Is Blur going to kill Opensea?

What is Blur?

@blur_io was launched by @PacmanBlur on Oct 2022.

It has no marketplace fees, and enforces a 0.5% minimum creator royalty.

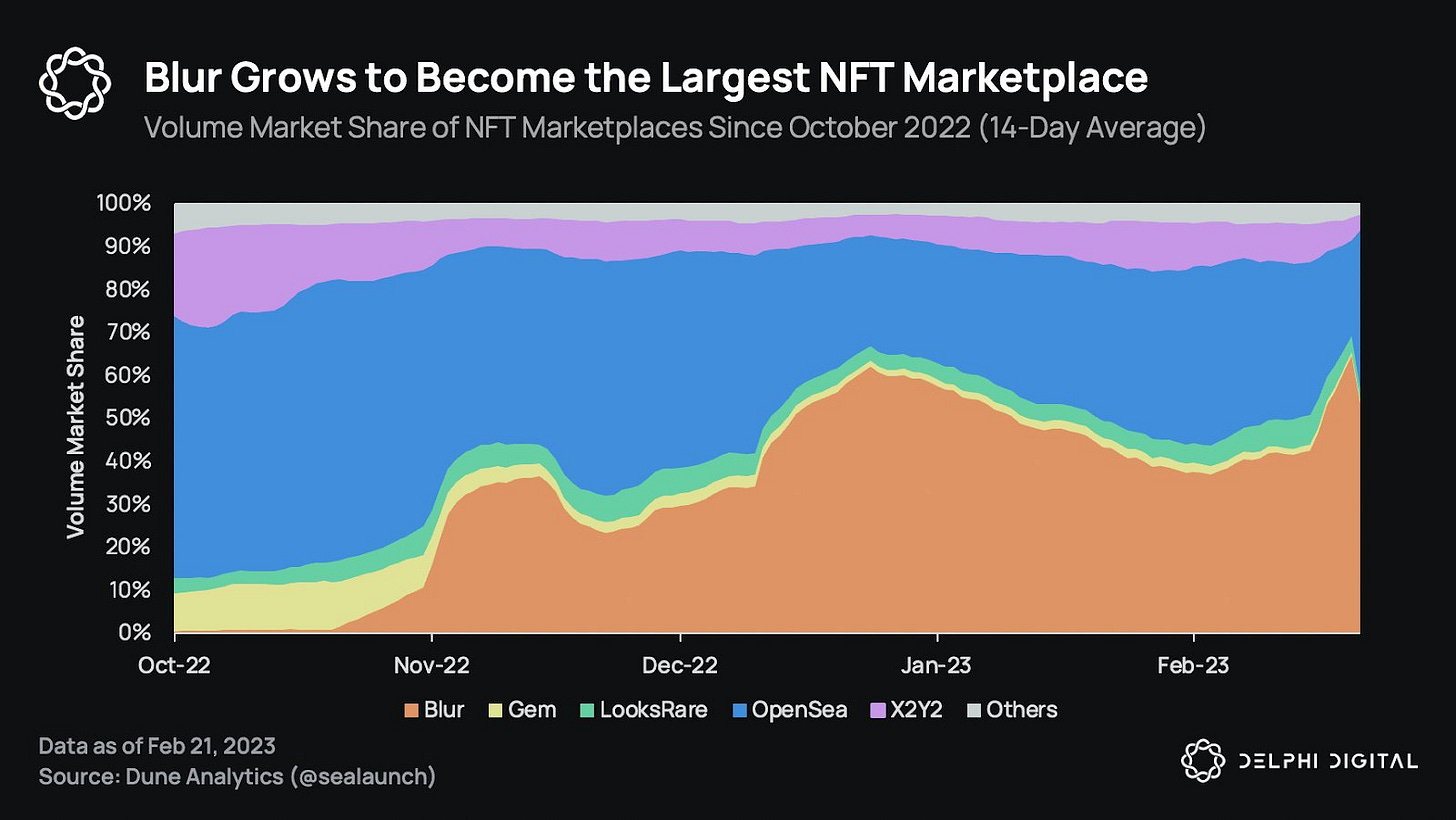

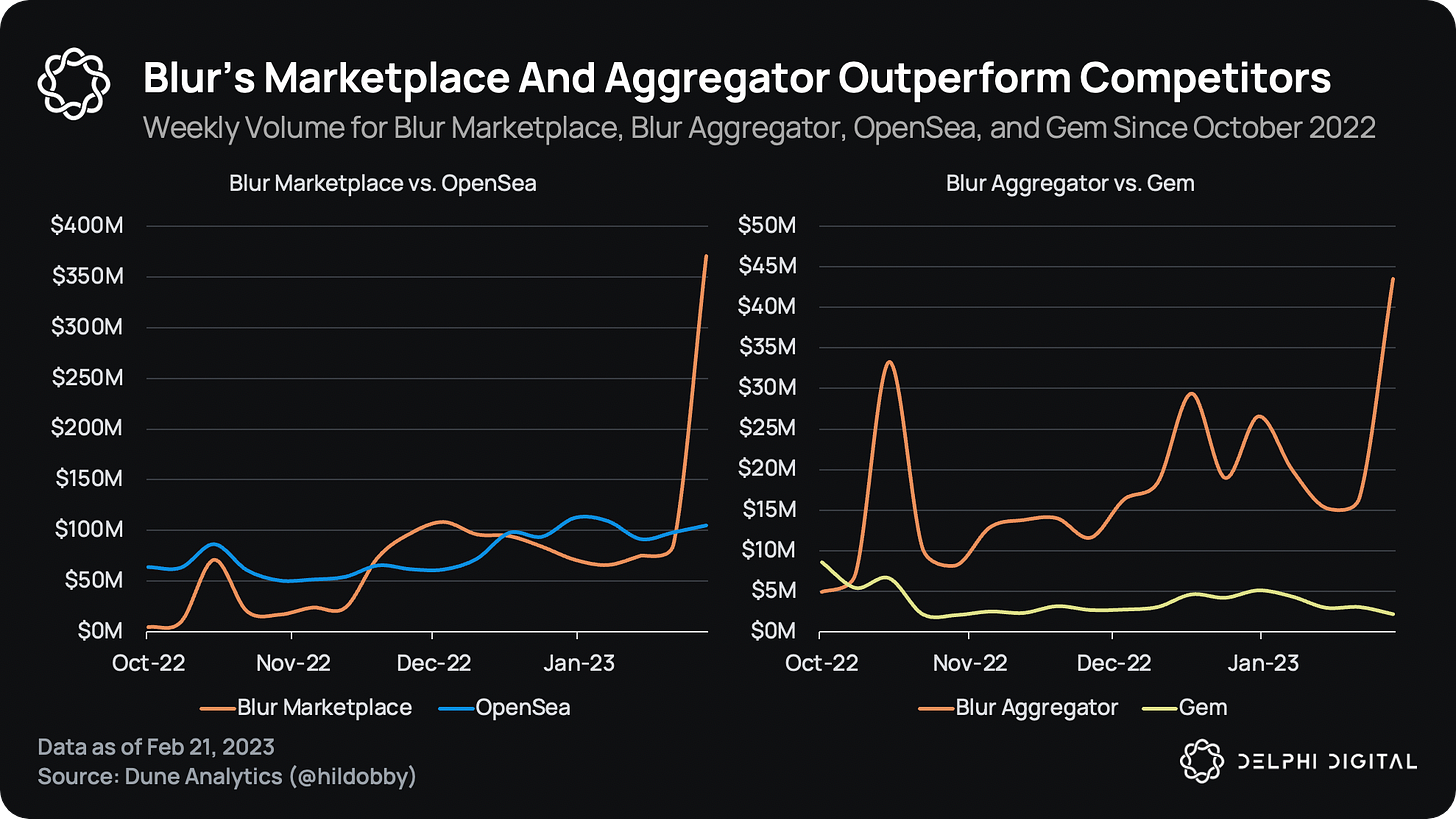

In 4 months, Blur has shaken Opensea’s domination.

