scale, EM users will move from offshore stablecoins to regulated US ones for safety and brand trust.

This is one of the most powerful adoption vectors in global finance.

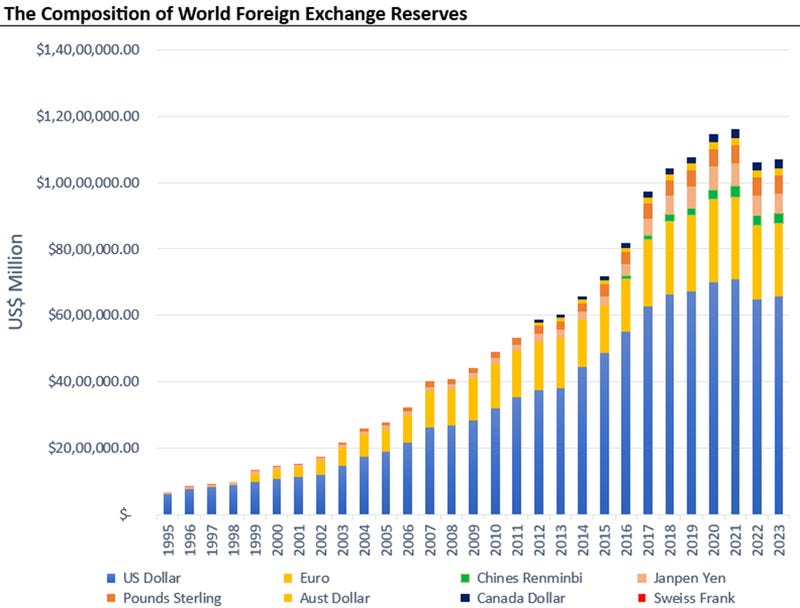

B. The 30–40 trillion dollar Eurodollar system is under threat

The Eurodollar system defined global finance for 50 years

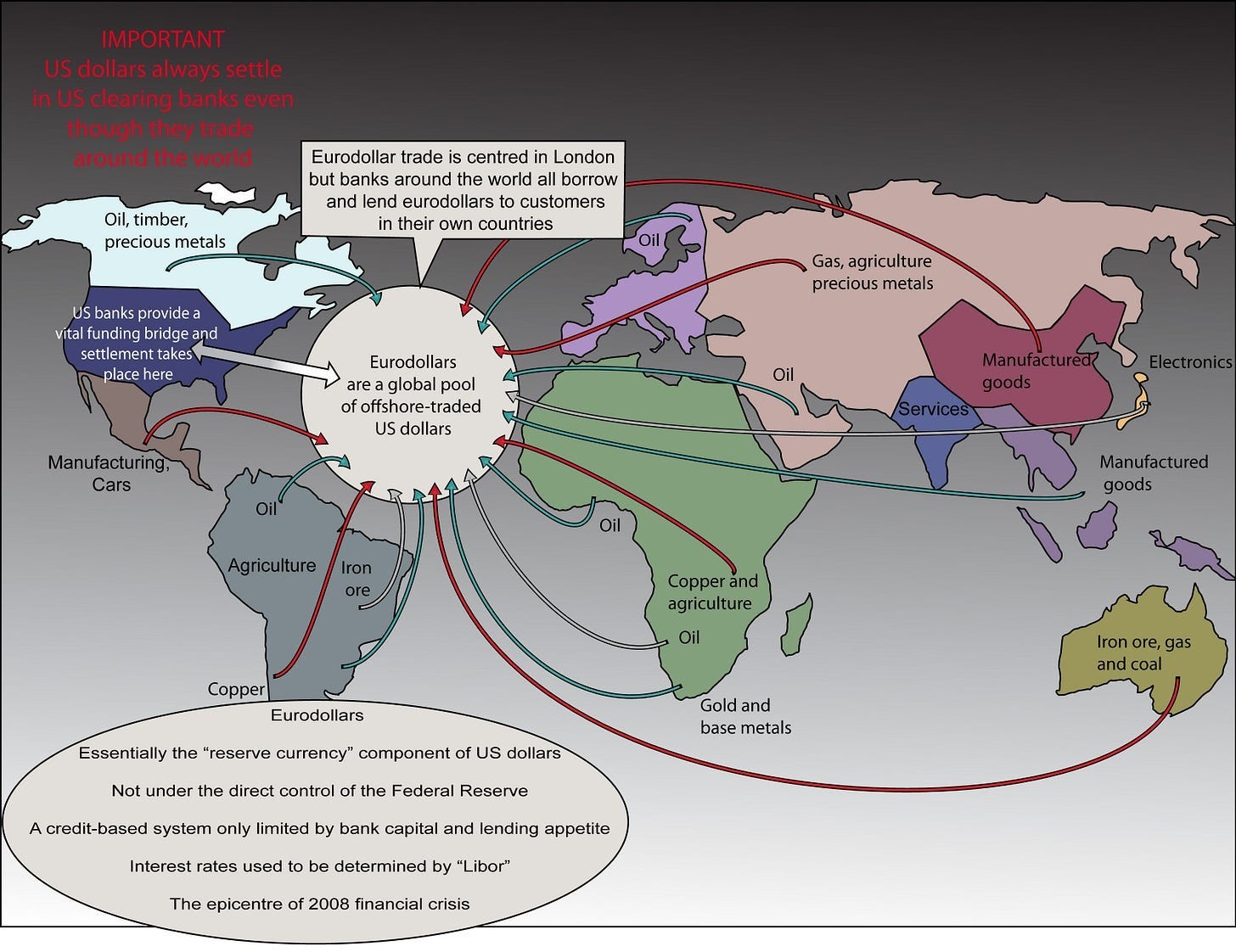

Since the 1960s, trillions of dollars have lived offshore in London and other foreign banking centers. These dollars are used for:

Global trade

Commodity finance

Corporate liquidity

Interbank lending

Total size estimates range from 30 to 40 trillion dollars.

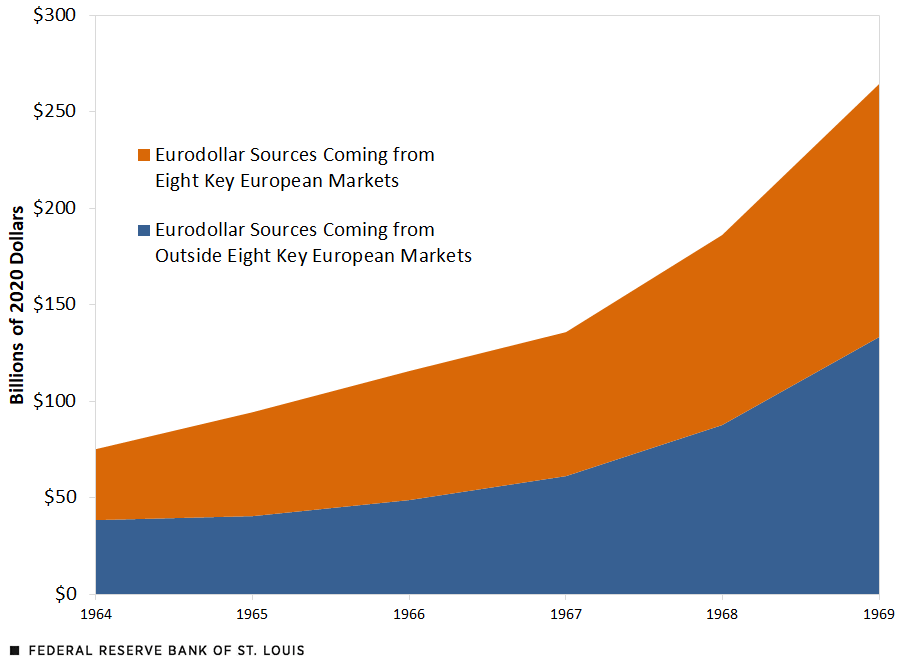

The Eurodollar market emerged in the late 1950s when Soviet and Eastern Bloc banks began holding US dollars in European institutions to avoid potential seizure by the US government. By the 1970s, it had exploded into a global offshore funding system because US banking regulations capped domestic interest rates, while London banks could offer higher returns. Through the 1980s–2000s, Eurodollars became the backbone of global finance. Corporations borrowed in Eurodollars for trade, commodity financing, and balance-sheet management. By 2020, the Eurodollar system was estimated at 30–40 trillion dollars, dwarfing the size of the US M2 money supply. Yet it remained opaque, unregulated, and largely outside US supervisory control. Dollar clearing relied on correspondent banking routes across London, Singapore, and the Caribbean, creating systemic points of failure.