Since it exploded onto the scene four months ago, Blur has disrupted the deeply entrenched power structure that has dictated the competitive dynamics among NFT marketplaces for a long time. After numerous miserably failed attempts to topple OpenSea have only bolstered the incumbent’s air of superiority, Blur has finally managed to break this pattern of defeat by genuinely threatening the giant’s dominance, which has turned into a standoff between David and Goliath.

The series of cleverly designed liquidity incentives, which have enabled Blur to take the NFT market by storm, have now culminated in the pinnacle of its growth strategy – the launch of the BLUR token. As part of its vision to function as the main steward for the pro NFT trading community, Blur puts the future development of its ecosystem into the hands of its users, which will be facilitated through a decentralized governance process.

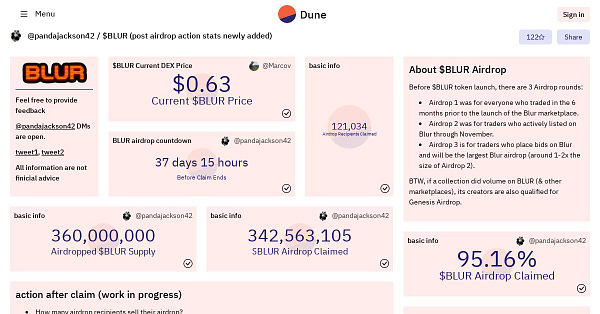

To this end, the BLUR token will act as the decision-making instrument that will allow the community to set parameters essential to the platform’s value accrual mechanism. The token was airdropped to users in the form of Care Packages, which transformed into BLUR tokens on February 14th at 12pm EST.

To participate in the protocol’s governance, BLUR token holders need to delegate their token balance to an address, which can be their own or someone else’s. Voting power is proportional to the BLUR balance of an eligible address, including the delegated balance. To enact a standardized procedure, the governance process will be conducted by means of Blur Improvement Proposals (BIPs), which will need to pass a three-stage process.

First, proposals need to be posted on the research forum for the purpose of eliciting feedback from the community. Once the proposal is battle-tested, it moves to the second phase. In short, the second phase consists of a 14-day voting period, which only allows delegated community members with a minimum of 100K tokens delegated to submit proposals.

If the proposal passes with at least 30M yes votes, it advances to the third phase. Lastly, an on-chain execution vote containing the code to be implemented will be set up, which will require a simple majority with at least 120M yes votes at the end of the 14-day voting period in order to be executed.

Above all, the primary levers for the community to pull through the governance process would revolve around the issuance of treasury grants as well as the change of the protocol fee. In addition, three committees will chaperone the early community, which will be tasked with specific functions, such as ensuring adherence to guidelines or executing policy changes around royalties.1

1/ Blur dropped its token on Feb 14.2

The same day its trading volume exceeded OpenSea’s.

360M BLUR (12% of total supply) were distributed to holders.

Whether the momentum is sustainable remains to be seen.

2/ After 4 days, Opensea made “big changes” in response:

- OpenSea dropped fees to 0% for a limited period of time,

- Implemented a 0.5% minimum creator earnings model,

- Allowed sales using NFT marketplaces with the same policies (including Blur)

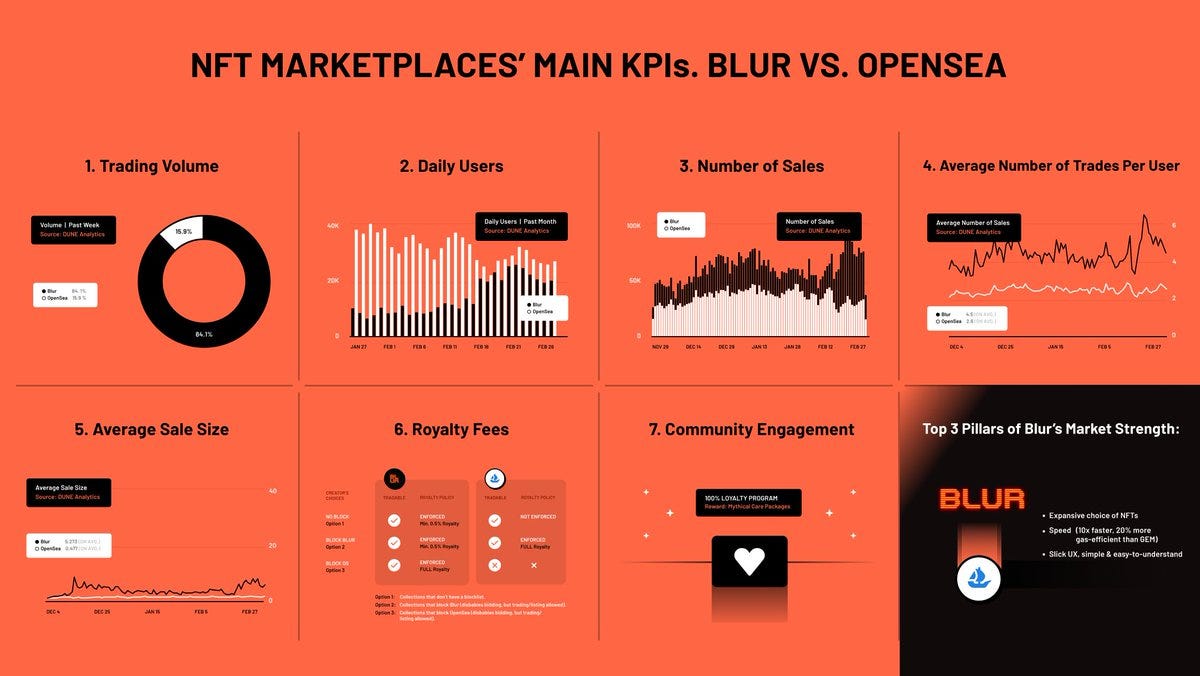

3/ NFT Marketplaces’ main KPIs

- trading volume

- users (unique buyers)

- number of sales

- average number of trades per user

- Average sale size

On Blur vs Opensea specifically, we add:

- royalty fees

- community engagement

4/ Trading volume

In the week of Feb 13, Blur was killing it.

Its trading volume was over 5x Opensea’s volume.

Worth noticing, top 3 wallets on Blur each received $1.5M+ worth of $BLUR.

Even considering wash trading - this was substantial.

5/ Daily users

So far, OpenSea has a steady daily user volume dominating the market.

Blur’s # of daily users has increased by 3x since their airdrop on DATE.