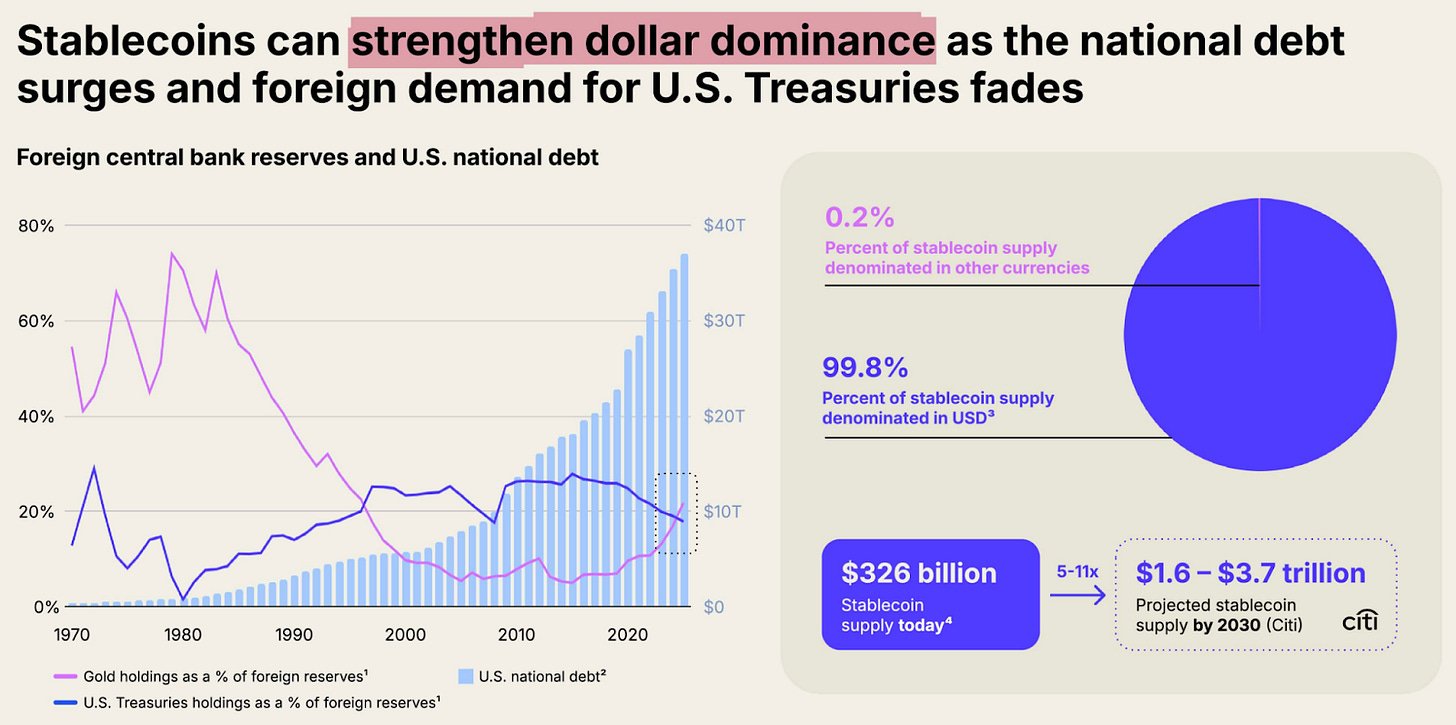

The US has long tolerated this system because it reinforced global dollar dominance. But geopolitical and financial dynamics have shifted. Offshore dollars weaken monetary visibility, complicate sanctions enforcement, and reduce treasury demand transparency. Stablecoins offer the first technological replacement for Eurodollars: instantly auditable, programmable dollars issued under US jurisdiction, with real-time traceability of flows. If global trade, EM savings, and corporate liquidity migrate into US-regulated stablecoins, the dollar’s international role strengthens while offshore opacity disappears.

Why the US wants stablecoins to replace Eurodollars

This matters deeply to the US: the only way to regain control over trillions of offshore dollars is by moving the world from Eurodollars to regulated stablecoins.

The US government has limited visibility and control over offshore dollars. Stablecoins reverse this dynamic by:

Pulling offshore liquidity back into US-regulated structures

Providing real-time visibility into flows

Offering programmable policy enforcement

Reducing systemic risk across opaque offshore markets

Stablecoins allow the US to re-domesticate the eurodollar system without changing how global participants transact.

London risks losing one of its most important banking pillars

Stablecoins issued under US jurisdiction pose a direct competitive threat to offshore dollar markets because they:

Offer faster settlement

Are cheaper to operate

Provide clearer regulatory oversight

Integrate natively with onchain financial rails

The geopolitical shift is profound. The last time the US had an opportunity to re-anchor global dollar flows under its own regulatory perimeter was decades ago.

Now stablecoins provide the mechanism.

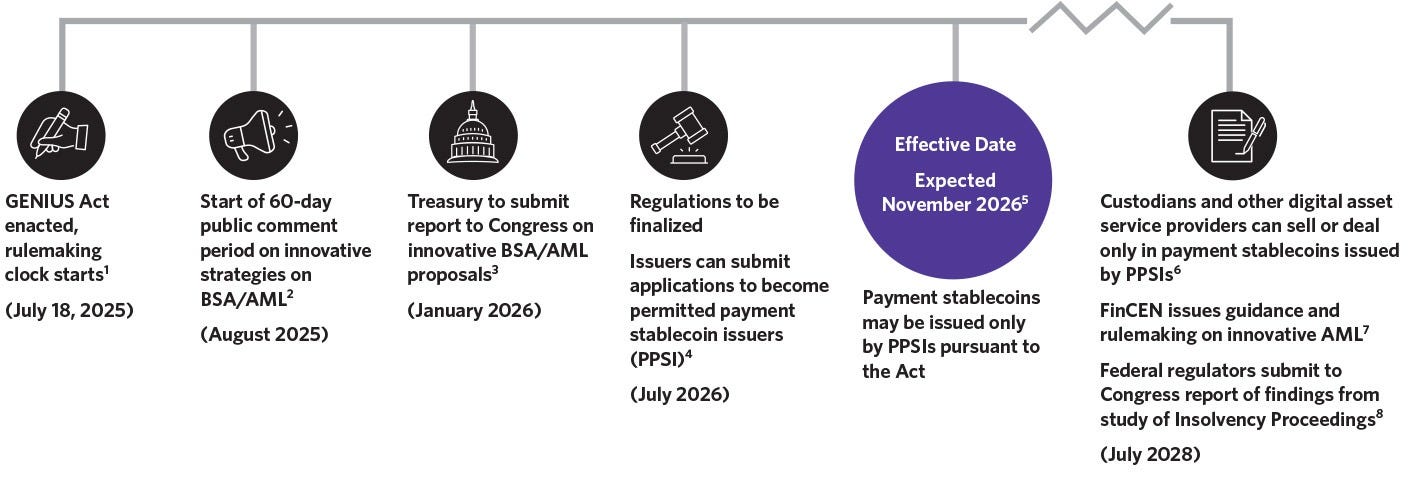

C. Genius Act and Clarity Act: The Regulatory Green Light

The Genius Act establishes the first comprehensive federal regime for issuing and supervising payment stablecoins. It defines which entities may issue stablecoins (insured depository institutions, qualified trust companies, and specially licensed non-banks), sets reserve composition standards (primarily short-duration Treasuries, repos, and cash), and requires daily reconciliation, real-time reporting, and guaranteed one-to-one redemption. Technically, it brings stablecoin liabilities onto regulated balance sheets, making them functionally equivalent to tokenized deposits. For example, a US bank could issue a stablecoin used for intraday settlement between corporate treasuries, reducing wire/ACH costs and settlement times from hours to seconds.