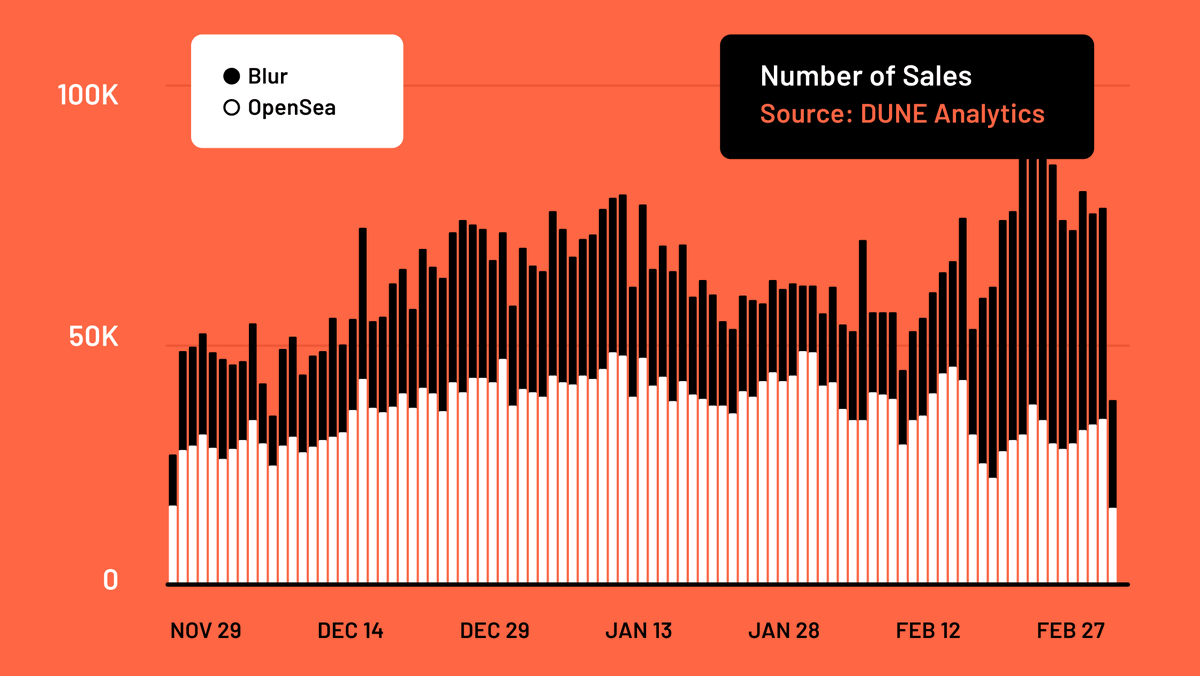

6/ Sale count

You can see, Opensea and Blur are two big players.

On Feb 20, Blur even got ~70k trade counts, while Opensea had ~77k.

Blur was capable of flipping the game

7/ Average number of trades per user

This indicator tells how well user retention is.

Blur’s early supporters are super active.

But the trend is volatile too, compared to Opensea’s.