The Clarity Act extends this framework to corporate and fintech issuers, creating licensing obligations, cybersecurity standards, and custody requirements, while imposing the critical rule that no yield or interest may be shared with users. This prevents stablecoins from becoming investment products and forces issuers to operate them as pure payment instruments. For instance, a retailer issuing a closed-loop stablecoin for rewards or checkout payments can earn interest on reserves but may not pass it to customers. This restriction shapes market incentives, economics, and the eventual fragmentation of institutional stablecoin liquidity.

This is the moment institutions were waiting for

The Genius Act and the upcoming Clarity Act create:

A formal pathway for banks and trust charters to issue stablecoins

Balance sheet and capital rules for issuance

Custody frameworks for institutional holders

Redemption and reserve transparency requirements

Explicit bans on passing yield to stablecoin users

Once passed, this will trigger a Cambrian explosion of institutional issuers including:

Banks

Fintechs

Corporates

Asset managers

Broker dealers

Retail giants (Walmart, Amazon, Target)

Why every institution will issue a stablecoin

Take Walmart as the example.

Roughly 2 percent of Walmart’s revenue flows out to payment processors like PayPal and Stripe - that’s billions in fees

With a regulated stablecoin, Walmart can:

Eliminate a large percentage of payment fees

Earn yield on customer balances through T-bills internally

Create closed-loop payment networks

Own customer distribution and data

Offer loyalty and cash-back mechanisms embedded into payments

And Walmart is only the template. Airlines can issue stablecoins for ticket settlement and loyalty ecosystems, reducing merchant fees and capturing float from unused miles. Telecom operators can turn prepaid balances into compliant stablecoins, earning treasury yield on billions in stored value. Ride-hailing and delivery platforms can streamline payouts to millions of drivers while internalizing payment costs. Large retailers, gaming companies, and streaming platforms can all build closed-loop economic systems where payments, rewards, and user balances operate on their own stablecoin rails.

Every major corporate CFO will run this math. Stablecoins become an enterprise-grade cost reduction engine and revenue flywheel.

But the Clarity Act introduces a crucial restriction

Yield is banned. Issuers cannot share any treasury or reserve income with users.

The Clarity Act bans yield because the moment a stablecoin pays interest, it stops looking like cash and starts looking like a money-market fund. That would force every issuer – from Walmart to JPMorgan – to follow strict securities or banking laws designed for investment products, not payment instruments. Regulators want stablecoins to behave like digital cash, similar to a dollar bill or a prepaid balance, not something consumers expect to “grow.” Allowing yield could trigger bank-run dynamics like 2008 money-market stress. By banning interest, the US protects its banking system, avoids shadow money funds at trillion-dollar scale, and keeps the stablecoin market simple, safe, and payment-focused.

This preserves stablecoins as payment instruments not investment products. It protects regulators from securities classification risk. But it also creates the largest structural mispricing in finance.

Trillions of dollars will sit in stablecoins that earn 0 percent for users while issuers earn risk-free yield on the backend.

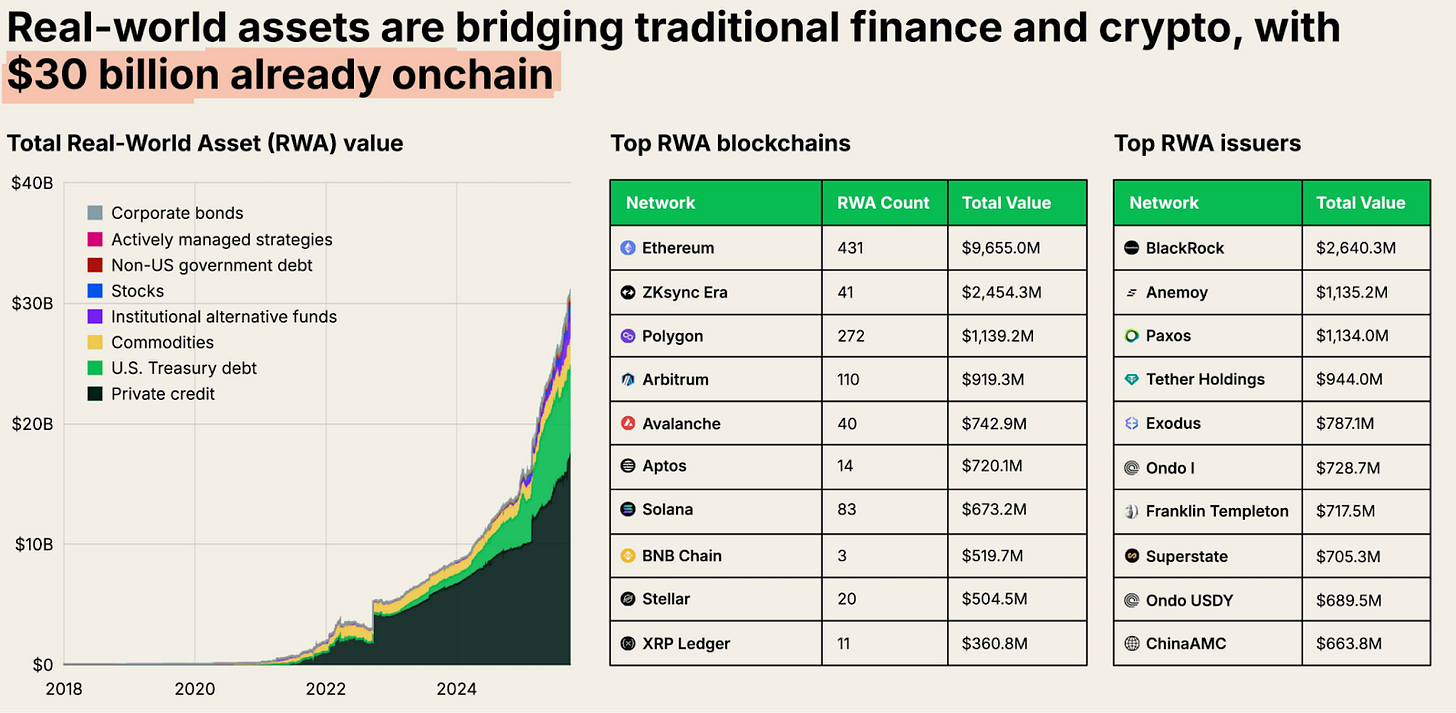

D. The Coming Liquidity Fragmentation Crisis

The next phase of regulation will unlock an unprecedented wave of institutional stablecoin issuance. Banks, corporates, fintech platforms, broker-dealers, retailers, telecoms, airlines, and asset managers will tokenize dollars, deposits, loyalty balances, inventories, receivables, and even commodities. Within a decade, the market could contain 1,000 or more regulated stablecoins and tokenized real-world assets, each backed by transparent reserves but constrained by one structural rule: they cannot offer yield. Users will hold trillions of dollars of digital cash that behaves like savings, yet earns 0 percent by design.

This creates the foundation of a Liquidity Fragmentation Crisis. Each issuer’s token is isolated, with its own redemption obligations, risk profile, chain deployment, and compliance stance. There is no uniform listing framework, no shared risk model, and no cross-issuer liquidity standard. In such an environment, neither DeFi nor TradFi can absorb or price these assets at scale.

Every regulated token would require its own oracle feed, risk curve, liquidation logic, governance approval, and due-diligence process. No lending protocol can scale bespoke integrations at that magnitude. Meanwhile, institutions cannot connect to dozens of chains and hundreds of protocols; the operational, legal, and reputational exposure is prohibitive. For example, for JPMorgan to use a tokenized deposit as collateral in open DeFi, it would need to integrate into lending markets, pass governance votes, supply price infrastructure, and accept onchain liquidation risk—an impossible proposition for a global systemically important bank.

When every institution issues its own stablecoin, we get:

1. Thousands of isolated issuer tokens

Every bank, corporate, and fintech launches a token with different risk, redemption, and liquidity profiles.

2. No listing standard

Exchanges and DeFi cannot uniformly list these tokens.

3. DeFi cannot underwrite 10,000 independent assets

Each asset requires

Its own oracle

Its own risk model

Its own liquidation logic

This is operationally impossible.

4. TradFi cannot integrate with 50 protocols across 20 chains

Banks cannot maintain bespoke integrations with fragmented DeFi liquidity.

5. Institutions need high-quality, compliant, liquid markets

They cannot touch retail yield farms, long-tail assets, or experimental protocols.

Result: Stablecoin issuers earn yield. Users earn 0 percent. DeFi cannot absorb the flow. TradFi cannot plug in. Liquidity is shattered.