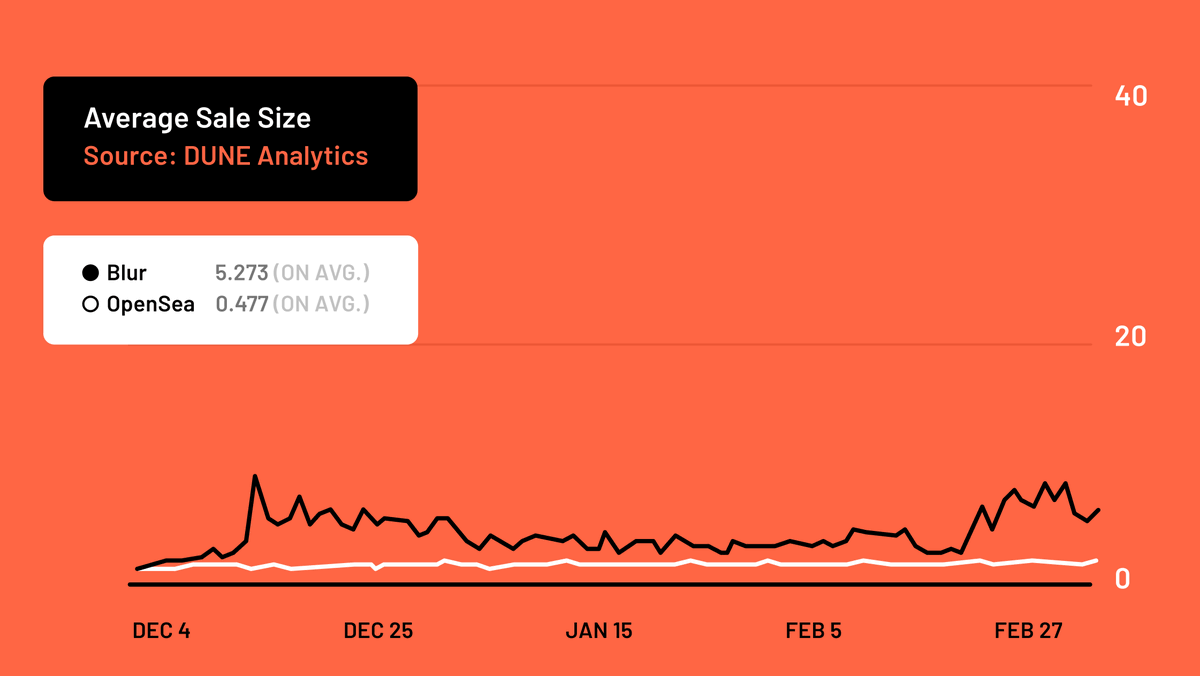

8/ Average sale size

OpenSea is a marketplace for NFT projects of any size.

So the average sale size is low (< 1 ETH).

Blur has a slightly higher average size.

Blur executes a lot of high-value trades with an average NFT sale price of $1,365 vs. OpenSea’s $351. OpenSea’s large, mass-market userbase trades smaller values. But Blur’s smaller target audience of NFT power users trades larger values.

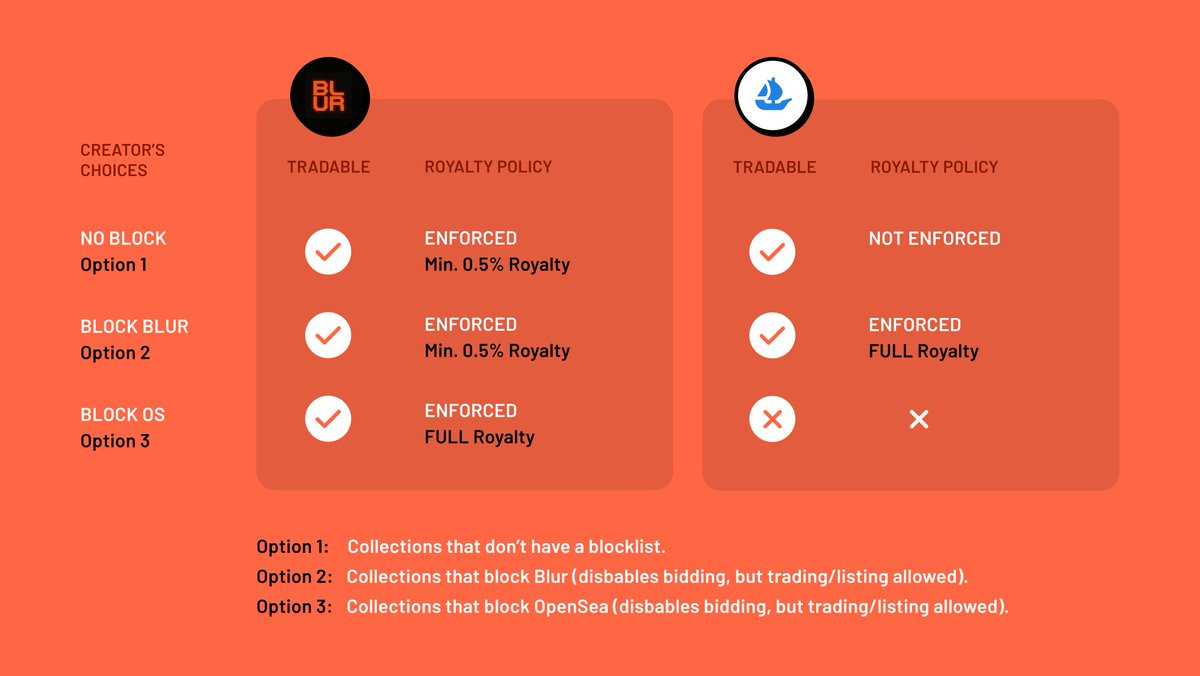

9/ Royalty fees — associated with the sale of NFTs, a percentage of sale price going to creators

Opensea: creators are limited to earning royalties on only one platform at a time.

Blur: trying to let creators earn full royalties everywhere.

10/ Blur wants 100% loyalty.