This is the structural gap emerging that is a hard problem to solve

Why Does access to (new) DeFi matter

Why does access to DeFi matter? Access to DeFi is critical because it is the only financial system capable of treating tokenized real-world assets as productive collateral at global scale. In traditional finance, collateralization is constrained by banking hours, intermediaries, credit committees, and bilateral agreements. Borrowing USD often costs 8–10 percent, reflecting regulatory capital, counterparty risk, and operational overhead. DeFi removes these frictions. With over $100 billion in constantly available liquidity, assets can be borrowed against in real time, 24/7, at market-clearing rates. Blue-chip lending markets frequently price USD borrowing at 3–4 percent, and during periods of low utilization, automated pools compress lending spreads to 0.2 percent, enabling ultra-efficient capital formation.

This efficiency is not theoretical—it is structural. DeFi is the only environment where collateralization, liquidation, and pricing occur programmatically, without human bottlenecks. A tokenized treasury bill, a corporate stablecoin, or a bank-issued deposit token could become instant collateral for credit, liquidity, or market-making. Without this access, institutional stablecoins remain financially inert—they move money but cannot generate economic activity. In a world heading toward thousands of yieldless stablecoins, the inability to tap DeFi’s liquidity engine traps trillions of dollars in idle form, distorting incentives for users, issuers, and the broader economy.

Lending protocols like Aave, Compound, Morpho, or Curve cannot scale underwriting for thousands of assets.

Risk curation does not scale

Oracle feeds do not scale

Governance does not scale

Liquidation engines break down

Institutional compliance requirements are unmet

Multi-chain fragmentation becomes unmanageable

Even if DeFi wanted to absorb institutional stablecoins, it physically cannot.

Institutions will issue assets that cannot touch DeFi and will earn 0 percent.

This is the trillion dollar vacuum.

Summary

The convergence of regulatory clarity, institutional participation, and global dollarization marks a historic shift in how digital dollars will be issued, saved, moved, and priced. The Genius Act and Clarity Act together initiate the largest institutional onboarding event in the history of crypto. As banks, Fortune 100 corporates, fintechs, and asset managers enter with regulated stablecoins, several inflection points will define the next decade of market structure:

Key Inflection Points to Watch

A major inflection point is the DTCC’s formal approval by SEC and rollout of tokenization frameworks in the US, which signals that the core market infrastructure for equities, funds, and collateral is preparing to migrate onchain. DTCC processes over $2 quadrillion in securities transactions annually. When an institution of this scale standardizes tokenization rails, it validates the technology for the entire financial system. This shift is not symbolic—it establishes the operational, compliance, and settlement backbone required for banks, asset managers, and broker-dealers to treat tokenized assets as first-class financial instruments. It is one of the strongest signals yet that the US intends to modernize its financial plumbing through tokenization.

Other key catalysts to watch out for in coming months:

Passage of the US Clarity Act

First Fortune 100 corporate stablecoin issuance

First US bank–issued stablecoin under Genius Act rules

EM users migrating from offshore to regulated US stablecoins

Liquidity fragmentation across dozens, then hundreds, of issuer tokens

DeFi’s inability to list or underwrite the new institutional asset universe

Each milestone expands adoption by an order of magnitude. Yet they also reveal the core systemic challenges: yieldless instruments, fractured liquidity, and no scalable pathway for institutional assets to access DeFi’s 24/7 capital engine. Trillions of dollars will sit in digital dollars that cannot be deployed, priced, or collateralized efficiently.

The Opportunity ahead lies at the intersection of these forces. The next generation of platforms will need to:

Bridge regulated issuers with scalable onchain markets

Provide compliant yield pathways where issuers legally cannot

Aggregate fragmented institutional liquidity

Standardize underwriting, risk, and pricing models

Give TradFi access to onchain assets without protocol complexity

Enable global users to earn safe, regulated yield without violating the Clarity Act

This transitional moment calls for a new category of neutral infrastructure—one built between TradFi and crypto, capable of unifying issuance, liquidity, and yield. The institutions are coming, the users are ready, and the regulatory rails are falling into place.

The remaining gap is the connective tissue.

The next decade belongs to whoever builds it.