A creative and bold move — a loyalty button.

Users get a 100% loyalty score if they don’t have listings anywhere else.

Blur wants to wipe out Opensea by having 100% loyal users.

11/ Now, Blur looks promising to beat Opensea.

Top 3 pillars that win Blur the market share:

- expansive choice of NFTs

- impressive speed - 10x faster, 20% gas efficient than GEM

- slick UX — simple and easy to understand

Blur has doubled down on speed since day one to make itself stick out from the competition via real-time listings and instant NFT metadata reveals. According to Blur, its marketplace is in the ballpark of being 10x faster and nearly 20% more gas-efficient than Gem, which is OpenSea’s NFT aggregator for veteran traders.3

12/ Opensea has been the market leader but Blur’s tokenomics changed that

By and large, Blur’s go-to-market strategy has been shaped by the belief that a token can be a useful vehicle for bootstrapping liquidity but has shied away from exploiting it as a means to sugarcoat modest traction, which might distract from the quality of the product. Therefore, the BLUR token economics renounce unnecessary complexities and, instead, double down on a tried-and-tested approach.

Simply put, it emulates Uniswap’s UNI vesting schedule, except for an additional cliff. More precisely, 51.0% of the total supply of 3bn BLUR tokens is earmarked for the community, of which 23.5% will be reserved for community members while 76.5% will be earmarked for the community treasury.

Apart from that, 28.9% will accrue to core contributors whereas 18.9% will be distributed among investors. The remaining 1.0% will flow to advisors and will be subject to a prolonged vesting schedule of 48 to 60 months as well as a cliff ranging between 4 and 16 months.

The platform is currently distributing its governance token to traders, based on a point system. This model rewards users for providing liquidity to the order book through listing NFTs and bidding on them. Users are rewarded for both, the amount of liquidity provided as well as the risk of the liquidity provided. Higher bids and lower asks, relative to the order book, will increase the point value of your orders. This mechanism gives weight to each order that incentivizes real liquidity to fill Blur’s liquidity pool order books.4

To maximize the number of points, traders can place bids as close to the floor price as possible on collections with high trading volumes. Accepting bids may reduce the chances of receiving rewards, which is why some traders place and cancel bids repeatedly. This creates a bidding wall of user-provided liquidity on Blur. Traders exchange these points for Care Packages, which contain an unspecified amount of BLUR tokens.

When properly designed, token airdrop mechanics can fuel a flywheel of behaviors that can jumpstart a project’s user adoption.

Blur’s structure offers NFT traders the lowest fees as well as the deepest liquidity on the market, and it’s working. Blur’s marketplace is outperforming OpenSea while Blur’s aggregator is outperforming Gem.

Blur has found product-market fit while leveraging its token to capture market share from OpenSea. Blur is proof that tactical incentives powering quality products rule the world. With decentralized blockchains, unenforceable royalties find themselves in a race to zero, one that Blur has fully embraced. The platform has now entered the “Airdrop Season 2” phase and specifically notes that traders that “bid on top collections closer to the floor get more rewards.” In other words, traders that put in a bid close to the floor price—that is, the cheapest available NFT for a certain project—of a popular project will maximize their eventual rewards. They’re both buying and selling in bulk as a result.

13/ @LooksRare and @the_x2y2 launched their own tokens and had price spikes.

Now, they have cooled down.

Many tokens tend to fall after their initial hype.

Will this happen to Blur too?

Once the BLUR airdrops are completed and incentives fall off, we will see whether Blur can continue to retain its user base as well as bid & listings liquidity. We think it has a very reasonable chance of being one of the top NFT marketplaces, largely because it has established a good product-market fit among NFT traders with its superior trading tools. As sure as the sun rises every morning, there will be new marketplaces that will arise to compete with Blur. That will be the true litmus test.

Nice I am a big fan of token engineering as the incentives engines. I would like to do a breakdown in my newsletter as well. For coloring: the points system is traded for care packages and it is not deterministic how those convert to BLUR?